The crypto market is thought for its volatility. Even the preferred currencies, like Bitcoin and Ether, are inclined to cost fluctuations. It’s as straightforward to generate profits on them as it’s to lose it.

Stablecoins provide a refuge from this market uncertainty, and monetary inclusion for many who keep away from conventional currencies. They’ve develop into so standard that at the moment, USDT has the third-largest market cap amongst all cryptocurrencies.

Because of this understanding what precisely stablecoins are, what varieties of stablecoins exist, and the way they work is the easiest way to begin navigating the world of crypto.

What Is a Stablecoin?

A stablecoin is a token whose worth stays comparatively secure.

Whereas a daily coin’s worth is determined by exterior components, recognition, and customers’ belief, a stablecoin is determined by no matter its worth is pegged to. Often, that’s a fiat currency like USD or EUR. This makes them excellent for interacting with cryptocurrency with out having to fret about leaping change charges.

Stablecoins are additionally backed by collateral within the type of belongings akin to gold or Treasury payments. These cash are perfect for financial savings, transactions, and even procuring—it’s as straightforward as having precise cash in your pockets.

Hold studying: What Is a Stablecoin?

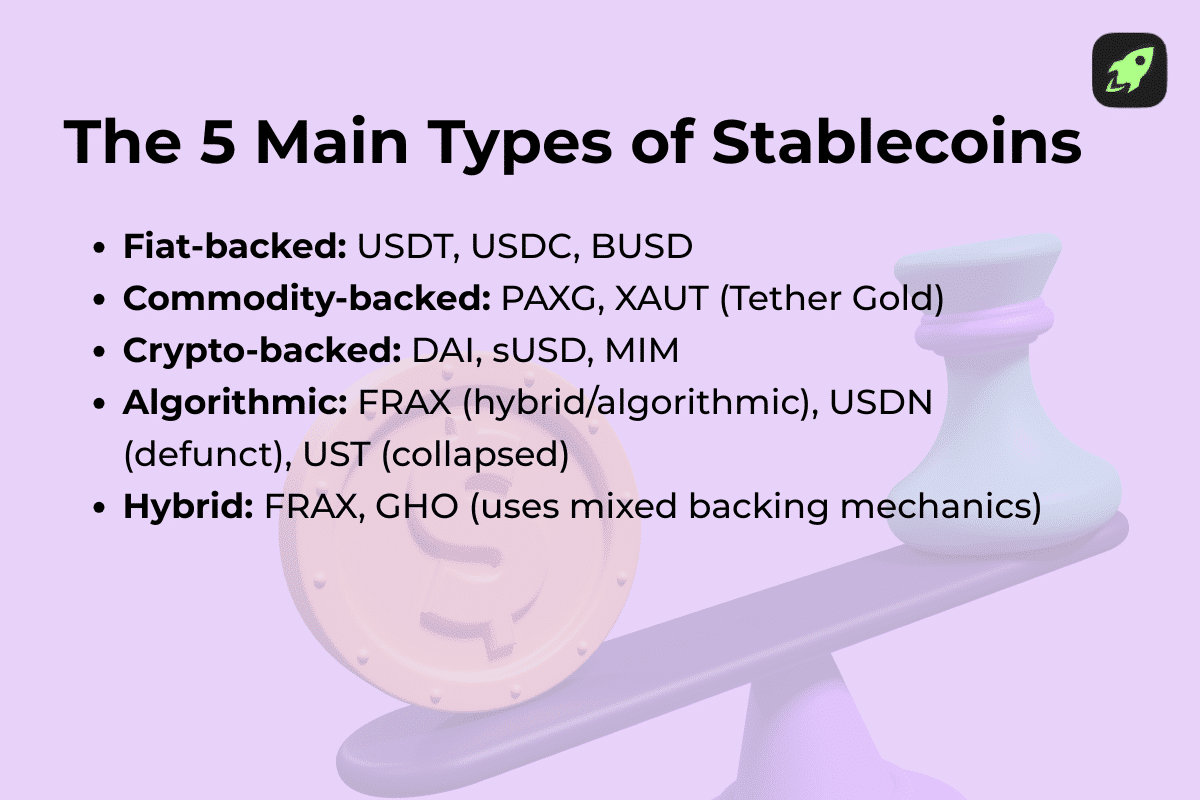

Sorts of Stablecoins

Stablecoins are cryptocurrencies designed to maintain their worth secure by being linked to a much less volatile asset, like gold or conventional cash. Various kinds of stablecoins are backed by completely different belongings, every with its personal advantages and disadvantages.

