A Nasdaq-listed firm simply moved to place its inventory on Ethereum on the identical day Ether slipped under $4,000 amid a recent wave of liquidations.

SharpLink Gaming (Nasdaq: SBET) announced Thursday it can tokenize its SEC-registered frequent inventory on the Ethereum blockchain, turning into the primary US public firm to concern fairness on Ethereum natively.

The transfer, in partnership with Robert Leshner’s Superstate, comes as Ethereum’s value slid again under $4,000 on September 25.

The Minneapolis-based sports activities gaming and expertise agency goals to check compliant secondary buying and selling of tokenized shares on automated market makers (AMMs).

Superstate will function SharpLink’s digital switch agent as a part of the deal, whereas its “Opening Bell” platform will deal with the on-chain issuance.

“Tokenizing SharpLink’s fairness immediately on Ethereum is greater than a technical milestone, it’s a press release about the place we imagine the way forward for the worldwide capital markets is headed,” stated Joseph Chalom, SharpLink’s co-CEO.

Robert Leshner, founder and CEO of Superstate, known as the launch a “milestone” and stated the corporate deliberate to work collectively on enabling compliant DeFi buying and selling of tokenized public equities.

This improvement highlights how conventional companies are experimenting with blockchain infrastructure at a time when the crypto market is below stress. Ethereum is dealing with renewed promoting stress under key ranges.

Why Did Ethereum Drop Beneath $4,000 Amid Heavy Liquidations?

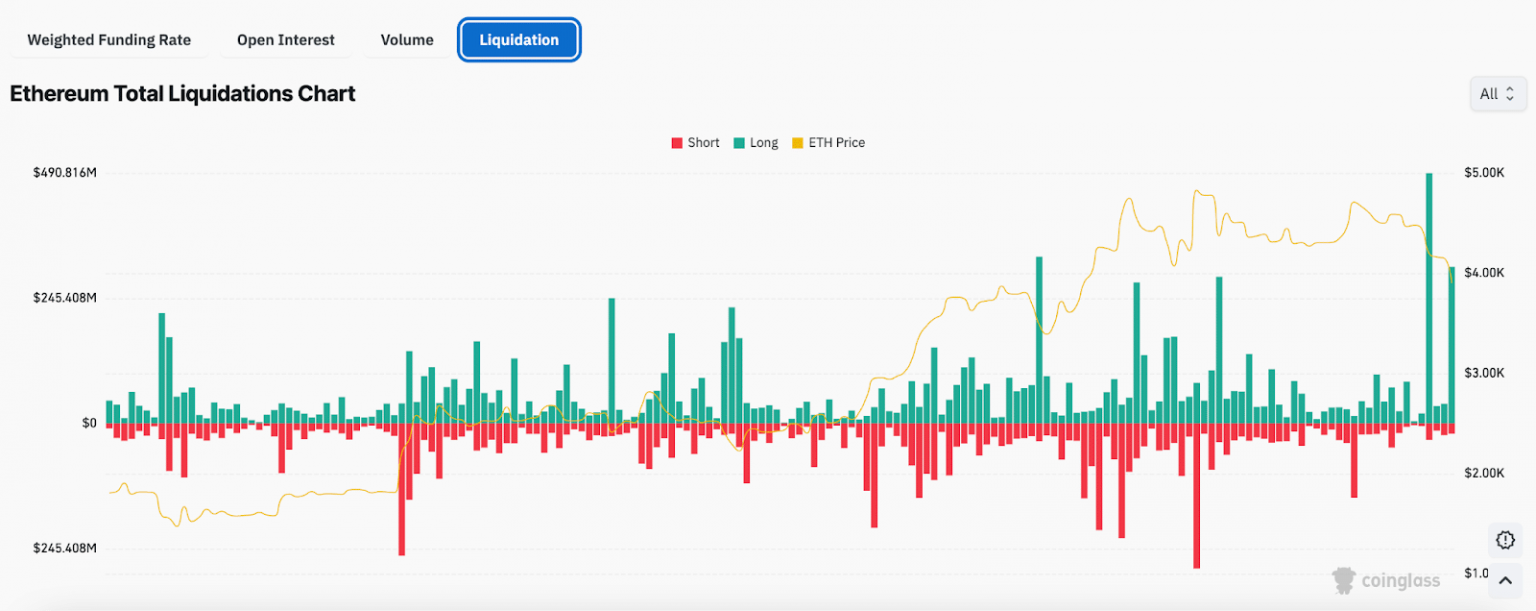

Ether dropped under $4,000 on Thursday, as derivatives markets noticed heavy unwinding.

