Bitcoin’s exchange-side provide sign is flashing a notable change: whale-sized transfers into Binance have dropped sharply from late-November panic ranges, suggesting giant holders are not leaning on the promote button with the identical urgency.

Promoting Strain From Bitcoin Whales Fade

CryptoQuant contributor Darkfost said present information reveals a “clear decline in whale transactions,” particularly BTC inflows to exchanges, which means “giant holders are sending considerably much less BTC to buying and selling platforms than earlier than.”

Within the publish, the chart focus was Binance inflows segmented by transaction dimension, spanning transfers from 100 BTC as much as the biggest prints above 10,000 BTC, flows which might be generally interpreted as potential sell-side positioning after they hit an change.

Associated Studying

The important thing backdrop in Darkfost’s thread is how rapidly whale conduct shifted across the market’s late-2025 drawdown. “December has been significantly difficult, even for these traders,” the analyst wrote, including that whales are sometimes “extra cautious” and “much less delicate to market actions than retail participants,” usually performing with “better self-discipline and persistence.”

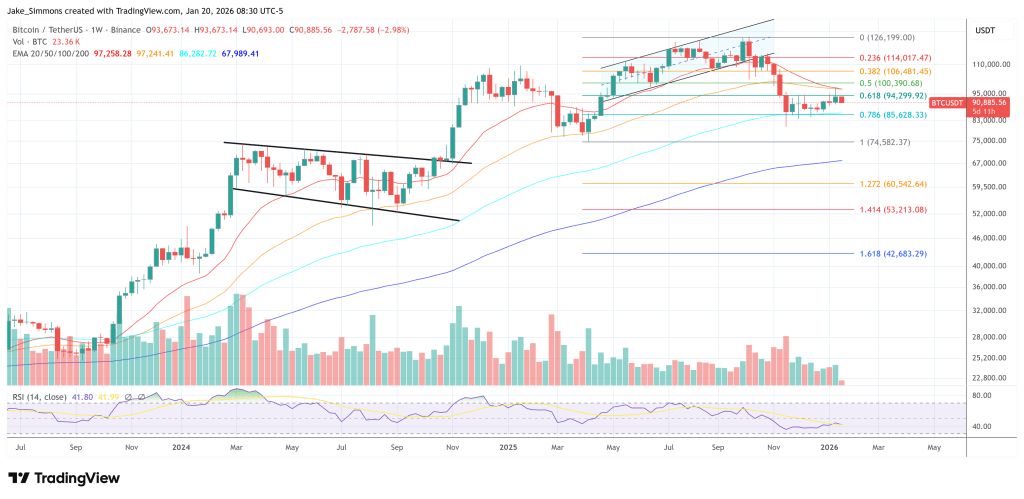

That self-discipline appeared to crack as Bitcoin rolled over from its newest all-time excessive close to $126,000. Darkfost described a surge in whale inflows to Binance on the finish of November as BTC “continued its correction,” with the “common month-to-month complete” reaching “practically $8 billion” throughout a interval when BTC “fell again under the $90,000 stage.”

“This section clearly triggered a panic-driven transfer,” the publish stated. “Transactions ranging between 100 and 10,000 BTC elevated considerably, particularly as value broke under the $85,000 stage. This conduct displays actual stress amongst sure whales, who selected to promote rapidly in an effort to restrict losses, thereby reinforcing promoting strain in the marketplace.”

The crux is what modified since that cluster. “At present, the state of affairs seems to be very completely different,” Darkfost wrote. These Binance inflows “have been divided by three and now stand at round $2.74 billion,” with “every day actions” turning into “far much less frequent than throughout the cluster noticed on the finish of November.”

Associated Studying

The analyst framed the drop as an observable behavioral pivot reasonably than a single-day anomaly. “This shift in dynamics means that whales have modified their conduct,” Darkfost wrote. “They’re not promoting aggressively and now seem to favor ready.”

Institutional Demand Aspect Stays Strong

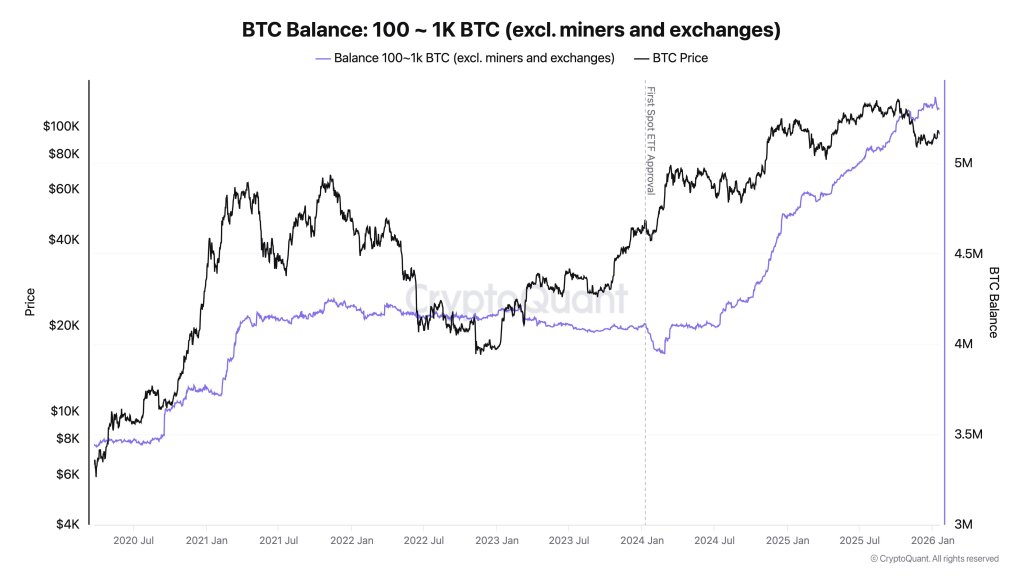

Whereas Darkfost’s publish focuses on whale-associated inflows as a proxy for potential promote strain, CryptoQuant CEO Ki Younger Ju pointed traders to the opposite aspect of the ledger: institutional accumulation.

“Institutional demand for Bitcoin stays sturdy,” Ki wrote on X. “US custody wallets sometimes maintain 100–1,000 BTC every. Excluding exchanges and miners, this provides a tough learn on institutional demand. ETF holdings included.”

Ki added that “577K BTC ($53B) [was] added over the previous 12 months, and nonetheless flowing in,” characterizing the pattern as ongoing reasonably than a accomplished wave.

At press time, Bitcoin traded at $90,885.

Featured picture created with DALL.E, chart from TradingView.com