Fiat-Collateralized Stablecoins

A fiat-collateralized stablecoin is a digital foreign money that’s tied to a conventional foreign money just like the US greenback or euro. Most of these stablecoins are backed by bodily reserves, akin to Treasury payments, which suggests the issuer ensures that there are sufficient reserves to cowl all of the cash in circulation. Examples of such stablecoins are USDT (Tether) and USDC (Circle), and their worth does often keep near 1:1 with the greenback.

These stablecoins are issued by centralized firms, that are answerable for sustaining reserve transparency and guaranteeing that these reserves match the quantity of cash issued. As an illustration, if there may be 1,000 USDT in circulation, the issuer should maintain 1,000 USD in a checking account. This connection to conventional monetary establishments helps reassure customers of the coin’s stability.

Earlier than shopping for a fiat-backed stablecoin, it’s essential take note of these three roles:

- Issuer: The entity answerable for minting the coin and sustaining its reserve.

- Custodian: The group that shops the digital asset (stablecoin).

- Auditor: The corporate that performs the audit of the coin’s code, guaranteeing transparency and safety.

The benefit of fiat-collateralized stablecoins is that their worth is simple to grasp and secure, making them handy for transactions and buying and selling, particularly on decentralized exchanges.

Nonetheless, they arrive with dangers as a result of customers should belief the issuer to maintain enough reserves. Plus, they’re not absolutely decentralized since they rely upon and are regulated by the issuing firms.

Learn extra: What is Tether (USDT)?

Commodity-Backed Stablecoins

Commodity-collateralized stablecoins are backed by bodily belongings like gold. This isn’t a brand new follow launched by crypto—some fiat currencies operate in an analogous method, being backed by oil or gold and overseas reserves.

The way in which they work is principally the identical as fiat-backed cash, however with a unique asset for collateral. These stablecoins are additionally centralized and managed by a selected firm or group.

Find out how to Get Free Crypto

Easy tips to construct a worthwhile portfolio at zero price

Since sure commodities provide a comparatively secure worth, such a stablecoin stays standard as an funding. On paper, shopping for them is like shopping for the asset itself. In actuality, customers and buyers should stay cautious and confirm that the reserves do, the truth is, exist.

That’s why an audit carried out by a reliable and neutral firm is essential: Earlier than shopping for a commodity-backed coin, it’s essential to familiarize your self with the documentation concerning the coin’s reserves.

A number of the hottest gold-backed stablecoins are PAX Gold and Tether Gold. Each PAXG coin is alleged to be backed by an oz. of gold, and you’ll hint it utilizing the serial quantity on the Paxos web site.

The principle benefit of those stablecoins is their publicity to commodities. Relying on the commodity, they’ll present stability and even progress over time.

Nonetheless, identical to anything, a commodity, even gold, can lose its buying energy, devaluing the stablecoin. Unnecessary to say that reserves should be saved and saved secure by the issuer.

Crypto-Collateralized Stablecoins

Sure stablecoins are backed by crypto belongings. Which means the issuer’s reserves comprise different cryptocurrencies. Since they’re unstable by nature, sometimes, issuers overcollateralize, that means the reserves exceed the quantity of foreign money in circulation, thus protecting for potential worth actions.

Crypto-backed stablecoins are secured by cryptocurrencies saved on the blockchain and managed by way of sensible contracts. These stablecoins depend on worth oracles to supply up-to-date details about the worth of the collateral.

Their parameters, akin to collateral sorts and stability guidelines, are set by way of group governance and a whitelist of authorised belongings.

DAI and MakerDAO are examples of such currencies. MakerDAO offers an attention-grabbing illustration of mixing decentralization and stability. The coin’s worth is soft-pegged to USD, which suggests 1 DAI coin equals 1 USD. The coin is collateralized by Ethereum and several other different cryptocurrencies. It may be issued by anybody, however to mint or borrow a coin, it’s essential to deposit collateral within the quantity of at least 150% of the coin’s worth.

[Image: explanation for the burn and mint process]

This method is put in place to guard cash from devaluation.

Cryptocurrency-backed stablecoins present two core parts of crypto—decentralization and transparency. You may search for all of the required info earlier than investing in these cash. The draw back of this technique is vulnerability to market volatility. You should additionally threat the potential for liquidation cascades if collateral costs fall sharply, and potential manipulation of the oracles that feed worth knowledge into the system.

Algorithmic Stablecoins

Much like the opposite varieties of stablecoins, algorithmic cash preserve a secure worth. To do this, although, they don’t depend on conventional collateral. As an alternative, they use mechanisms akin to seigniorage programs or dual-token fashions.

A seigniorage system adjusts the availability of cash mechanically. Twin-token fashions use one token to stabilize the opposite.

