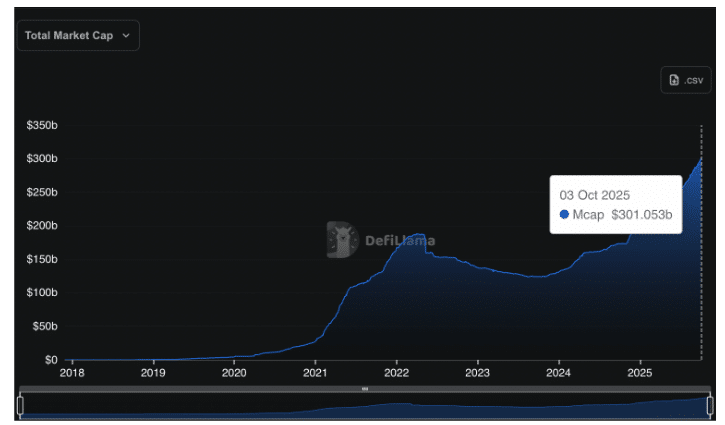

A $300Bn money cushion simply shaped in crypto, and merchants are asking when that “dry powder” will rotate into altcoins.

The worth of dollar-pegged tokens in circulation has topped $300Bn for the primary time, marking a milestone that usually boosts liquidity throughout digital property.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Does the Stablecoin Provide Ratio Reveal About Market Liquidity?

Knowledge from DeFiLlama exhibits the entire stablecoin market cap at about $301.6Bn right this moment, a +2% achieve over the previous week.

