Mama! Tether is at it once more; they’ve purchased 8,888 extra BTC. This occurred whereas Bitcoin traded in a decent vary after the information, as we weighed the bullish sign of extra institutional shopping for in opposition to worries about stablecoin danger. This comes whereas regulators and score businesses improve scrutiny on stablecoins and their backing.

Tether acquired 8,888.8888888 BTC in This fall 2025.https://t.co/vMh1uzv1wO

— Paolo Ardoino (@paoloardoino) December 31, 2025

What Does Tether Shopping for Extra Bitcoin Really Imply?

Tether points USDT, the biggest stablecoin, which tracks $1 the best way a on line casino chip tracks a greenback on the cage. You utilize the chip to play, however you belief that the on line casino retains sufficient actual money within the again. In crypto, USDT performs that position on exchanges.

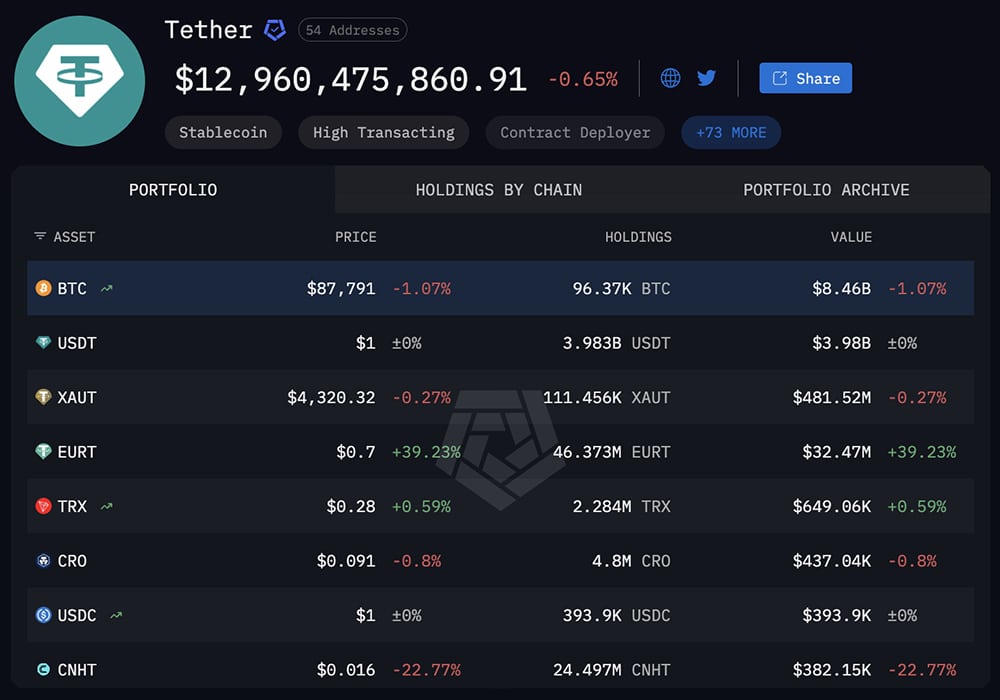

Since 2023, Tether has adopted a coverage of sending about 15% of its earnings into Bitcoin, with common purchases of roughly 8,888 BTC 1 / 4. Their stack grew to over 92,000 BTC earlier in 2025, and a later addition of 8,889 BTC in This fall pushed complete BTC reserves to round $9.7 billion.

Tether now holds Bitcoin as about 5.6% of its complete reserves, greater than $8 billion of its $12 billion complete crypto holding. That slice provides upside if Bitcoin runs greater, nevertheless it additionally means a piece of the “$1 tokens” individuals use on daily basis depends upon a risky asset.

