Solana (SOL) has dropped to its lowest stage since June 23, indicating clear stress throughout the market.

The drop displays heavy promoting strain that has been constructing for days, and the chart now exhibits clear indicators of weak point. Throughout a number of timeframes, indicators counsel stronger bearish momentum and a decline in shopping for curiosity. That blend raises the chance of extra draw back if sentiment doesn’t shift quickly.

CoinGecko data exhibits that the Solana worth is buying and selling at roughly $125.32, up round 8% on the day.

It traded between $122.66 and $135.27, with spot quantity topping $ 10.2 billion, displaying that merchants are nonetheless lively round these ranges.

DISCOVER: Top Solana Meme Coins to Buy in 2025

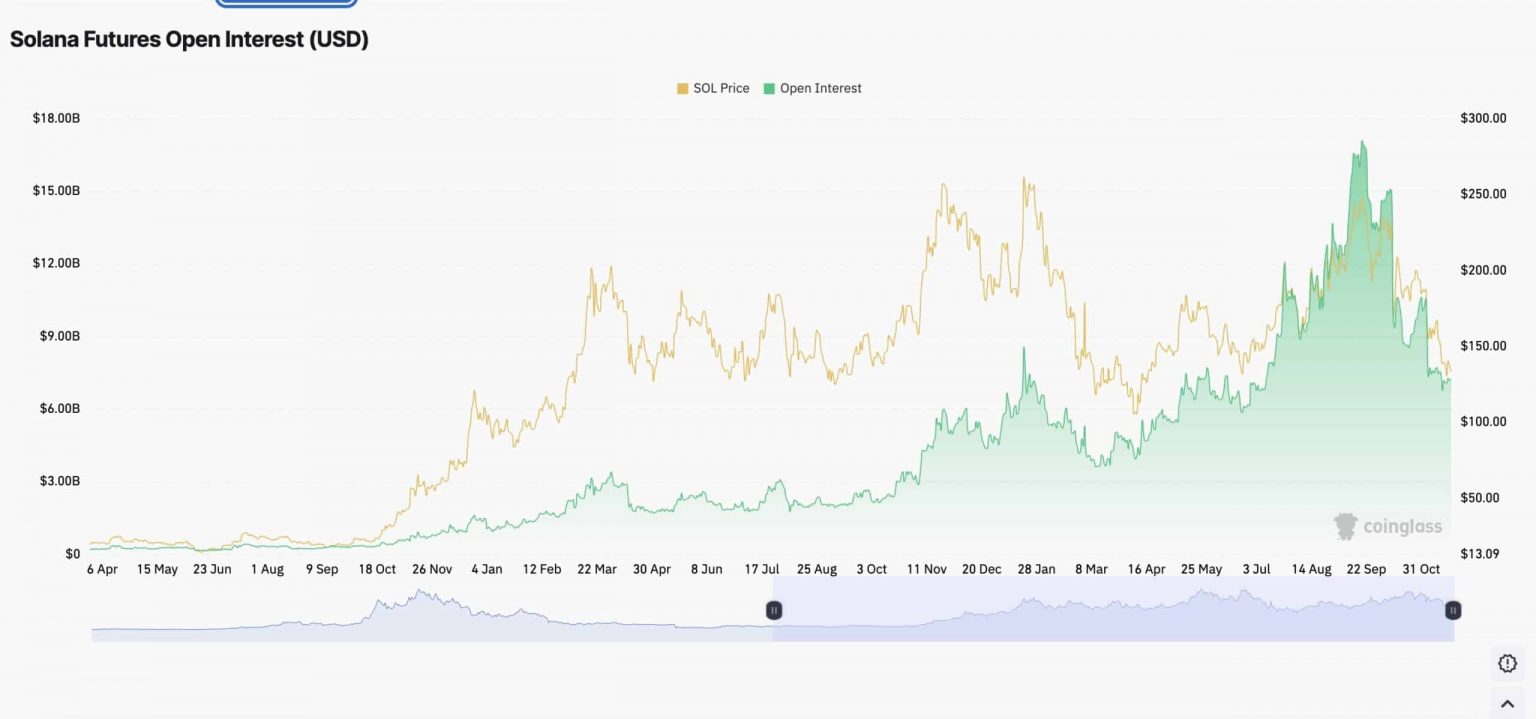

In keeping with Coinglass data, Solana’s open curiosity is close to $6.47Bn, and futures quantity over the previous day is at roughly $29.3Bn. The numbers point out a crowded market with quite a few leveraged positions nonetheless in play.