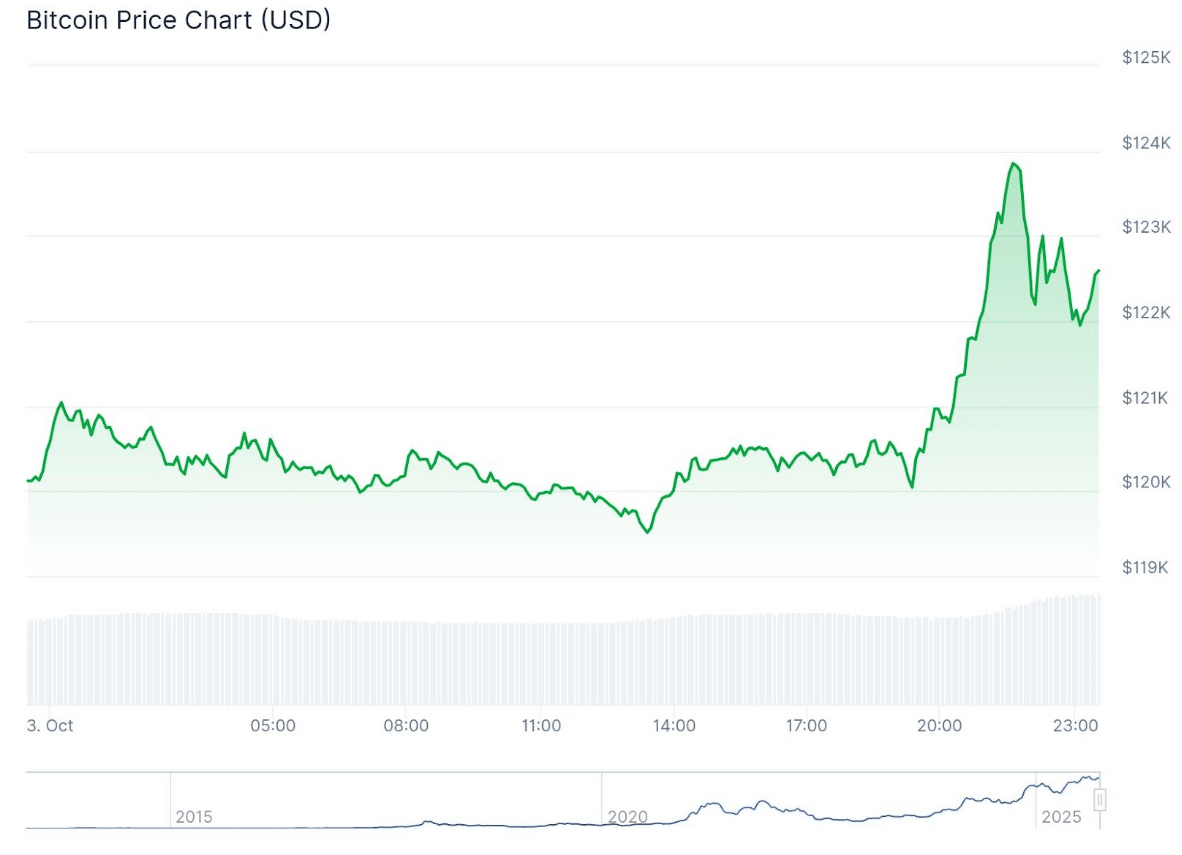

The rise is noticed with Bitcoin buying and selling as excessive as two months at round $120,000-123,000, which gives a positive danger urge for food environment in October.

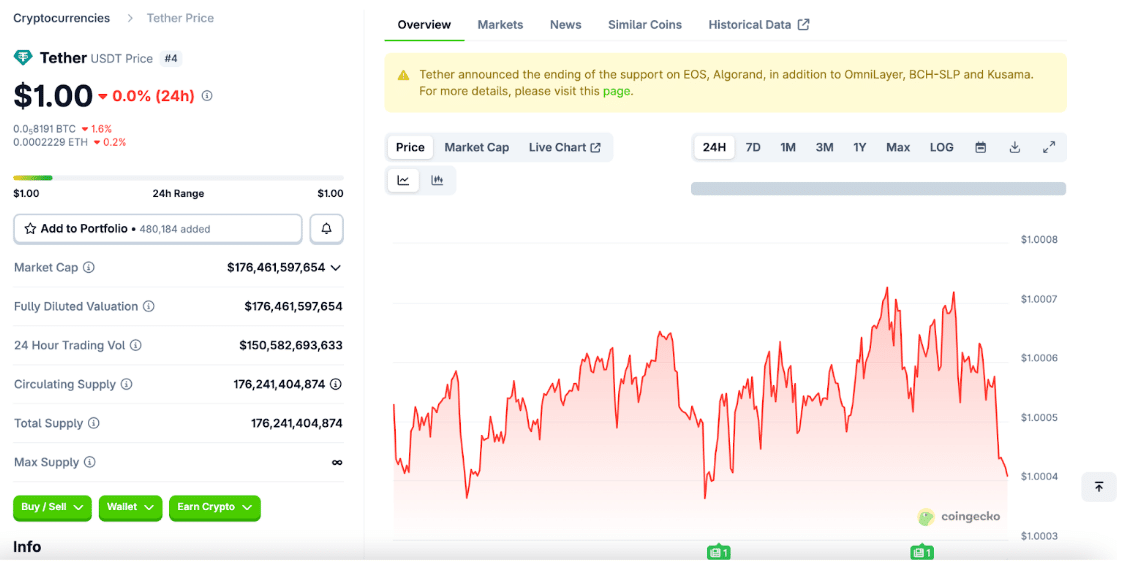

Tether (USDT) is the chief of the issuers, and its market cap is nearly $176Bn.

USD Coin (USDC) ranks next with an approximate worth of $74-$75Bn, and artificial stablecoin USDe is near the worth of $14.8Bn. These three tokens made up a lot of the internet issuance of 2025.

This 12 months’s development marks the quickest stablecoin enlargement since early 2021. Even so, analysts say the market should speed up additional to satisfy long-term forecasts.

