You’d be forgiven for pondering that technological improvement was following a predetermined trajectory. Previously few a long time, we’ve seen the rise of private computer systems, the web, cell units, and now, the appearance of Bitcoin.

It’s already well-established that bitcoin is the perfect asset. That’s only a matter of primary monetary literacy. When you can learn a graph, the proof is apparent.

Supply: CaseBitcoin & Market Information (2025)

What’s much less apparent is Bitcoin’s utility, and the way that’s going to recast our financial lives within the coming a long time. Past its properties as an asset, that are getting many of the consideration and recognition, Bitcoin is a technique to transfer worth. That’s its core utility. And it’s not about shopping for espresso or underwear (at the least not but). Because it’s a foreign money designed on and for the web, retail adoption will probably come after it goes mainstream on-line. And the way it will go mainstream on-line is by commoditizing worth switch — letting anybody transfer worth anyplace for any function with out intermediaries.

Shifting worth is such an enormous a part of our lives that increasing that realm of prospects means altering our conduct and the form of our societies. With regards to transferring worth, borders will evaporate, colossal establishments like banks will shrivel, and new connections will sprout like blossoms in spring. The dimensions of the transformation will rival that of the web itself.

Bodily books have been laborious to acquire and simple to ban (and generally burn). The web liberated info, giving way more individuals entry to way more concepts than we had ever had earlier than. Typical cash is locked within the walled gardens and most well-liked pathways of market incumbents. Bitcoin represents the tip of this method and the start of one other.

The web unlocked info; bitcoin is unlocking worth.

To understand the potential of the present transformation and to distinguish it from boilerplate pro-Bitcoin rhetoric, consider it as a shift from the fiat-based fee paradigm to the Bitcoin-based value-transfer paradigm. This sounds extra summary than it truly is.

First, let’s recall the acquainted: funds. Typical funds are directions to clear a debt, a definition echoed by skilled economists. If somebody sells you a espresso or cuts your hair, you owe them, and you agree that debt by paying them. Notice that, in follow, paying them requires instructing intermediaries — banks, apps, playing cards, center males — to truly transfer the worth.

Distinction that with worth switch. There are two key variations. First, as we conceptualize it, worth switch is direct. It’s not an instruction to an middleman to carry out an motion; it’s the act itself. Second, worth switch needn’t settle a debt. Cost is a quid professional quo. Worth switch is simply quid. You possibly can ship worth at a whim; it doesn’t essentially indicate a commerce, although it may.

Money makes the variations between funds and worth switch readily obvious. Once you pay somebody in money, you’re not asking permission. You might be bodily transferring worth from one hand to a different. And money can do greater than settle money owed, i.e. greater than funds. Dropping some change right into a busker’s hat or giving your child an allowance are easy transfers of worth with out prior debt. You possibly can “push” worth with money quite than simply commerce it.

Nevertheless, money is being marginalized by the authorities and it’s poorly suited to our digital world, so we’re dropping our skill to switch worth. We belief these third-party intermediaries, like banks, bank card corporations, and fintech suppliers, to honor our fee directions and fulfill our requests, however fee directions are sometimes denied or delayed.

Extra importantly, these fee directions are restricted to predefined patterns dictated by the intermediaries’ siloed constructions (e.g. from buyer to service provider, from employer to worker, from one checking account to a different if the banks share a wire-transfer protocol). This would possibly sound like an exaggeration, however take into account platforms like Uber, OnlyFans, AirBnB, and Spotify. On the floor, all of them appear like decentralization: the platforms simply join service suppliers with shoppers. However the funds all run alongside the platforms’ predefined paths, which embrace lengthy chains of grasping intermediaries — banks, fintech apps, bank card corporations. and so forth. Every of those intermediaries provides price, a possible level of failure, and a supply of permissioned friction, regulatory and in any other case.

The distinction to worth switch is stark. Merely put, worth switch distills the permissionlessness, instantaneousness, and suppleness of money funds with out the constraints of getting to carry and transfer bodily objects.

However how can we reimagine money in a digital world? How can we transfer from the restrictions of funds to the empowerment of worth switch? If solely we had a technique to ship and obtain peer-to-peer digital money…

Bitcoin is extra programmable, extra versatile, extra adaptable than digital funds might be. Bitcoin lets us retailer and transfer worth simply as easily and simply as our telephones retailer and share a snapshot. By treating worth as simply one other type of info, Bitcoin will allow new patterns of financial exercise constructed on complete ecosystems of explicit use instances.