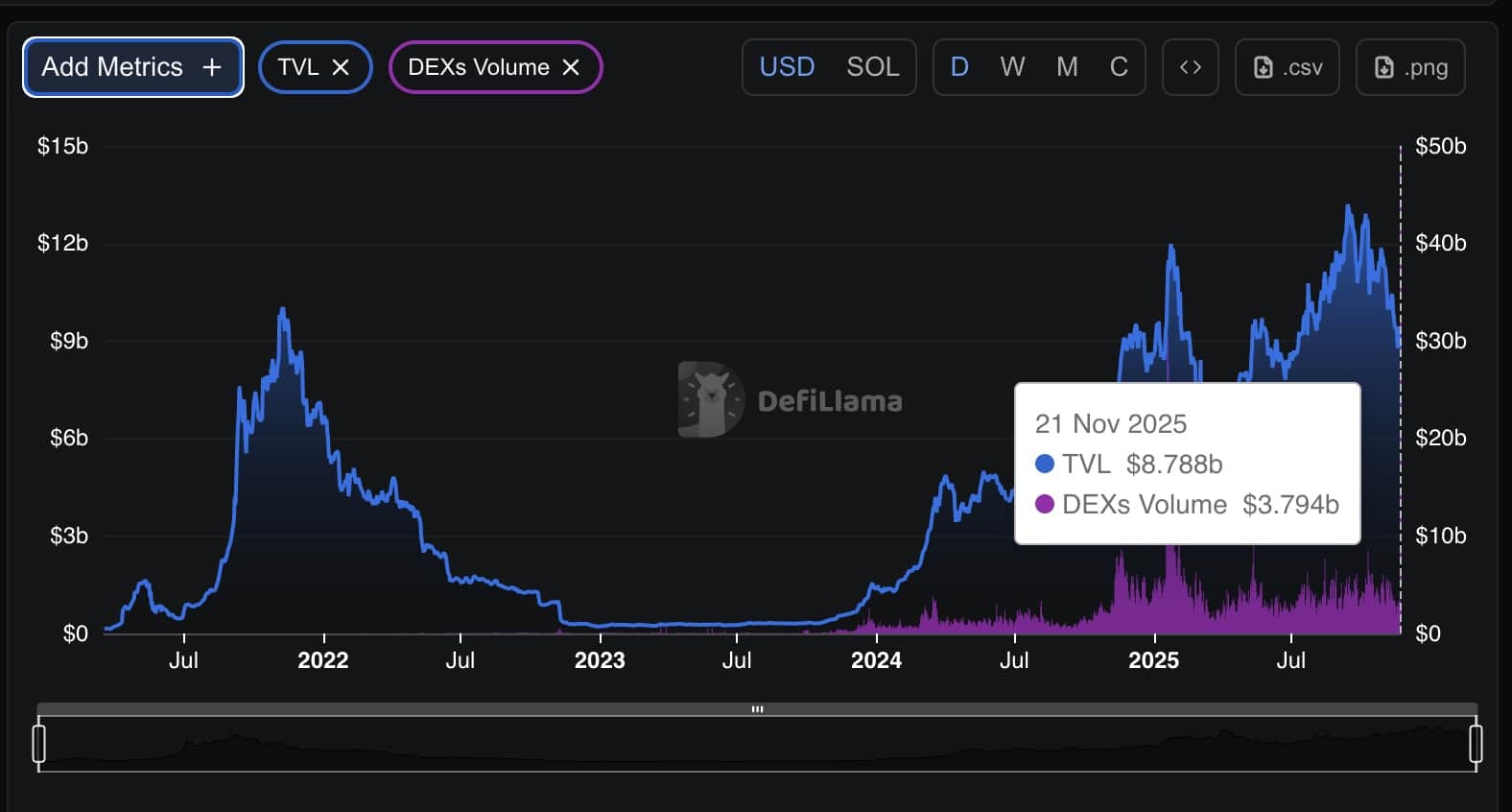

DeFi Llama reports Solana’s DeFi TVL at round $ 8.78 B, down -4.7% in a single day. DEXs dealt with roughly $ 3.32 billion in 24-hour quantity, an indication that customers are lively however cautious because the market adjusts.

Taken collectively, the rebound in spot costs, the heavy futures open curiosity, and regular DeFi exercise point out that the market stays lively.

Nonetheless, the slight dip in TVL additionally suggests some rotation and profit-taking throughout the Solana ecosystem.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Solana Value Prediction: What Occurs If Solana Fails to Break Above Recent Resistance?

Solana is now buying and selling at a vital stage after a pointy pullback pushed the market nearer to key assist.

The 4-hour chart shared by analyst Crypto Tony exhibits SOL making an attempt to recuperate from a deep drop that sliced by the mid-$120 vary earlier within the session.

The worth has bounced barely, shifting towards the $128–$130 space. That zone is now the fast barrier. A transparent transfer above it could shift short-term sentiment, whereas one other rejection may preserve strain on the draw back.

The latest periods present a sample of decrease highs and decrease lows, highlighting regular promoting and a decline in purchaser power. The break beneath $130 triggered a robust, quick transfer down, wiping out hours of sideways motion in a single candle.

Lengthy decrease wicks close to $123 point out patrons stepped in, although the restoration thus far is small in comparison with the pace of the decline.

The chart highlights a transparent horizontal stage round $130, which Crypto Tony known as the important thing line to observe. He summed it up merely: “$130 reclaim is bullish. Rejection and drop is a brief place.”

That view matches the setup on the chart. Solana is urgent in opposition to an space that after acted as assist and now sits as contemporary resistance. A agency shut again above $130 would counsel a short-term shift in momentum and will open the door towards the $134–$138 vary.

But when SOL fails to maneuver above that stage, the broader downtrend stays in management. In that case, the worth may slip again to $123, with $120 sitting as the subsequent assist zone.

The latest swings and repeated rejections point out that the market stays below stress. And until SOL can regain power above $130, merchants are prone to deal with any bounce as one other likelihood to brief the transfer.

EXPLORE: Who is Pavel Durov? Founder of Telegram & TON

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Solana Price Prediction: Can SOL Reclaim the $130 Level and Break the Current Downtrend? appeared first on 99Bitcoins.