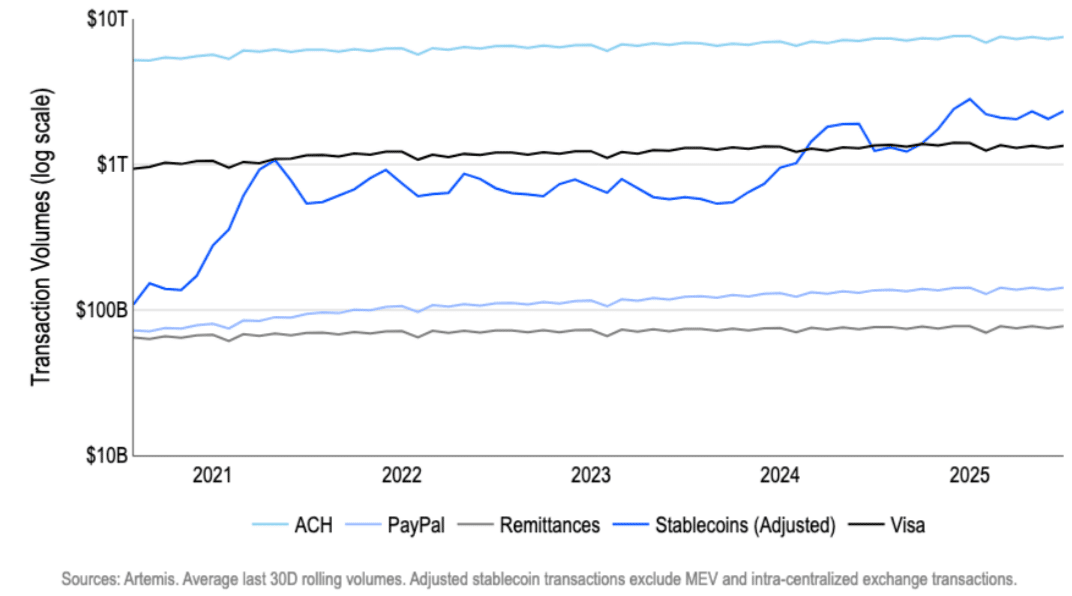

Coinbase projects $1.2 trillion in provide by 2028, whereas Commonplace Chartered sees $2 trillion and Citi as a lot as $4 trillion by 2030.

On the present tempo of about $10Bn added every month, it could take greater than 5 years to achieve the decrease finish of these estimates.

Circle’s push towards the general public market and reviews of a giant Tether funding spherical are seen as key drivers that would increase the sector’s function in international liquidity.

A key metric to look at is the Stablecoin Provide Ratio (SSR). It compares the provision of Bitcoin to that of stablecoins, measured in BTC phrases. A decrease SSR means there’s extra stablecoin liquidity, usually described as “dry powder” able to movement into crypto.

In response to Glassnode data, a easy public proxy utilizing Bitcoin’s market cap divided by the entire stablecoin market cap sits round 8.1.

That’s roughly $2.45 trillion in Bitcoin in opposition to $301.6Bn in stablecoins. Methodologies can differ, however this ratio provides a directional view. A decrease or regular studying tends to point out stronger shopping for energy on the sidelines.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in October2025

How Are Stablecoins Performing as a Hedge Earlier than the Fed Assembly?

The backdrop appears to be like supportive. Stablecoin issuance has been increasing, with the market just lately crossing a recent round-number milestone.

On the identical time, Bitcoin’s worth close to $120,000 retains consideration on the broader crypto market. If flows rotate past Bitcoin, mid-cap tokens are normally the primary to profit.

In response to Glassnode’s framework, a sustained low SSR or additional decline within the proxy ratio would point out that stablecoins nonetheless retain vital shopping for energy for future market strikes.