And sure, it should be Bitcoin.

Worth switch — transferring worth at will immediately between sender and recipient — represents a momentous shift from the traditional fee paradigm. So why isn’t fintech making it occur? Isn’t this what stablecoins are for? Why is bitcoin the mandatory basis for an financial system primarily based on worth switch?

The brief reply is that funds are deeply embedded within the structure of the fiat system, together with fintech.

A fintech fee includes an indefinite chain of intermediaries. For every middleman to earn income from the transaction, they want a billing mannequin. And so they go for discrete funds as a result of that’s what regulated cash transmitters are allowed to do. Due to the KYC, AML, and danger evaluation concerned, it’s an costly enterprise, so their charges are commensurately excessive.

Past price, intermediation essentially introduces friction. Every middleman is topic to regulatory constraints that change throughout borders and jurisdictions, which limits their markets and their attain. They need to additionally take into account extraneous enterprise considerations, like the danger of huge shoppers in a single sector revoking their enterprise due to unrelated transactions in one other sector. Furthermore, these funds aren’t any extra programmable than the intermediaries enable, and they’re neither last nor instantaneous. The intermediaries can course of them at their leisure, and the payer can typically rescind the fee after the actual fact.

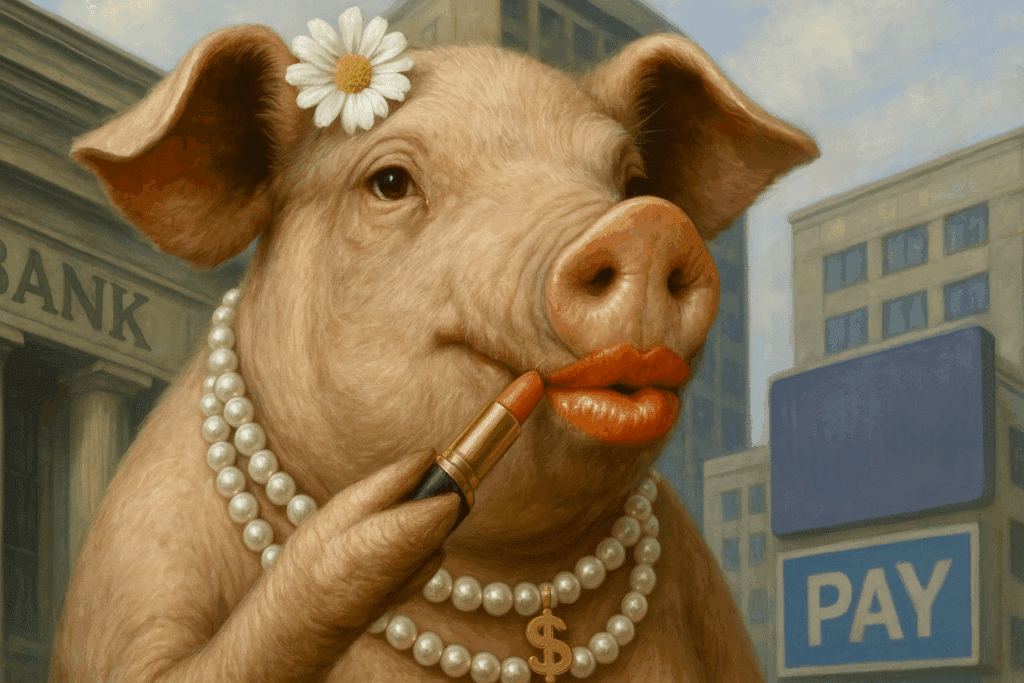

Stablecoins, typically touted as an answer, merely substitute one fiat-based promise for one more. As MiCA and the GENIUS Act present, stablecoins are deeply susceptible to foreign money controls. A given stablecoin would possibly work for cross-border funds right now, however not subsequent quarter. USDT and 9 different tokens have been delisted from European exchanges in the beginning of 2025 in response to the brand new rules. Stablecoins’ issuers are topic to the identical extraneous considerations as fintech suppliers, and they’re solely as programmable as these central entities enable them to be. Stablecoins are simply fiat beheld by blockchain-colored glasses. Certainly, stablecoins and fintech are digital lipstick on a legacy-payments pig.

Bitcoin succeeds the place fintech and stablecoins fail. The place their pricey intermediation requires funds, bitcoin allows worth switch. The place their operational constraints restrict entry and use instances, Bitcoin is an open, decentralized, impartial financial community that works for anybody, anyplace, anytime. The place they entice regulatory scrutiny and develop into geopolitical pawns, Bitcoin gives a minimal regulatory footprint and not using a native jurisdiction. The place they restrict programmability to guard established patterns and privileges, Bitcoin fosters innovation and the programmability that it requires.

