Why is crypto happening immediately? Friday, August 29, marks a essential day for the crypto markets as Binance Futures all of the sudden went offline whereas a large $15 billion in Bitcoin and Ethereum choices contracts are set to run out. The Bitcoin choices market exhibits a put/name ratio of 0.79, with the “max ache” stage at $116,000 and open curiosity heaviest at $140,000. Ethereum contracts present related bullish momentum, with a put/name ratio of 0.76 and max ache at $3,800.

With merchants already bracing for turbulence, the outage provides additional uncertainty — and it has many asking what might be the very best crypto to purchase now.

BREAKING: BINANCE FUTURES OFFLINE IN ORDER TO DISABLE SELLING. UP ONLY RESUMES SHORTLY. https://t.co/cflQlRG5rk

— VikingXBT (@VikingXBT) August 29, 2025

Some merchants are joking that since Binance Futures is briefly offline, possibly the market can lastly go up once more. Effectively, that’s not what is going on — a minimum of for now. However not all crypto are happening.

Two potential conterders as finest crypto to purchase now might be Chainlink (LINK) and Pyth Community (PYTH): each secured high-profile roles in bringing U.S. authorities financial knowledge on-chain.

Chainlink has been outperforming many altcoins lately, fueled by robust fundamentals: new U.S. authorities and institutional adoption, rising use instances in real-world asset tokenization, and its rising position as core blockchain infrastructure. These drivers recommend LINK might have extra room to climb whilst broader markets face turbulence.

EXPLORE: Top 20 Crypto to Buy in 2025

Chainlink and Pyth Community Achieve Momentum with U.S. Authorities Backing: Greatest Crypto to Purchase Now?

Each Chainlink and Pyth are rallying on groundbreaking partnerships with the U.S. Division of Commerce. For LINK the optimistic momentum is fueled by two main developments:

- U.S. Division of Commerce Partnership. The DOC introduced it can use Chainlink to deliver very important macroeconomic knowledge. This together with GDP, the PCE inflation index, and consumption metrics — on-chain from the Bureau of Financial Evaluation.

- First Public Firm LINK Treasury. Caliber, a NASDAQ-listed actual property asset supervisor, launched the first-ever company LINK treasury, allocating funds into Chainlink.

These catalysts reinforce Chainlink’s place as a key infrastructure layer for tokenized property and world finance, giving traders contemporary causes to think about it the very best crypto to purchase now.

As for Pyth Network (PYTH): PYTH skyrocketed 91% in 24 hours after being chosen to distribute official GDP knowledge throughout greater than 100 blockchains. The token’s buying and selling quantity surged previous $2.1 billion, at $1.2 billionmarket cap, as momentum indicators like MACD signaled a bullish divergence.

$PYTH is extraordinarily underpriced examine to $LINK and now that we 're having US GDP knowledge on blockchains powered by @PythNetwork, reprice commences and it's going to be televised.

what if pyth at hyperlink market cap worth…? pic.twitter.com/B5n2Rd5857— sumptu◎us (@sumptuosol) August 29, 2025

Pyth is about to publish 5 years’ price of historic GDP knowledge and increase into extra macroeconomic indicators. Might PYTH actually compete with LINK?

On the time of writing, Bitcoin trades close to $110,300 and Ethereum round $4,390, whereas Chainlink’s momentum is holding its place. Excessive volatility is anticipated.

Keep tuned to our real-time updates under.

Bitcoin and Ethereum ETFs See Sturdy Inflows Regardless of The Crimson Market

Regardless of broader market weak spot, each Bitcoin and Ethereum ETFs recorded stable inflows on August 29. Bitcoin ETFs noticed a internet influx of 1,578 BTC, price about $174.35 million. BlackRock’s iShares led the best way with 568 BTC ($62.74 million) added, bringing its whole holdings to 746,584 BTC valued at $82.5 billion.

Ethereum ETFs additionally posted positive aspects, with a internet influx of 12,489 ETH, price $54.86 million. BlackRock once more dominated, securing 15,127 ETH ($66.45 million), and now holds 3,777,263 ETH valued at $16.59 billion.

