Tom Lee and his Ethereum guess is again within the headlines this time on experiences of a recent $281 million purchase that has crypto merchants asking what he sees subsequent for ETH.

Tom Lee’s BitMine Immersion reportedly purchased 72,898 ether, price about $281 million, throughout the final 24 hours.

BREAKING: Tom Lee's Bitmine Immersion simply purchased $281 million price of Ethereum. pic.twitter.com/sdzhLhj9N5

— Ash Crypto (@Ashcryptoreal) October 18, 2025

BitMine’s Ethereum holdings have risen to three.03 million ETH, about 2.5% of the full circulating provide, after including roughly 202,000 tokens since Oct. 6.

BitMine offered its newest holdings replace for Oct 13, 2025:

$12.9 billion in whole crypto + "moonshots":

– 3,032,188 ETH at $4,154 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR) October 13, 2025

Analysts famous there aren’t any seen transaction hashes, pockets addresses, or regulatory filings to confirm the acquisition. BitMine has not commented publicly on the declare.

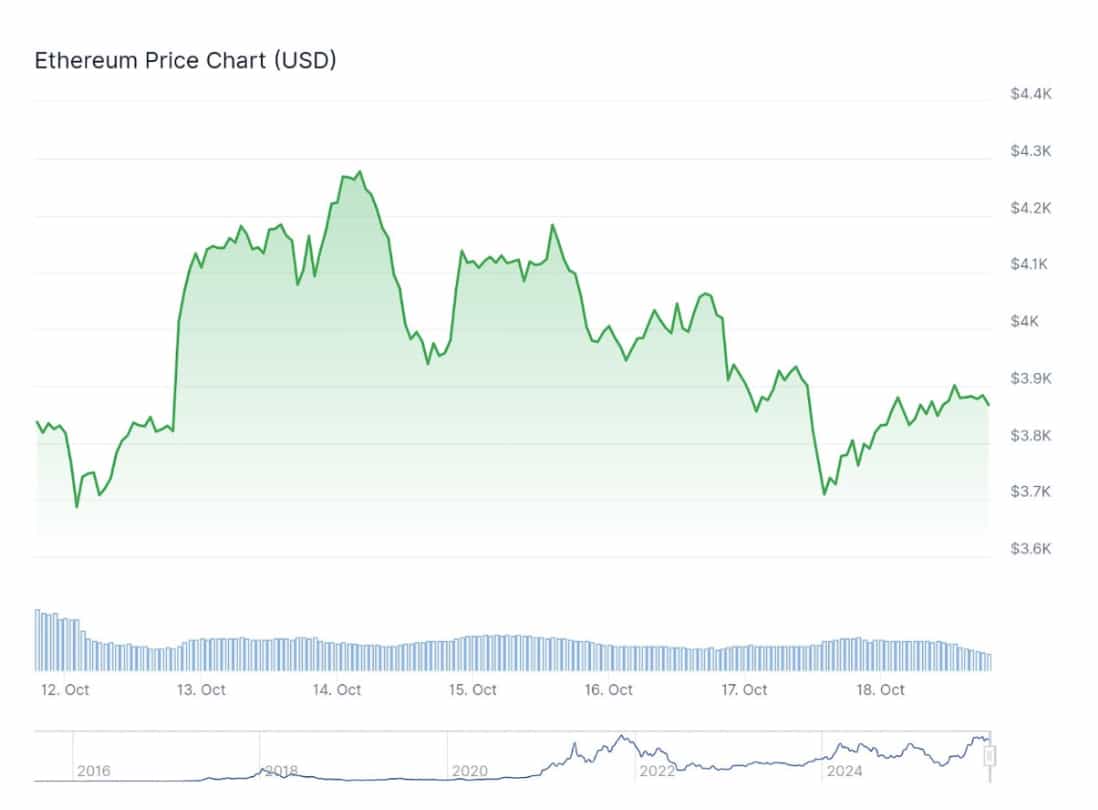

In line with Coingecko data, Ether traded round $3,830 to $3,870 on Friday, posting slight day by day good points of +0.8% but nonetheless under its early-October highs.

(Supply: Coingecko)

The token stays beneath strain after final week’s sharp correction, when the Oct. 10–11 liquidation wave, the most important in crypto’s historical past, briefly pushed costs into the mid-$3,400s.

Market observers say buyers comparable to Lee seem like accumulating throughout weak spot, wagering that Ethereum’s long-term fundamentals will outweigh short-term swings.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What Does the $4,400–$4,800 Liquidity Zone Imply for Ethereum’s Subsequent Transfer?

