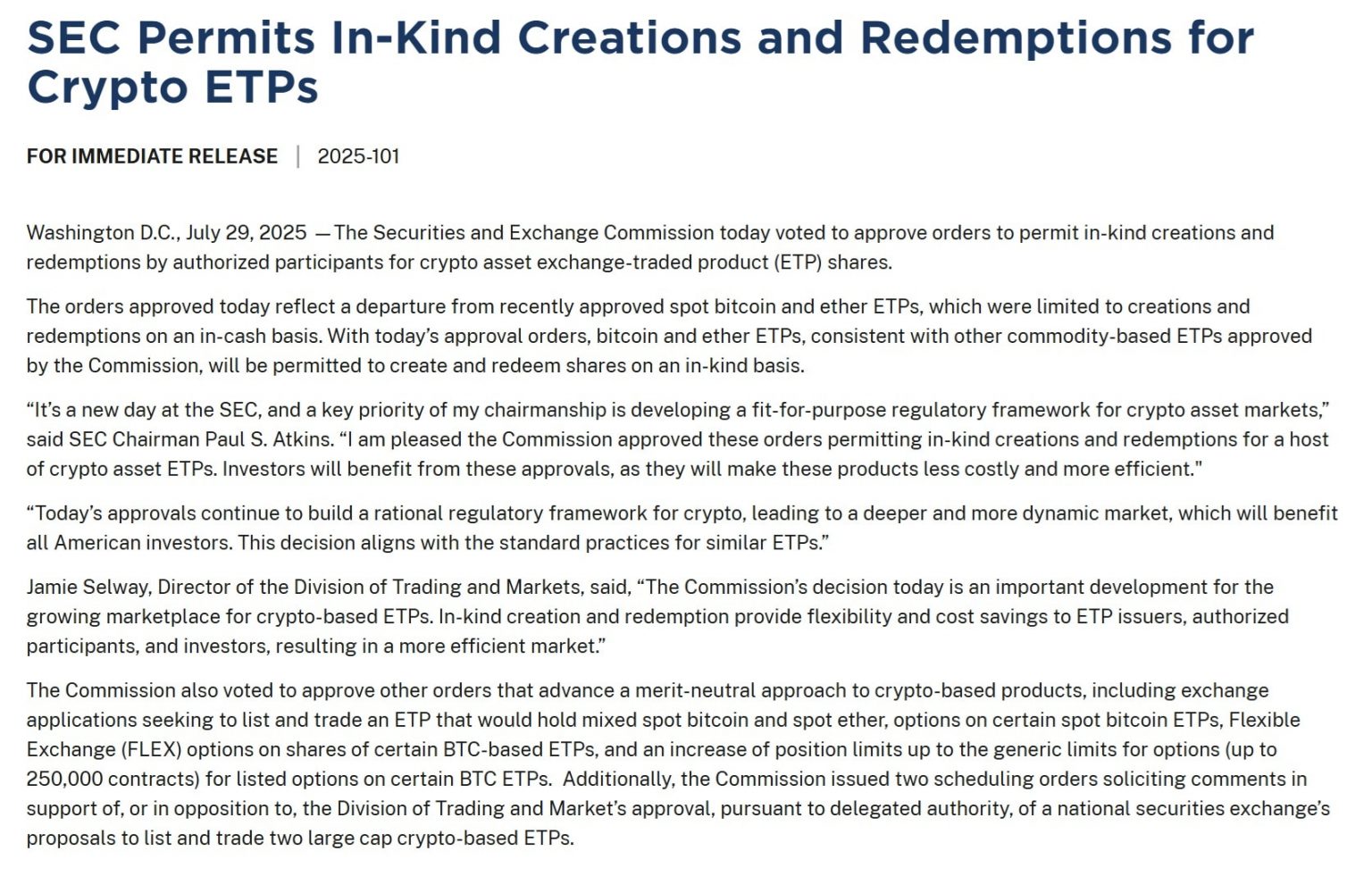

The U.S. Securities and Trade Fee has approved in-kind redemptions for spot Bitcoin and Ethereum exchange-traded merchandise. This means ETF issuers and approved individuals can now ship or obtain precise Bitcoin or Ether when creating or redeeming shares. Till now, they’d to make use of money. This rule change brings crypto ETFs nearer to how commodity ETFs like gold are dealt with.

