Ten straight days, contemporary money each session: Wall Road continues to purchase US spot Solana ETFs. Bitwise’s BSOL and Grayscale’s GSOL posted their tenth day of internet inflows on Monday, November 10.

Collectively, they generated roughly $6.78 million. That brings the entire internet consumption since launch to roughly $343 million.

The run started after BSOL hit the market on October 28, and it hasn’t slowed, whilst crypto costs have swung sharply.

How A lot Cash Has Flowed Into BSOL and GSOL So Far?

The regular demand suggests buyers need regulated publicity to Solana, not simply spot tokens. It’s additionally occurring at a time when broader markets really feel uneasy.

Monday’s flows totaled roughly $5.92 million into BSOL and roughly $850,000 into GSOL. That retains the streak of each day inflows going because the funds launched.

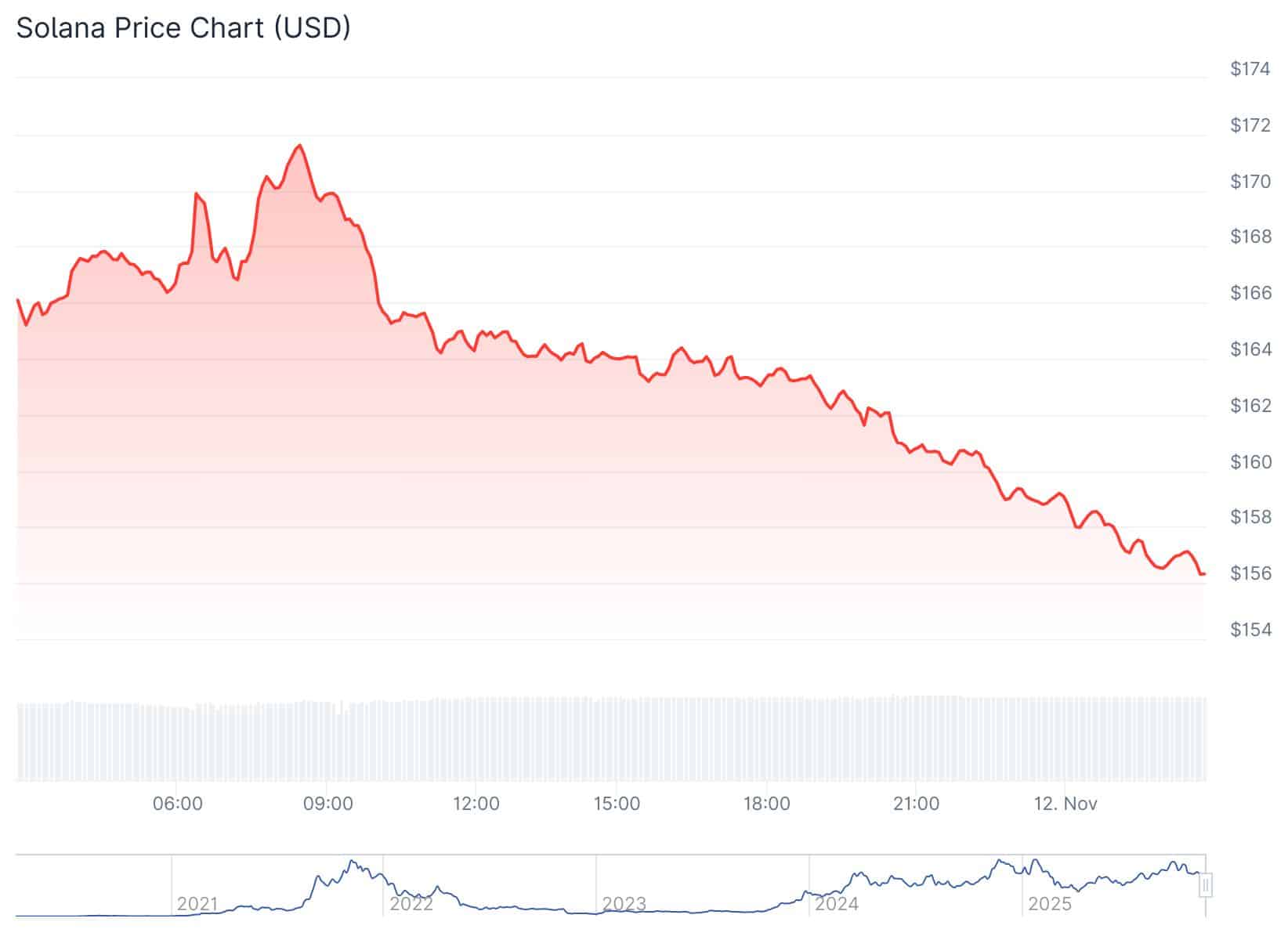

SOL held in a good band close to $156–$172 over the previous day, with buying and selling quantity round $6 billion.

The regular tempo suggests huge buyers nonetheless need SOL publicity by regulated merchandise.

BSOL drew about $420 million in its first week. It went stay by an expedited course of in the course of the SEC shutdown, which has prompted competing issuers to speed up their very own timelines.

Each merchandise stake SOL. BSOL discloses a 0.20% gross payment however is waiving it for 3 months on transactions of as much as $1 billion, successfully dropping the web value to zero.

GSOL can be waiving charges early and posting staking yield on-line. These phrases make it simpler to draw and hold capital.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Why Are Solana ETFs Seeing Robust Single-Day Inflows?

Bloomberg analyst Eric Balchunas stated a latest $72 million single-day haul was “an enormous quantity, good signal,” noting that Solana funds proceed to tug curiosity past what many anticipate from a non-Bitcoin or Ethereum product.

$BSOL did extra quantity on Day Two.. $72m is a large quantity. Good signal. pic.twitter.com/KpTbiQxZnv

— Eric Balchunas (@EricBalchunas) October 29, 2025

Bitwise’s BSOL additionally shook up the market with its launch in late October. The product slipped in underneath new, extra versatile itemizing guidelines that now not require prolonged, case-by-case evaluations.

That transfer has prompted different issuers to rethink their timelines and paved the best way for sooner approval of altcoin ETFs.

Some analysts now imagine that billions might shift into non-BTC/ETH ETFs over the subsequent few months if buying and selling stays easy.

The massive take a look at is whether or not this influx streak can survive sharp market swings. There’s additionally room for brand new entrants to problem Bitwise and Grayscale, probably by completely different payment courses or product options.

A gradual tempo of contemporary cash would sign that Solana is incomes a long-term position in conventional portfolios, moderately than serving as a fast buying and selling play.

EXPLORE: Bitcoin Futures: BTC Trading Guide For 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit TradFi Solana ETF Frenzy Continues: What Does Wall Street Know That You Don’t appeared first on 99Bitcoins.