Bitcoin Value Weekly Outlook

The bears got here out in full pressure as soon as once more final week as bitcoin took out final week’s low at round $105,000 to hit $103,000 and alter. We once more noticed a pleasant bounce from the assist zone down there, however thus far the bounce is weaker than we skilled the week prior. The bulls are again on their heels as soon as once more and searching like they may stay subdued for the foreseeable future. Final week gave us a closing worth of $108,717, firmly under the 21 EMA assist stage we had been hoping to carry, and offering additional conviction to the general bearish bias.

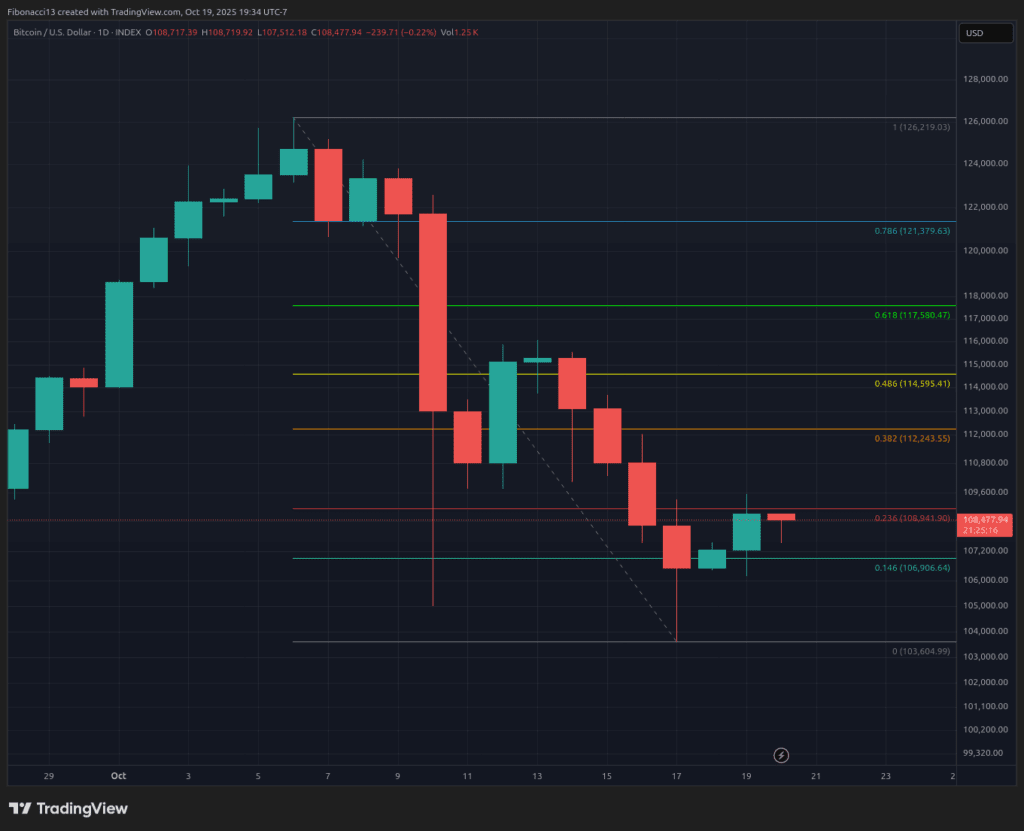

Key Assist and Resistance Ranges Now

Overhead resistance is now trying extraordinarily formidable on the chart. Now we have a wall of resistance above worth now, with resistance ranges sitting at $112,200, $115,500 after which $117,600 sitting proper on the 0.618 Fibonacci Retracement. Even when worth manages to climb above all of those ranges, we nonetheless have to shut convincingly above $122,000 with a view to flip bias again in the direction of the bulls and search for greater costs.

On the low finish, we now have gotten all of the power we might hope for out of the $105,000 to $102,000 assist zone, so if worth revisits the lows there we should always count on that zone to fail. Sturdy assist is sitting round $96,000 under there, with the 55 EMA sitting at $98,000. At this level, we should always count on to see worth transfer additional downward to attempt to check these decrease helps. Closing under $96,000 opens up a spread of decrease targets and basically places an finish to the bull market.

Outlook For This Week

We’re as soon as once more seeing an anticipated bounce again up from the Friday low into Sunday night time. It will likely be a tall order to shut a day above even the primary resistance stage this week at $112,200, worth will probably want to check it greater than as soon as to face an opportunity at breaking it. There’s a little little bit of “hope-ium” assist on the $106,900 stage, so if worth rolls over and heads again down early this week, we are able to search for this stage to carry to provide the bulls some hope. Nevertheless, closing a day or two under this stage is a big invitation to sub-$100,000 costs and all the way down to $96,000 assist.