Why In-Variety Issues for Establishments

For institutional merchants, this replace simplifies the method. As an alternative of promoting crypto for money or changing fiat into tokens throughout every ETF transaction, they will deal instantly with the belongings themselves. That saves time, reduces taxes, and cuts down on pointless buying and selling prices.

On the identical time, the SEC has raised the place limits for Bitcoin ETF choices to 250,000 contracts. That’s a giant soar from the earlier restrict and offers establishments extra room to construct and handle giant hedging positions. It additionally means extra flexibility for superior methods with no need to separate trades throughout a number of funds.

A Shift in Regulatory Method

This is among the first main strikes below SEC Chair Paul Atkins, and it stands out. Relatively than preventing the construction of crypto ETFs, the company is adjusting its guidelines to accommodate them. That features not solely Bitcoin and Ethereum ETFs, however doubtlessly future merchandise as properly. Analysts consider this might pave the way in which for altcoin-based ETFs to enter the market with fewer hurdles.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July2025

Behind-the-Scenes Mechanics Get an Improve

From the surface, most traders gained’t discover a lot distinction. ETF shares nonetheless commerce on the inventory alternate similar to earlier than. However the behind-the-scenes course of for creating and redeeming these shares simply bought much more environment friendly. As an alternative of getting to unwind money positions or undergo third events, approved individuals can transfer crypto instantly in or out of the fund.

This lowers the operational burden on ETF issuers and makes arbitrage sooner, which ought to assist maintain the ETF worth near the precise worth of its underlying crypto belongings.

Broader ETP Adjustments Accompany the Replace

The SEC additionally gave the inexperienced mild to funds that maintain each Bitcoin and Ethereum in a single product. It accredited listed and flex choices for these ETPs too. This makes the present era of crypto ETFs really feel extra full and extra like the normal merchandise establishments are used to coping with.

Corporations like BlackRock, Constancy, and Ark Make investments had been pushing for these adjustments because the authentic approvals went by way of. The SEC’s determination reveals it’s listening and adapting because the market matures.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Market Response and Institutional Outlook

Reactions have been largely constructive. Merchants anticipated this alteration, however that doesn’t make it any much less essential. With in-kind redemption now reside, institutional gamers have fewer excuses to remain on the sidelines. The brand new choices limits additionally take away a main constraint for desks that need to scale up publicity or handle bigger consumer flows.

So, What Comes Subsequent?

With infrastructure in place, ETF issuers could begin to discover broader choices, probably together with different crypto belongings. Regulators will likely be watching how corporations deal with these instruments, particularly in unstable markets. However for now, the construction is stronger, and that’s excellent news for any institutional investor seeking to take crypto extra significantly. By permitting direct transfers of Bitcoin and Ether, the SEC ETF rule brings crypto merchandise nearer to conventional commodities.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The SEC now permits in-kind redemptions for spot Bitcoin and Ethereum ETFs, letting issuers instantly transfer crypto as an alternative of utilizing money.

- Institutional traders profit from fewer taxes and decrease friction, as they will now switch Bitcoin and Ether instantly in ETF transactions.

- Place limits for Bitcoin ETF choices jumped to 250,000 contracts, giving giant buying and selling desks extra room for methods and hedging.

- The change displays a extra versatile stance from the SEC and will open the door for ETFs based mostly on different crypto belongings like altcoins.

- The transfer improves ETF pricing effectivity and reduces operational prices, whereas funds holding each BTC and ETH additionally obtained SEC approval.

The put up SEC Opens Door for In-Kind Redemptions in Crypto ETFs appeared first on 99Bitcoins.