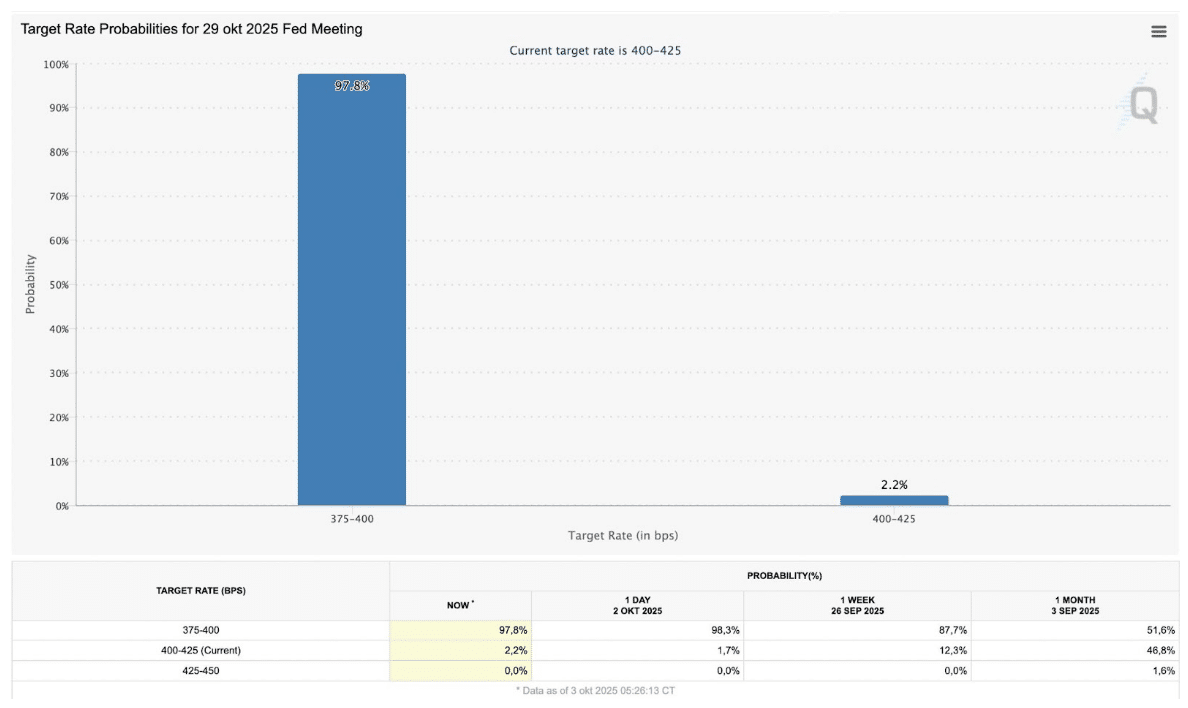

The newest FedWatch information signifies that markets are nearly totally anticipating the Federal Reserve to chop charges at its October 29, 2025, assembly.

Present pricing factors to a 97.8% probability that charges will fall to the 375-400 foundation level vary, leaving simply 2.2% odds that the Fed holds regular at 400-425 bps.

Expectations shifted sharply from final month, when merchants had been almost break up.

Crypto analyst Ted tied this shift to stablecoin flows. He stated retail merchants are piling in with bullish bets, whereas institutional buyers appear to be trimming positions.

Unpopular opinion: October price cuts are already totally priced in.

Retail is piling in with excessive bullishness.

Establishments are quietly offloading.

You join the dots.

I could also be fallacious, however I’m risk-managing with 70% in stablecoins. pic.twitter.com/E7dkhNDWH4

— Ted (@TedPillows) October 3, 2025

“October price cuts are already totally priced in,” Ted stated, and he added that he has moved 70% of his portfolio into stablecoins as a part of his personal danger administration.

The Fed’s determination may form liquidity throughout markets and affect danger urge for food.

For now, merchants are treating easing as a close to certainty, with stablecoins serving as a well-liked hedge earlier than the coverage name.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Stablecoins Hit $300Bn Valuation: When Will It Pump Altcoin Markets appeared first on 99Bitcoins.