Tron Cuts Community Charges by 60% to Increase Stablecoin Dominance

Tron has accepted a 60% reduce in community charges, aiming to strengthen its lead within the stablecoin switch market. The proposal, backed by the community’s tremendous representatives, comes after transaction prices doubled over the previous 12 months and hit report highs in June.

Founder Justin Solar acknowledged the price discount will briefly decrease Tron’s profitability, since community earnings relies upon instantly on charges. Nonetheless, he expects long-term progress as cheaper prices appeal to extra customers and improve transaction volumes. To take care of stability, Tron will introduce quarterly price critiques.

The blockchain stays the highest platform for Tether’s USDT stablecoin, internet hosting practically $81 billion price, in accordance with DeFiLlama. TRX, Tron’s native token, has surged 126% up to now 12 months regardless of rising prices.

Bitcoin ETFs See $179M Inflows, Overtake Ethereum After Week-Lengthy Lull

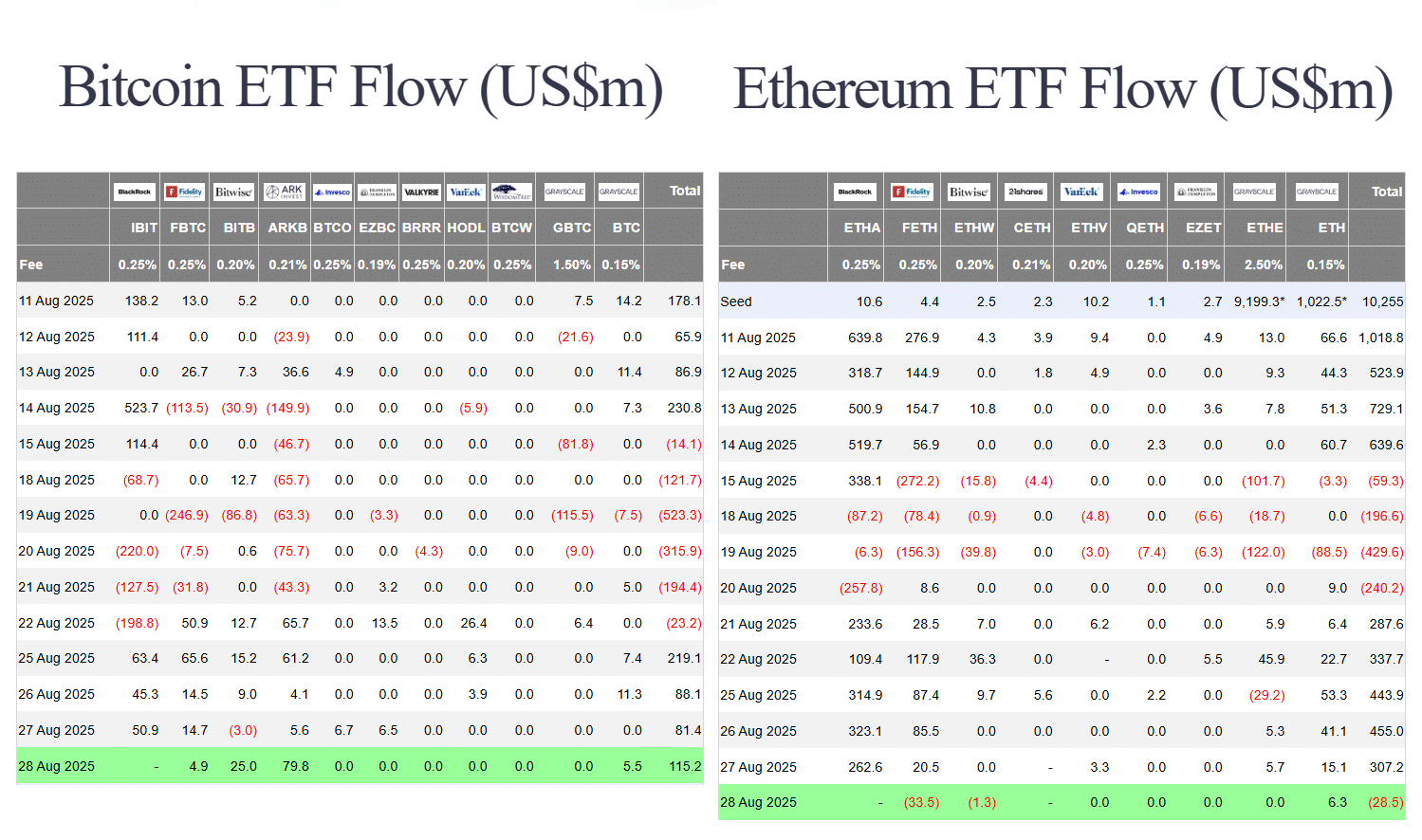

Bitcoin ETFs have staged a comeback, recording $179 million in inflows on August 28, considerably forward of Ethereum’s $39.2 million.

Ark 21Shares’ ARKB led with $80 million, adopted by BlackRock’s IBIT ($63.7 million) and Bitwise’s BITB ($25 million). Different issuers, together with Grayscale and Constancy, reported smaller flows, whereas a number of funds noticed no exercise.

Ethereum-tracking ETFs posted blended outcomes. BlackRock’s ETHA introduced in $67.6 million and Grayscale’s ETH added $6.3 million, however withdrawals of $34.7 million from Constancy and Bitwise weighed on internet inflows.

(Supply: BTC/ETH ETFs)

The transfer marks the primary time in over per week that Bitcoin funds have outperformed Ethereum’s in day by day flows. From August 21 to 27, ETH ETFs collected $1.83 billion, whereas BTC ETFs managed simply $171 million. Regardless of the latest catch-up, Bitcoin ETFs nonetheless dominate in scale, holding $145 billion in property, in comparison with Ethereum’s $29.5 billion.

