Solana worth has trended decrease since January, even because the community racks up document utilization and income. We watched SOL lag whereas the chain generated over $271 million in Q2 2025 charges and funds, greater than some other community for 3 straight quarters.

The hole between worth and exercise sits inside a much bigger crypto story: cash rotating between Layer-1s, meme cash, and ETFs whereas regulators and establishments deal with Solana.

Why Has Solana Fallen Whereas The Community Appears to be like Robust?

If you’re new to Solana, it’s a high-speed blockchain laptop competing with Ethereum. It handles a lot of transactions cheaply, which attracts merchants and app builders. In accordance with CoinDesk, Solana introduced in over $271 million in community income in Q2 2025 and led all chains in customers for 3 quarters in a row.

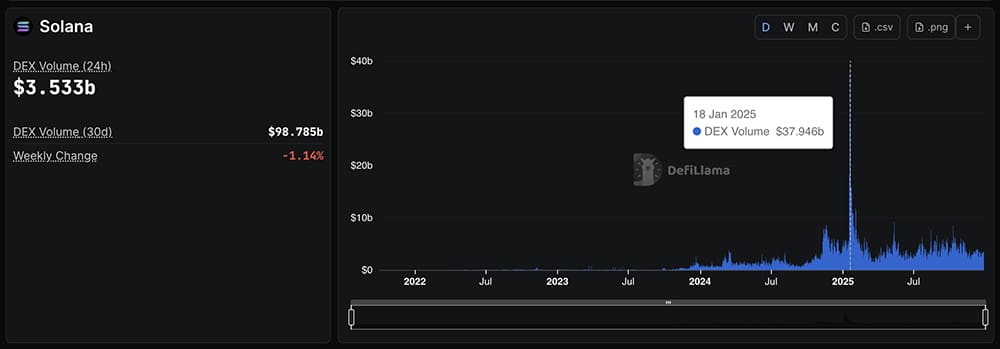

So why does the value sag? One cause is that the wild buying and selling spike early within the 12 months cooled off. January 2025 noticed peak decentralized alternate (DEX) exercise on Solana with about $408 billion traded, with greater than $37 billion on the 18th of January. A DEX itself is a crypto inventory market with no inbetweener. As that frenzy slowed by March, short-term merchants left, and the momentum has pale.

We’ve already seen how this sample performs out in different protection, like our piece on Solana DEX volume beating Binance. The chain dealt with extra buying and selling than the most important centralized alternate, but SOL’s chart appears heavy. That disconnect confuses us, who anticipate “extra utilization = larger worth” on a straight line.

(supply – Defillama)

DISCOVER: 10+ Next Crypto to 100X In 2025

What Does This Utilization-Worth Hole Imply For Solana Holders?

Solana worth reacts to flows and narratives within the brief time period, whereas utilization and income information the lengthy story. When merchants rotate into meme cash or different Layer-1s like Aptos, Sui, or Close to, SOL can drop even when Solana’s apps hum alongside.

It hurts should you purchased close to the highs and stare at pink candles each day. Sure, think about being the one who purchased Solana at its $293 prime, or 59% right down to immediately’s worth.

JUST IN: 27% OF @SOLANA'S OUTFLOWS SHIFTED TO @SUINETWORK IN THE PAST MONTH pic.twitter.com/C6D0nJnoun

— ToreroRomero (@ToreroRomero) October 8, 2024

On the similar time, massive cash retains lining up merchandise round Solana. Franklin Templeton spot SOL ETF is stay, it’s now letting individuals purchase publicity to SOL in an everyday brokerage account. Extra just lately, CME Group is making ready to launch Solana futures, per one other Reuters report, which is a giant step for Wall Avenue merchants.

NEW: FRANKLIN TEMPLETON ANNOUNCES ITS SOLANA ETF IS NOW LIVE pic.twitter.com/D6BzKnUX6Q

— DEGEN NEWS (@DegenerateNews) December 3, 2025

These strikes matter as a result of they make it simpler for establishments to commerce and hedge SOL. That doesn’t assure the next worth, nevertheless it means SOL is graduating from pure retail hype into the identical toolbox as Bitcoin and Ethereum. In order for you extra background earlier than risking cash, our primary Solana market positioning guide helps you see how this matches the 2025 narrative.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How Ought to We Deal with SOL In This Type Of Downtrend?

When worth falls whereas fundamentals look strong, the most important hazard is emotional buying and selling. Many learners both panic-sell close to the underside or revenge-buy dips with out a plan. As a substitute, deal with Solana like a high-growth tech inventory: thrilling, however dangerous, very dangerous.

Ask your self, “Am I shopping for a five-year story or chasing final month’s chart?”

In the event you already maintain SOL, test what % of your internet value sits in it. For us, protecting any single altcoin as a small slice of your portfolio helps you sleep at evening. By no means retailer lease, emergency cash, or debt funds in SOL. The identical community that posts $271 million in quarterly income can nonetheless drop 50% in a nasty market swing.

Additionally, keep in mind that robust metrics don’t erase dangers. Solana has handled outages and stress occasions earlier than, which we lined in our piece on Solana under DDoS pressure. Excessive throughput is nice, however you continue to rely on the chain staying steady, devs transport, and regulators staying comfy with SOL ETFs and futures.

(supply – Google)

In the event you consider in Solana’s long-term function alongside Ethereum and different Layer-1s, this sort of downtrend is extra about place sizing and persistence than prediction.

Watch how utilization, income, and ETFs progress, evolve, zoom out, and cease taking a look at simply the every day candle. As establishments step in and hypothesis cycles via, the true story will present up the place the builders, customers, and costs go, not simply the place the road strikes this week.

Follow 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Each day Knowledgeable Market Evaluation.

The submit Solana Price Slides While Usage Booms: What’s Really Going On? appeared first on 99Bitcoins.