Market temper: Bearish – We simply accomplished two large crimson weekly candles in a row with heavy promoting quantity each weeks. The bears are securely in management and could be getting began on a downtrend right here.

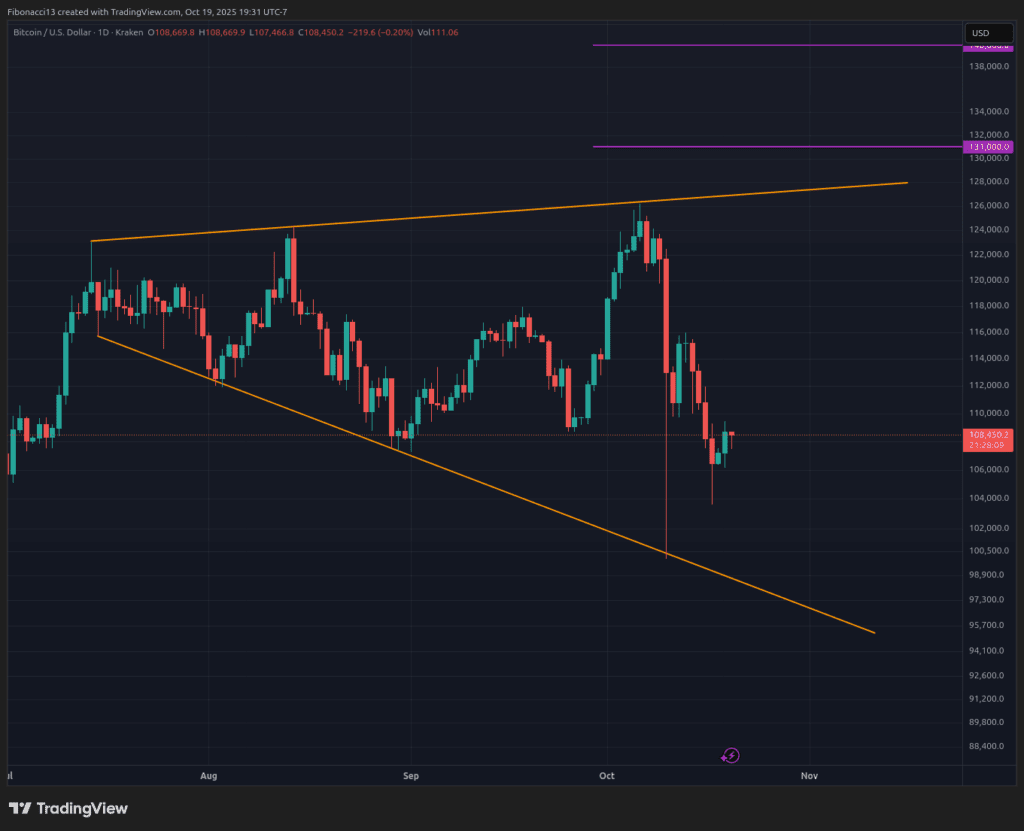

The following few weeks

On the intense aspect, the broadening wedge sample has not damaged down but. Dare I say, we might even wick to $96,000 and reverse and nonetheless stay throughout the construction. So we can’t definitively say that the long run prime is in till worth breaks down out of this broadening wedge sample. The bulls will want a whole lot of assist to get again on observe right here, something wanting a 50-basis level lower on October twenty ninth’s FOMC Assembly probably results in extra draw back within the subsequent few weeks. The bitcoin bulls will probably be begging Powell and his buddies to throw them a bone right here and provides the markets an enormous fee lower to provide them an opportunity to renew the long run uptrend.

Terminology Information:

Bulls/Bullish: Patrons or buyers anticipating the worth to go greater.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Assist or assist stage: A stage at which the worth ought to maintain for the asset, at the least initially. The extra touches on assist, the weaker it will get and the extra probably it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent that’s prone to reject the worth, at the least initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the worth.

EMA: Exponential Shifting Common. A transferring common that applies extra weight to latest costs than earlier costs, lowering the lag of the transferring common.

Fibonacci Retracements and Extensions: Ratios based mostly on what is named the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart sample consisting of an higher development line performing as resistance and a decrease development line performing as assist. These development strains should diverge away from one another with a view to validate the sample. This sample is a results of increasing worth volatility, usually leading to greater highs and decrease lows.