If we may return to the daybreak of the web and design a foreign money optimized for the digital age, it might appear like bitcoin. It is bitcoin.

Apps are the automobiles of change. They’re the nodes of our fixed information streams, and they’re the instruments that alter how we work, how we transfer, how we love, and the way we predict. Apps outline the digital setting to which we people are adapting, and we construct apps to adapt our surroundings to us. Worth switch is eclipsing funds, and apps are its conduits.

To grasp how apps will combine and foster worth switch, take into account the evolution of the digital digital camera. The primary “filmless” cameras hit the market within the mid-Seventies, however for the primary twenty years, they have been single-purpose units. Even the cameras hooked up to early cell telephones have been “simply” cameras. They took footage, nothing extra.

The revolution in what digital cameras can do and in our relation to them got here in 2007 with the discharge of the primary iPhone. It wasn’t simply the digital camera itself however the mixture of the digital camera with apps that modified every thing. Builders rapidly built-in the digital camera into their apps, enabling customers to take, modify, and share pictures.

The synergy of digital cameras and apps modified our actuality and our conduct. Apps like TikTok, Instagram, and Pokemon GO make behaviors that may have appeared deranged 20 years in the past (e.g. photographing hamburgers, chasing invisible monsters by parks, choking oneself to the purpose of blacking out, and so forth.) mainstream, perhaps even aspirational. We’re consistently capturing our lives and consuming others’ lives by the pictures we see in our apps, on our telephones. Even Meta’s AI glasses are mainly only a digital camera hooked up to an everything-app.

What bitcoin does is commoditize worth switch, making it as versatile and freely adaptable because the digital digital camera on a cellphone. Any developer engaged on any type of app can combine worth switch. Messaging apps can let customers connect worth to their messages. Social apps can let customers increase funds and cut up payments with the convenience of liking a put up. Constructing a market — like Uber, Spotify, AirBnB, OnlyFans — not requires tens of millions of {dollars} and navigating a labyrinth of walled fee gardens; any dev can do it.

Funds require bankers and legal professionals. Commoditized worth switch simply wants Bitcoin and builders.

Bitcoin is maturing out of its adolescence. Particularly, Bitcoin wanted Lightning to extend throughput and improve interoperability. For its half, Lightning wanted to seek out its place because the widespread language for bitcoin-based worth switch.

However we’re there. A biome of distinct bitcoin subnetworks, together with Spark, Ark, Liquid, Fedimint, Botanix, and Cashu has arisen, every with distinctive benefits. SDKs are actually out there that allow any developer add worth switch to their apps. When it comes to the digital digital camera analogy, it’s 2007, the iPhone has simply hit the market, and builders are beginning to play with the digital camera API.

It’s an opportune second. The expertise is ripe, however the market has but to cost the transformation in. Worth is about to start out transferring like info. It’s late sufficient for strong projections of what’s about to occur and early sufficient to benefit from the disruption. The convergence of bitcoin-based worth switch and apps is as inevitable because it was so as to add a digital camera to a smartphone.

Funds are the camcorders of our age, the following expertise whose time has handed. The brand new age that’s simply starting will really feel qualitatively totally different, just like the second Dorothy steps out of her black-and-white world into the colourful colours of Oz. When worth flows as freely as info, the financial system adjustments, and society adjustments with it. Borders matter much less. Wealth and worth move just like the breeze (pun supposed). World interactions throughout political and sophistication boundaries shift from distinctive to atypical.

The parts are all in place. Bitcoin is prospering, outstripping each different asset. Lightning permits any bitcoin endpoint to speak with some other. Protocols now exist to serve quite a lot of makes use of and preferences. Builders are discovering SDKs that simplify the combination of bitcoin-based worth switch into their apps, and so they’re studying from one another about new methods to use and leverage worth switch, methods that may make their apps as indispensable as utilities like ChatGPT and Google Maps.

We’re dwelling on the finish of an age that our descendants will regard as primitive, just like the age earlier than electrical energy and working water. We’re additionally dwelling in the beginning of an age that they may take into account transformative, just like the Renaissance or the beginning of the web. Let’s make them happy with all we’ve completed for them and astounded at how we ever acquired by with out the instruments we constructed.

It is a visitor put up by Roy Sheinfeld from Breez. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.