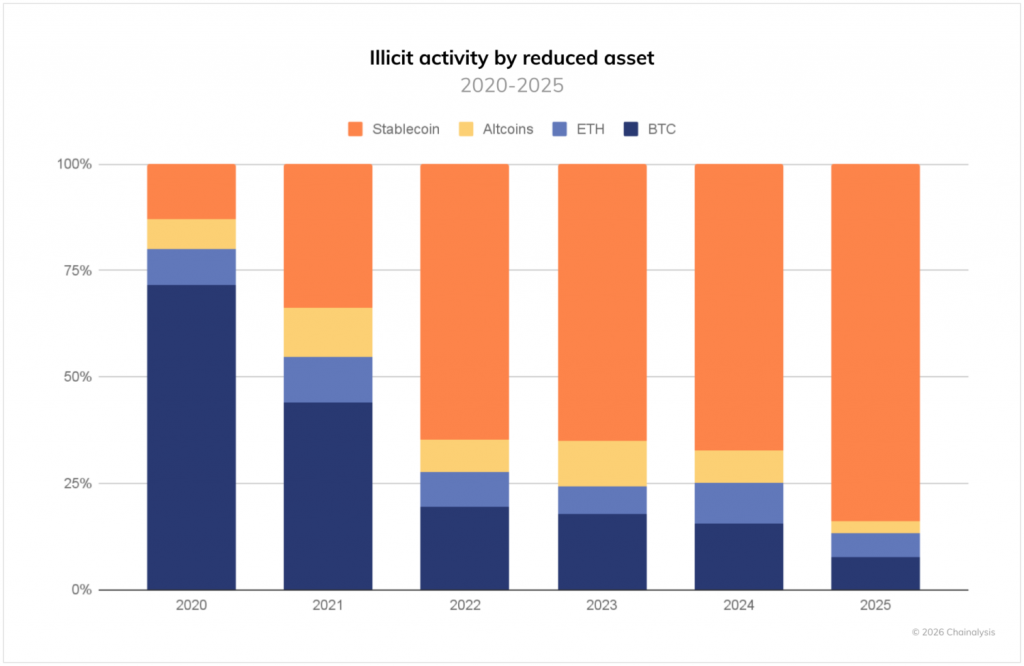

Stablecoins now sit on the middle of most unlawful crypto exercise, not Bitcoin, based on new knowledge from Chainalysis. This comes at a time when governments are tightening crypto guidelines and stablecoins have gotten extra widespread in on a regular basis funds.

Why Are Criminals Selecting Stablecoins Over Bitcoin?

Stablecoins are cryptocurrencies designed to maintain a gentle value, normally round one US greenback. You’ll be able to consider them as digital money that strikes on blockchains. Common examples embrace USDT, often known as Tether, and USDC.

Earlier this week, Chainalysis reported that stablecoins accounted for about 84% of illegal crypto transactions in 2025, far more than Bitcoin. The reason is simple. Criminal groups want consistency.

If somebody calls for a million {dollars} immediately, they need it to nonetheless be price a million tomorrow.

Bitcoin costs transfer up and down an excessive amount of for that. These swings will be nice for merchants, however they create issues for anybody who wants a set quantity. Stablecoins take away that uncertainty.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in January2026

What This Knowledge Says About Crypto’s Rising Pains

This development doesn’t imply crypto use is usually felony. Criminal activity nonetheless makes up lower than one % of all crypto transactions. The change is about what folks use inside that small portion.

A big share now comes from teams making an attempt to maneuver cash round worldwide sanctions, usually utilizing stablecoins on quick and low cost networks like TRON. WIRED reported that some state-linked teams desire these networks as a result of they will transfer funds throughout borders with out counting on banks.

For normal customers, this highlights the necessity for better oversight of stablecoins. Governments all over the world are already debating stricter guidelines for them, as seen within the ongoing discourse on stablecoin regulation.

How This Impacts On a regular basis Crypto Customers

For those who use stablecoins to commerce or ship cash, you’re doing nothing mistaken. They’re nonetheless a core a part of how crypto markets work. On the identical time, exchanges and pockets apps now face nearer checks.

That always results in extra id requests, extra transactions being reviewed, and generally accounts being frozen whereas platforms examine exercise. This stress additionally grows as banks start constructing their very own stablecoin programs, as coated in our report on stablecoin infrastructure.

Over time, this will make cost programs extra dependable, though it will probably additionally imply much less privateness and some further steps for customers who worth velocity.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2026

Danger Verify: Don’t Confuse Headlines With Private Hazard

Information about crypto crime can sound alarming, however context helps. Money continues to be used for much extra crime than crypto.

Even so, inexperienced persons ought to deal with stablecoins the identical manner they deal with on-line banking. Follow trusted wallets. Keep away from random hyperlinks. Verify addresses rigorously earlier than sending cash. And keep in mind that “steady” solely refers to cost, not security.

As regulators focus extra on unlawful stablecoin use, guidelines will doubtless change into stricter, whereas the programs themselves change into extra stable. For customers, the takeaway is simple. Learn the way the instruments work, then use them with care.

DISCOVER: 20+ Next Crypto to Explode in 2025

Comply with 99Bitcoins on X for the Newest Market Updates and Subscribe on YouTube for Each day Professional Market Evaluation

The publish Stablecoins Now Power Most Crypto Crime, Not Bitcoin appeared first on 99Bitcoins.