Technique Chairman Michael Saylor pushed again on Friday towards recent claims that his firm had decreased its bitcoin holdings.

The discuss started when X person Walter Bloomberg highlighted Arkham knowledge exhibiting what regarded like a drop in Technique’s wallets, from about 484,000 BTC to roughly 437,000 BTC.

$MSTR – ARKHAM: SAYLOR’S STRATEGY CUTS BITCOIN HOLDINGS BY 47K

Arkham knowledge exhibits Michael Saylor’s Technique (MSTR) decreased its Bitcoin holdings from 484,000 to about 437,000, a drop of roughly 47,000 BTC. It’s unclear whether or not this got here from transfers or gross sales. That is the primary…

— *Walter Bloomberg (@DeItaone) November 14, 2025

Bloomberg reported it was unclear if the shift got here from inside transfers or precise gross sales, noting it could be the primary recorded lower since July 2023.

The put up unfold rapidly, and Saylor responded quickly after.

DISCOVER: 10+ Next Crypto to 100X In 2025

May Technique’s New Inventory Providing Add 1000’s Extra BTC?

Talking on CNBC, the Technique co-founder dismissed the reviews and mentioned the corporate has not modified its long-term view, even because the market continues to slip.

We’re ₿uying.pic.twitter.com/6g11E9G6pO

— Michael Saylor (@saylor) November 14, 2025

“We’re shopping for. We’re shopping for quite a bit, truly, and we’ll report our subsequent buys on Monday morning. I feel individuals might be pleasantly shocked,” Saylor mentioned throughout the interview.

Arkham pushed again on Bloomberg’s report, saying Technique typically shifts its wallets and custodians.

Technique recurrently undergoes pockets/custodian rotations.

Many of the actions which were reported this morning seem like a continuation of these transfers.https://t.co/CSsqSiCLHH

— Arkham (@arkham) November 14, 2025

The agency added that the actions seen earlier within the day have been doubtless a part of these routine transfers.

A Nov. 10 filing with the US Securities and Trade Fee exhibits Technique purchased 487 BTC for about $49.9M, bringing its complete to 641,692 BTC.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

MSTR Value Prediction: May MSTR Rebound Towards $260 Earlier than Falling Decrease?

Bitcoin slipped beneath $97,000 on Friday because the market’s downturn from the day gone by continued to tug costs decrease.

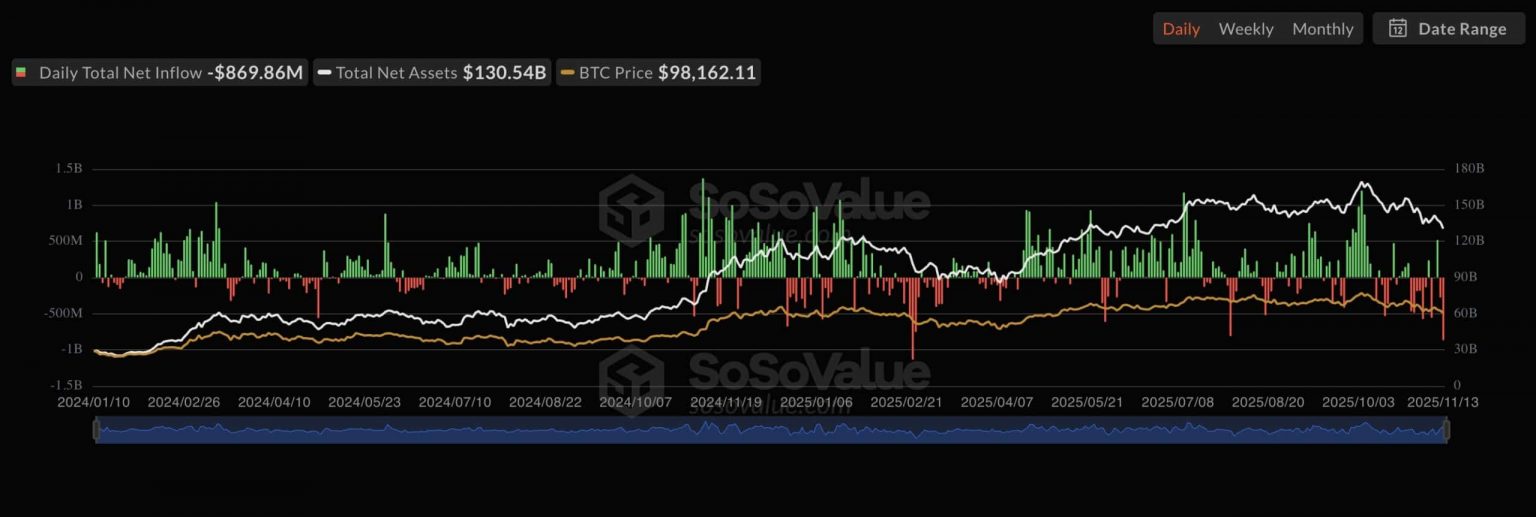

As per SoSoValue data, Spot Bitcoin ETFs noticed about $869M in outflows, marking the second-largest withdrawal on report.

MicroStrategy (MSTR) inventory was down about -2.2% to $203.79 on the time of publication and has fallen roughly 18% over the previous 5 days.

Ali Martinez, a crypto analyst, posted Technique Inc.’s weekly chart, which exhibits a transparent fractal echo of the 2021–2022 breakdown. In each durations, the value misplaced a significant horizontal help degree after which dropped sharply.

The present transfer displays that very same construction, with MSTR breaking beneath the $245 space and persevering with to maneuver decrease. The chart factors to a attainable short-term rebound towards $260, much like the reduction transfer proven within the earlier shaded part. However the wider development nonetheless seems weak. If this sample continues monitoring the earlier cycle, the subsequent main drop might push the inventory towards the $120 zone.

Merlijn The Dealer, a outstanding crypto dealer, noted that Bitcoin and MicroStrategy now present the identical weekly construction.MicroStrategy slipped beneath its 50-week shifting common after a agency rejection, which sparked a pointy sell-off.

Bitcoin is now again at a key level on the chart, sitting proper on its 50-week shifting common after a number of failed makes an attempt to carry above it.

Current candles present fading energy, with decrease highs and regular strain constructing alongside the development line.

A transparent break beneath this degree would sign that long-term help has slipped. That may increase the danger of a sharper correction.

The analyst says that if this line offers approach, the market must be prepared for a heavier draw back.

EXPLORE: What is Liquid Staking & How Does it Work?

The put up Saylor Hits Back at Rumours: We’re Still Buying – But Will BTC USD Survive Low Volume Weekend? appeared first on 99Bitcoins.