Amid renewed deal with Bitcoin, investor consideration can also be turning to Bitcoin Hyper (HYPER): a presale challenge constructing a Bitcoin Layer 2 with Solana-level pace and decrease charges. Designed to increase BTC’s utility in dApps and staking, Bitcoin Hyper has raised practically $12.7 million to date.

Presale patrons can use HYPER tokens for transaction charges and governance, with staking rewards supplied at as much as 89% yearly. Tokens are presently priced at $0.012825, with the subsequent worth improve anticipated quickly.

PetroChina Explores Stablecoin-Primarily based Cross-Border Settlement Amid Hong Kong Regulatory Shift

PetroChina has announced plans to check the feasibility of utilizing stablecoins for cross-border settlement and funds, marking a serious step towards monetary innovation within the vitality sector. The information comes as Hong Kong’s new stablecoin regulatory framework formally took impact on August 1, requiring issuers to acquire licenses and meet strict capital necessities.

In keeping with Yahoo Finance, PetroChina’s CFO Wang Hua confirmed the initiative throughout the firm’s half-year outcomes briefing, noting that the agency is carefully monitoring developments from the Hong Kong Financial Authority. This transfer positions PetroChina as one of many first vitality giants to discover digital asset-based settlement underneath Hong Kong’s new guidelines.

Business analysts recommend stablecoins might decrease prices, cut back FX dangers, and improve effectivity in world vitality commerce.

Mantle Surpasses $4 Billion in Treasury Belongings, Turns into Market Chief

Mantle has introduced that its treasury has surpassed $4 billion in property, making it the biggest within the crypto market. Alongside this milestone, Mantle highlighted its involvement within the latest U.S. Division of Commerce and Chainlink integration, which goals to deliver key U.S. authorities knowledge on-chain.

The submit Today Crypto News, August 29 – $15 Billion Bitcoin and Ethereum Options Expire, Binance Futures Goes Offline: Chainlink and Pyth Compete for Best Crypto to Buy Now appeared first on 99Bitcoins.