CoinGlass data exhibits that previously 24 hours, lengthy merchants confronted about $332M in liquidations, including to almost $718Min losses this week.

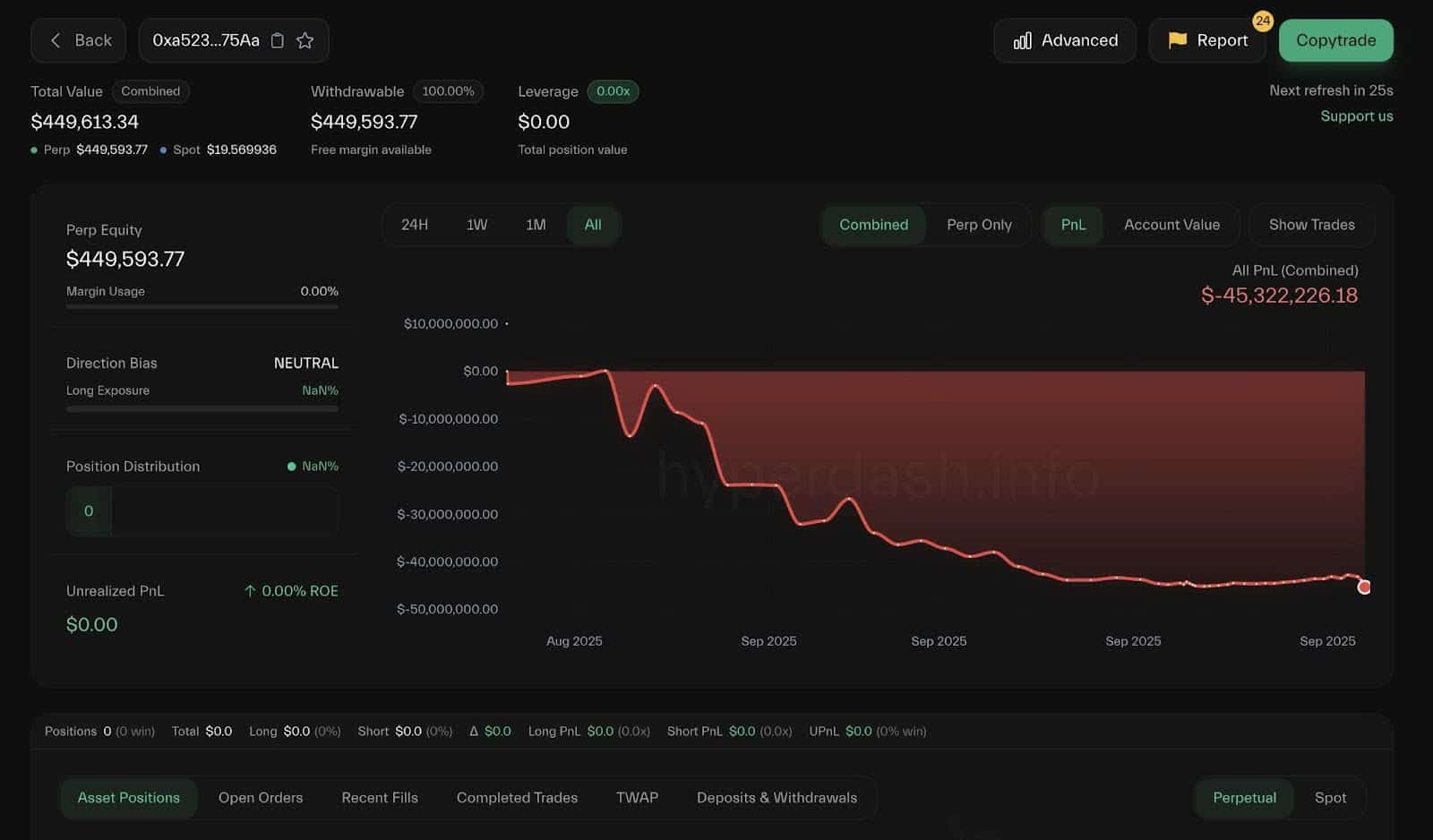

In keeping with Lookonchain information, one giant pockets, “0xa523,” took a single $36.4M hit.

