With the BTC USD worth beneath $100,000, Bitcoin prediction fashions are bearish. The unhealthy information is that it may worsen, particularly if digital gold crashes beneath $90,000.

Each time the Bitcoin worth ticks decrease, MicroStrategy, the world’s largest holder of BTC, comes underneath renewed stress. Final week, when BTC USDT fell beneath $100,000, MicroStrategy’s internet asset worth (NAV) fell beneath 1.

Microstrategy mNAV drops to ~1x, money available is $54mm,

Assuming all common debt is 0% (it's not), and $STRF/ $STRK preferreds are 8% or 10%. $MSTR will both promote inventory, pay dividends in inventory, or as a final resort promote $BTC (could be disastrous by way of optics), thereby… pic.twitter.com/nysxTi2Qy4— baran (@barankayhan) November 12, 2025

That was sufficient of a scare as a result of it meant every thing the general public firm held was lower than the worth of its Bitcoin holdings. Would they be keen to promote if the state of affairs turns into dire? Will buyers demand motion and safety?

DISCOVER: 20+ Next Crypto to Explode in 2025

Peter Schiff Says MicroStrategy and Michael Saylor Are Fraudsters

For MicroStrategy and Michael Saylor, their status is determined by whether or not Bitcoin and a few of the best cryptos to buy will get well. If not, there’s a actual danger that Saylor will probably be labeled a fraudster and MicroStrategy a giant Ponzi as some critics declare.

Amongst these firing photographs now that Bitcoin costs are shaky is Peter Schiff. Schiff is a giant gold advocate and all the time thinks Bitcoin and most “store-of-value” cryptos don’t have a future.

Curiously, Schiff has no drawback with Saylor as an individual. As an alternative, he’s fearful in regards to the enterprise mannequin that MicroStrategy has employed. On Sunday, he known as their treasury a fraud and even challenged Saylor to a debate on the Binance Blockchain Week in Dubai set for December.

In a put up on X, Schiff thinks MicroStrategy’s mannequin of counting on funds to purchase its “high-yield” most well-liked shares is unsustainable. Schiff is skeptical whether or not the promised excessive yield will probably be paid within the first place.

MSTR’s complete enterprise mannequin is a fraud. Saylor and I’ll each be talking at Binance Blockchain Week in Dubai in early December. I problem @saylor to debate this proposition with me. No matter what occurs to Bitcoin, I consider $MSTR will finally go bankrupt. Let’s go!

— Peter Schiff (@PeterSchiff) November 16, 2025

In the event that they by no means observe via, he predicts a state of affairs the place buyers will rush for the exits and dump MSTR most well-liked shares, inflicting a demise spiral impacting Bitcoin and even a few of the best Solana meme coins.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Bitcoin Prediction: Will the BTC USD Value Dump Proceed?

Nonetheless, Bitcoin and crypto merchants are optimistic.

Even after the MSTR mNAV fell beneath 1 final week earlier than recovering to round 1.2 at press time, means decrease than the best 2, MicroStrategy didn’t promote BTC.

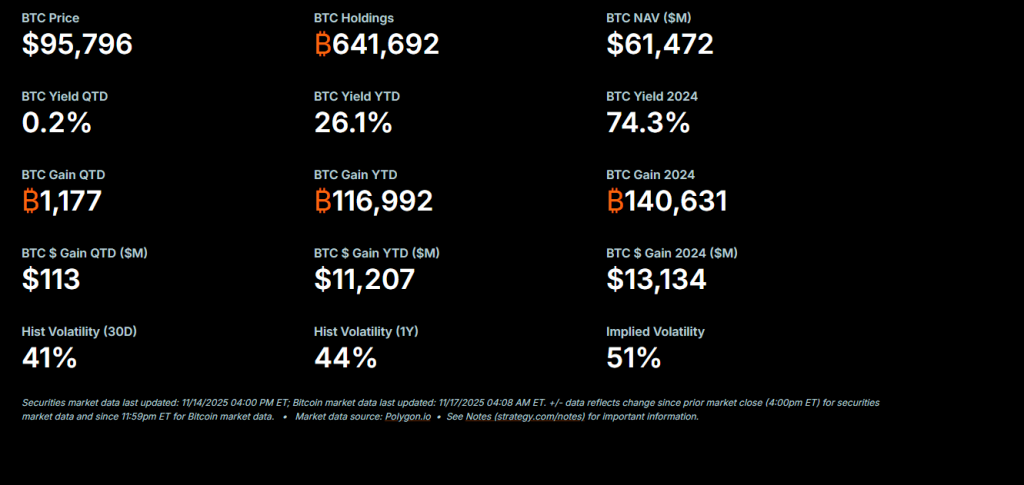

From knowledge, their Bitcoin NAV, that’s, the market worth of its Bitcoin holdings, stands at $61,487, providing a 26.1% yield year-to-date at spot Bitcoin charges.

(Supply: Strategy)

Wanting on the Bitcoin day by day chart, there’s a ground at $93,000. If consumers load up at this degree, pushing costs larger, ideally above $100,000, MicroStrategy will discover a breather.

Conversely, any drop beneath final week’s low may see bears push the Bitcoin worth nearer to the Bitcoin NAV, negatively impacting MicroStrategy’s prospects.

On X, one analyst means that if the BTC USD worth falls additional and MicroStrategy is compelled to promote attributable to a falling NAV, the Bitcoin worth may collapse by over 30%.

Breaking: MicroStrategy simply traded BELOW its Bitcoin holdings worth for the primary time since 2024.

The 300% premium period is lifeless.

And the forced-selling cascade that might tank Bitcoin 30–50% is now nearer than ever.

Right here’s the chilly reality no person needs to say out loud.… pic.twitter.com/U1QGTi3aZK

— Andrea Lisi, CFA (@Andrea_Texas_82) November 15, 2025

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Peter Schiff Calls Saylor A Fraudster: Bitcoin Prediction For 2026?

- Bitcoin prediction fashions bearish

- BTC USD worth capped beneath $100,000

- Peter Schiff calls Michael Saylor of MicroStrategy a fraudster

- Will falling BTC USDT pressure MicroStrategy to promote?

The put up Peter Schiff Calls Saylor A Fraudster, Bitcoin’s YTD Gains Evaporated Last Week: Bitcoin Prediction For 2026 Close? appeared first on 99Bitcoins.