(supply – Arkham)

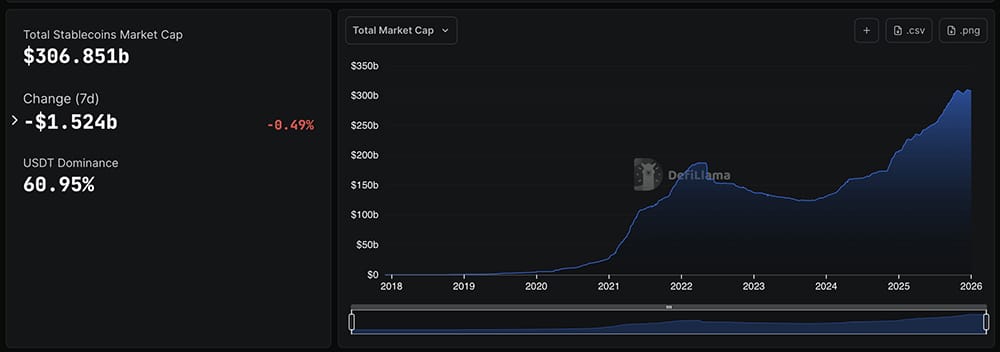

Why does this matter to us? As a result of Tether controls about 61% of the worldwide stablecoin market and greater than $185 billion USDT circulates worldwide, processing over $500 billion a month in transfers. When you commerce on an enormous trade, likelihood is you already use USDT, even for those who by no means take into consideration Tether’s steadiness sheet.

If you wish to see how giant gamers behave once they construct huge Bitcoin positions, you possibly can evaluate this to earlier Bitcoin whale accumulation cycles and different circumstances of institutional BTC accumulation.

(supply – Defillama)

DISCOVER: 10+ Next Crypto to 100X In 2026

How May Tether’s BTC Guess Affect Our Crypto Danger?

On the bullish facet, Tether retains eradicating giant chunks of BTC from the market and locking them away in reserves. Much less liquid Bitcoin on exchanges typically helps long-term holders as a result of it reduces the obtainable provide when new demand exhibits up.

Each time a serious participant accumulates BTC, it additionally sends a story sign: “We deal with Bitcoin as a reserve asset.” That may appeal to extra establishments, just like how company treasuries or funds add BTC over time. For us, this helps the concept Bitcoin behaves extra like a long-term financial savings asset than a fast buying and selling token.

However there’s a actual commerce‑off. S&P just lately downgraded the standard of Tether’s reserves due to its further publicity to Bitcoin and different danger property, based on the Financial Times. Ranking businesses fear about precisely what you would possibly fear about: “What occurs to my stablecoin if Bitcoin dumps arduous?”

We already noticed how shaky design and dangerous backing can damage a stablecoin in circumstances like algorithmic cash and over‑engineered yield merchandise. For extra background on how reserve decisions have an effect on belief, test our explainer on stablecoin reserves and why merchants generally flee riskier designs.

What Ought to We Do Now?

First, don’t panic‑swap all of your USDT simply because Tether holds some Bitcoin. A 5–6% BTC share in reserves doesn’t equal a home of playing cards. However it’s best to deal with stablecoins the identical approach you deal with banks: don’t hold your complete web price in anybody issuer.

Unfold your “money” publicity. Holding a mixture of USDT, USDC, and even transferring some idle funds again to your checking account reduces single‑issuer danger. Rivals like USDC and new merchandise comparable to Tether’s deliberate USAT goal totally different regulatory setups, so that you don’t must marry one coin endlessly.

Second, separate your methods. Use stablecoins for brief‑time period buying and selling and funds. Use Bitcoin for lengthy‑time period financial savings if that matches your danger profile. Simply because Tether blends Bitcoin into its reserves doesn’t imply it’s best to blur your personal “money vs funding” line.

And third, measurement your bets like an grownup. Institutional Bitcoin adoption is thrilling, nevertheless it doesn’t take away the draw back. Assume Bitcoin can nonetheless drop 50% from any stage and plan your publicity so a crash hurts your pleasure, not your lease cash.

As Tether retains stacking sats and regulators circle the stablecoin sector, count on extra headlines and extra emotion. Your edge comes from one thing boring: understanding what backs your cash and maintaining your personal danger unfold out, it doesn’t matter what the whales do.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

Follow 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Day by day Professional Market Evaluation.

The submit Tether Loads Up 8,888 BTC Again: Smart Reserve Play or Risky Game? appeared first on 99Bitcoins.