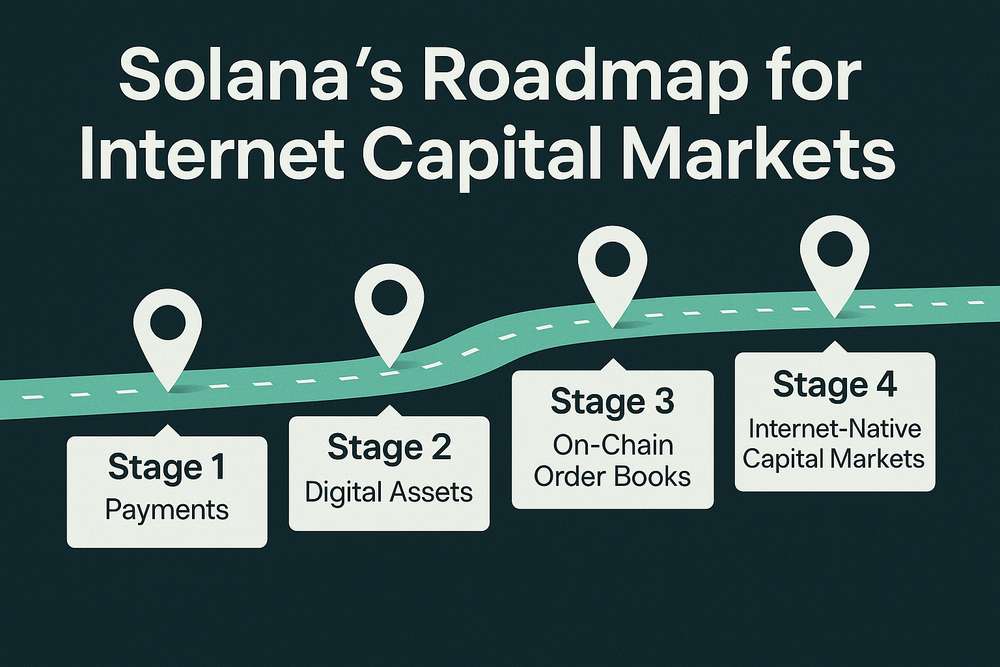

Solana ecosystem leaders have unveiled a complete roadmap to determine blockchain-powered Web Capital Markets, aiming to revolutionize international finance via decentralized infrastructure. The initiative brings collectively core builders, traders, and DeFi protocols to create a permissionless monetary system with atomic composability and real-time transparency.

On the coronary heart of this imaginative and prescient lies Utility-Managed Execution, a technical framework permitting protocols to customise transaction processing. This strategy allows tighter spreads, decrease charges, and enhanced capital effectivity whereas sustaining Solana’s signature excessive throughput.

The roadmap emerges from collaboration between Solana Basis, Anza, Jito Labs, DoubleZero, Drift, and funding agency Multicoin Capital. Their white paper outlines a phased deployment technique concentrating on institutional adoption whereas preserving decentralization rules.

Technical Roadmap

Growth will happen in three distinct phases with concrete deliverables:

| Timeline | Initiative | Operate |

|---|---|---|

| Brief-term | Jito’s BAM buying and selling module | Enhanced liquidity administration |

| Mid-term | DoubleZero community & Alpenglow | Low-latency cross-chain communication |

| Lengthy-term | Multi-Chief Mechanism (MCL) | Concurrent transaction processing |

This infrastructure stack particularly addresses the MEV (Maximal Extractable Worth) challenges highlighted in latest ecosystem reviews. Options like Triton’s Protect validator whitelisting system will mitigate sandwich assaults whereas sustaining community efficiency.

Ecosystem Development

Solana’s H1 2025 ecosystem report reveals explosive DeFi growth, with tasks like Jupiter, GMX, and Kamino driving adoption. Chainlink’s latest CCIP integration now secures over $19 billion in cross-chain property, offering essential oracle infrastructure for capital markets.

New launch platforms together with Imagine and Radium’s Launch Lab show modern capital formation fashions. These facilitate permissionless token distribution whereas giving international traders equal entry to alternatives beforehand restricted by geography.

Sergey Nazarov of Chainlink emphasised at Solana Speed up 2025: “We’re getting into a brand new stage the place capital markets and institutional adoption will drive business progress. Chainlink already secures prime Solana purposes as a result of our reliability meets institutional necessities.”

Market Impression

The Web Capital Markets thesis essentially reimagines monetary structure via:

- International entry to funding alternatives

- Actual-time auditable leverage

- Tighter spreads through conditional liquidity

- Atomic composability throughout protocols

This improvement positions Solana as a viable settlement layer for conventional finance property whereas capturing worth from MEV redistribution. Ecosystem calls reveal energetic collaboration between core groups to stability scalability with safety as adoption grows.

Set up Coin Push cellular app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

The roadmap’s execution may set up Solana because the premier blockchain for institutional-grade capital markets, combining conventional finance reliability with DeFi innovation. Success hinges on sustaining decentralization whereas scaling to fulfill international demand.

- Utility-Managed Execution

- A Solana framework permitting protocols to customise transaction processing guidelines and sequencing for specialised use instances.

- MEV (Maximal Extractable Worth)

- Revenue validators can earn by reordering transactions, which Solana mitigates via options like Jito’s block engine.

- Atomic Composability

- The power to execute a number of transactions throughout completely different protocols concurrently, making certain all succeed or fail collectively.

- Conditional Liquidity

- Superior market-making methods that regulate quotes primarily based on real-time community situations to tighten spreads.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your personal analysis earlier than making any funding choices.

Be happy to “borrow” this text — simply don’t overlook to hyperlink again to the unique.

Editor-in-Chief / Coin Push Dean is a crypto fanatic primarily based in Amsterdam, the place he follows each twist and switch on the planet of cryptocurrencies and Web3.