ETH simply dropped under $4,000!

The largest loser, 0xa523, simply obtained WIPED.

His whole 9,152 $ETH($36.4M) lengthy place was absolutely liquidated.

His complete losses now exceed $45.3M, leaving him with lower than $500K in his account.https://t.co/8C3XNE5tMS pic.twitter.com/JplqJl0cPy

— Lookonchain (@lookonchain) September 25, 2025

Charts now recommend ETH might revisit the $3,600-$3,400 vary if stress continues.

On the similar time, SharpLink is transferring forward with an uncommon experiment: tokenizing SEC-registered fairness immediately on Ethereum.

The plan exams whether or not regulated shares might be held in self-custody wallets and ultimately traded on automated market makers with out violating securities guidelines.

The corporate says the hassle is supposed to “modernize capital flows” and tie its enterprise nearer to Ethereum’s monetary infrastructure.

SharpLink has additionally been constructing an ETH-heavy treasury since June. It holds over 838,000 ETH and has earned over 3,800 ETH in staking rewards by late September.

A Bitget be aware this week said the agency collected 509 ETH in staking rewards final week, with no new purchases or buybacks, an indication it’s specializing in treasury administration because it develops on-chain market instruments.

Past Ethereum, new infrastructure work continues throughout the sector.

A characteristic from The Block spotlighted Goat Community’s push for a Bitcoin Layer 2 utilizing zero-knowledge rollups, exhibiting how scaling tech is spreading to carry quicker settlement and broader performance.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in October 2025

Ethereum Value Prediction: Can ETH Value Get well Above $4,000 After Heavy Promoting Strain?

Ethereum’s sharp pullback has drawn two contrasting however hopeful takes from market watchers on X.

Crypto analyst Merlijn The Dealer said ETH has slipped about 16% from current highs, touchdown in what he calls a well-known “purchase zone.”

$ETH IS BLEEDING!

However look nearer: that is the precise purchase zone we ripped from final time.

Weak arms panic.

Sturdy arms load.We’ve seen this playbook earlier than

That is the place large beneficial properties are secured. pic.twitter.com/lXst5sUAet— Merlijn The Dealer (@MerlijnTrader) September 25, 2025

His chart exhibits the token testing the 100-day transferring common (100 MA), a stage that has beforehand marked sturdy rebounds.

He argued that whereas short-term merchants could also be panicking, long-term holders might view this correction as an opportunity to build up. “Weak arms panic. Sturdy arms load,” he stated, including {that a} previous bounce from this zone led to a major rally.

Regardless of current volatility, ETH stays above its 50 MA and 100 MA, suggesting the broader uptrend remains to be intact.

In the meantime, Mister Crypto highlighted a special sign: a bullish divergence between Ethereum’s value and the Relative Energy Index (RSI).

BULLISH DIVERGENCE ON $ETH! pic.twitter.com/6KlLVW1WhC

— Mister Crypto (@misterrcrypto) September 25, 2025

ETH lately dropped under $4,000, printing decrease lows, whereas the RSI climbed off oversold ranges round 27.37.

He stated that divergence usually marks the tip of a selloff and the beginning of a reduction rally.

If momentum holds, ETH might try to retest close by resistance, although analysts cautioned that broader sentiment will determine whether or not the rebound sticks.

Collectively, the 2 analyses body the present drop as a attainable turning level: one suggesting affected person accumulation, the opposite pointing to a technical setup for a bounce.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Sharpbet Makes Stock Tokenization Gamble As ETH Price Loses $4,000 appeared first on 99Bitcoins.