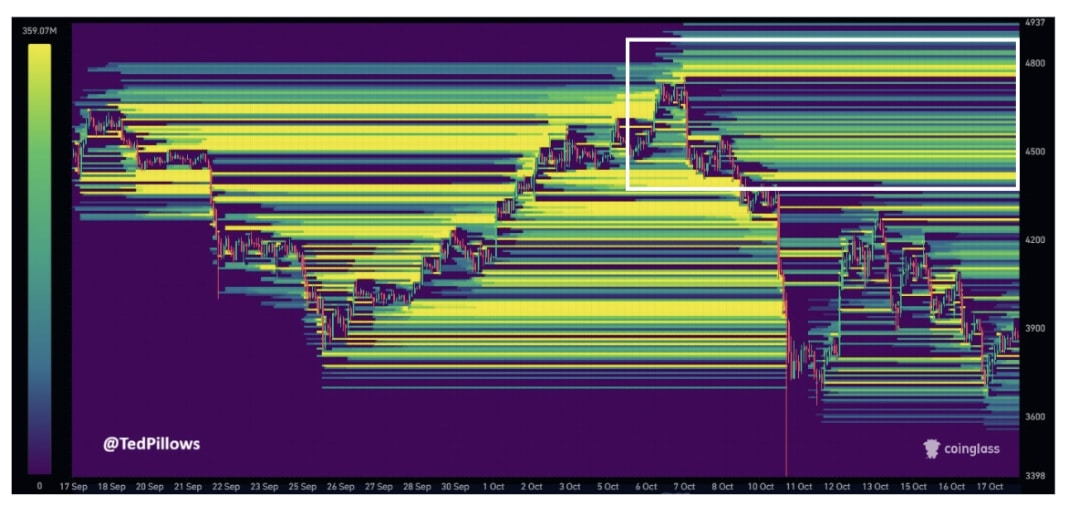

Crypto analyst Ted says Ethereum’s subsequent transfer relies on the way it reacts to a big liquidity cluster between $4,400 and $4,800.

There’s a huge liquidity cluster for $ETH across the $4,400-$4,800 degree.

If the US-China commerce deal occurs, Ethereum might faucet this liquidity cause.

In any other case, it'll drop in direction of the $3,200-$3,400 degree earlier than reversal. pic.twitter.com/z2RiHuGM8s

— Ted (@TedPillows) October 18, 2025

The chart reveals heavy promote orders stacked in that vary, an indication that many merchants are making ready to exit or quick close to these ranges.

(Supply: X)

Ethereum’s rebound from under $3,600 misplaced power across the mid-$4,000 zone. The chart reveals a attainable double prime forming close to $4,600, adopted by a pullback.

On the draw back, new liquidity has began to construct round $3,200-$3,400, pointing to sturdy shopping for curiosity if costs fall once more.

Ted mentioned that if a US-China commerce deal goes by, Ethereum might attain the higher band close to $4,800 as shorts begin closing.

But when market sentiment weakens, ETH might slip again towards decrease help earlier than discovering a base.

Proper now, Ethereum sits between two main liquidity zones, one above, one belo,w and whichever breaks first might set the tone for the following large transfer.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Ethereum Worth Prediction: Is ETH’s Present Correction Setting Up a Double Backside Round $3,300?

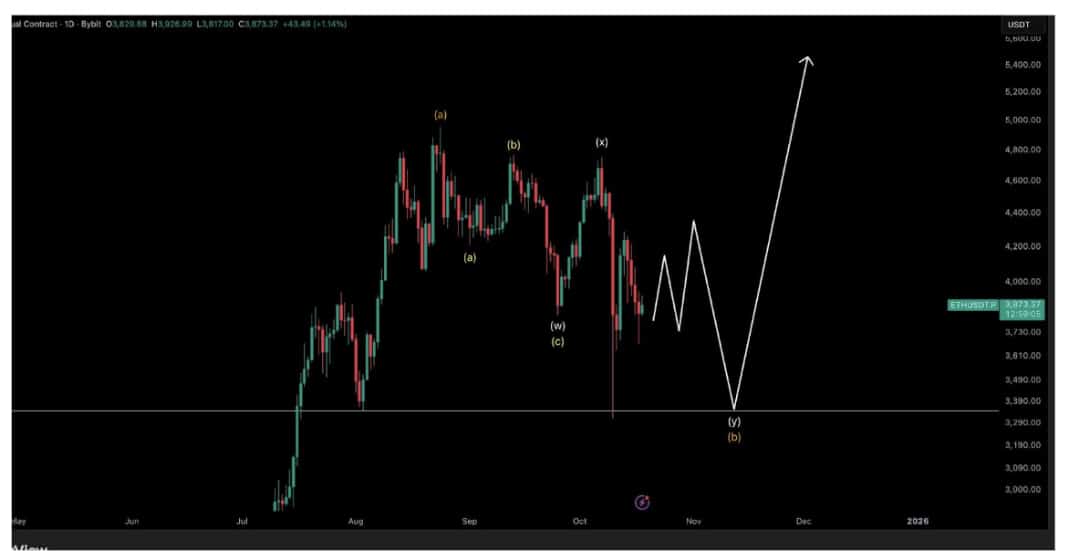

Crypto analyst Crypto Tony shared a cautious however hopeful view on Ethereum (ETH) in his newest market replace on X.

That is what i’m in search of on Ethereum as finest case situation. One other check of the lows and double backside. From the highs we’re seeing a corrective transfer as a substitute

The macro outlook tells me we’re in the midst of a corrective macro transfer. pic.twitter.com/dVqYIL9kNs

— Crypto Tony (@CryptoTony__) October 18, 2025

His chart reveals that ETH is probably going in a corrective part, not a full development reversal.

In line with his Elliott Wave evaluation, Ethereum is shifting inside a W–X–Y corrective construction, usually seen earlier than a restoration part.

(Supply: X)

The coin is at present buying and selling close to $3,870, and Tony expects one other check of the $3,300–$3,400 vary, a zone that would mark the formation of a double backside, a basic sign of vendor exhaustion and potential reversal.

He famous that this projected wave (b) low matches throughout the ongoing correction, hinting at one remaining dip earlier than a rebound.

His chart outlines a possible transfer towards $5,000 by late This fall 2025 or early 2026 as soon as Ethereum builds a base at decrease ranges.

The analyst added that the broader construction stays “corrective however secure,” suggesting that the latest weak spot could also be half of a bigger bullish cycle nonetheless intact.

If consumers return round help, he believes ETH might quickly shift again into restoration mode.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Tom Lee Bought $281 Million in Ethereum Crypto: Does He Know Something We Don’t? Will ETH Hit A New High? appeared first on 99Bitcoins.