Each these designs cut back the necessity for big reserves in an try to attain capital effectivity. However these programs carry important dangers. A serious instance is the collapse of TerraUSD, the place the coin misplaced its peg dramatically as a result of reflexive failures and low belief amongst customers.

Hold studying: What Is an Algorithmic Stablecoin?

Hybrid Stablecoins

Hybrid stablecoins mix the options of several types of stablecoins with a view to stability out their current professionals and cons. The purpose is to attain security and capital effectivity with out compromising the decentralized construction.

For instance, some cash use partial reserves as collateral whereas implementing the burn/mint logic, the place a portion of issued tokens is burned. This helps maintain the value and demand in test.

Which Stablecoin Is Thought of the Most secure Proper Now, and Why?

At the moment, USDC is extensively considered the most secure stablecoin. It’s issued by Circle Web Group, Inc., recognized for its transparency and common audits. USDC’s reserves are absolutely backed by money and short-term US Treasuries, confirmed by impartial auditors—making it one of the crucial trusted fiat-backed stablecoins in the marketplace.

USDT, issued by Tether Restricted Inc., stays the preferred stablecoin by quantity, nevertheless it has confronted criticism for restricted disclosure of its reserves. Whereas each USDT and USDC are centralized and tied to conventional monetary programs—which presents a way of security—that doesn’t make them risk-free.

Learn extra: USDT vs. USDC: Which Is a Better Choice?

A stablecoin pegged to fiat may sound like a secure guess. However remember the fact that the protection of every stablecoin is at first decided by its backing. If the collateral loses worth, so does the coin.

This isn’t the one hazard you face with stablecoins, because the regulatory framework for cryptocurrencies remains to be in its early levels. Malicious issuers may falsely declare the existence of reserves, and with out the required due diligence, many customers find yourself uncovered to cost fluctuations.

Apart from that, it’s not unusual to fall sufferer to fraud. In 2024, the FBI issued a warning concerning impersonation tokens, the place criminals contact customers with a proposal to buy faux stablecoins that resemble actual ones.

In the case of stablecoins, it falls upon you to analysis all the things previous to investing. It’s important to develop into fluent within the stablecoin market—data is essential to your belongings’ security.

Find out how to Select a Stablecoin

There’s a purpose DYOR (Do Your Personal Analysis) is the common motto of the cryptocurrency market. Right here’s a option to rapidly receive all the required info if you happen to’re pondering of shopping for stablecoins.

Step 1. Recognition

Discover a checklist of the preferred stablecoins. Choose the one that matches your pursuits. For rookies, it’s finest to begin with fiat-backed stablecoins issued by a reliable challenge. If you happen to desire decentralized finance, be additional vigilant in your analysis. To be fully positive that the coin maintains worth stability, evaluation the current worth historical past on exchanges.

Step 2. Regulatory Framework

Discover out which group serves because the issuer, the place they’re based mostly, and who supervises them. Ensure that your native jurisdiction matches theirs, particularly if you happen to’re planning cross-border funds. A great instance is the Hong Kong Financial Authority, because it offers a detailed guide on its necessities for stablecoin issuers. Crypto belongings within the European Union are regulated by MiCA, and the US would require compliance with the GENIUS Act beginning in 2027.

Step 3. Underlying Property

Verifying that the claims of the issuer are true may be probably the most advanced step in your analysis. Customers should depend on the phrase of the auditors, so guarantee that these are revered firms with a stellar status. In your analysis, don’t be afraid to hunt out unfavorable opinions, however stay neutral. It helps if organizations or representatives from conventional banking programs have connections to the issuer.

Step 4. Safety

Each coin requires auditing. That is related to fiat foreign money, gold, or different crypto belongings used to again the coin, nevertheless it’s far more essential in regard to the sensible contracts of the stablecoin challenge. They should be secure, and the potential for errors or exterior affect needs to be minimal. Familiarize your self with the challenge’s audit. Evaluate the variations offered by the auditor and the coin issuer. Keep away from any stablecoin initiatives that omit or edit their audits.

Step 5. Adoption and Ecosystem

Widespread adoption isn’t a assure, nevertheless it’s simpler to belief a coin when you’ll be able to depend on the expertise of others. It’s additionally essential to ensure the coin is flexible and may provide cross-border transactions, usability, liquidity, and stability.

Remaining Ideas

Understanding the several types of stablecoin is crucial for navigating the crypto market. Each presents a stability between stability, transparency, and decentralization. Fiat-backed cash like USDC are among the many most trusted, as they’re supported by reserve belongings akin to US Treasury payments and controlled by respected issuers. Commodity-backed stablecoins hyperlink their worth to different belongings like gold, whereas crypto-backed stablecoins depend on blockchain expertise and sensible contracts to keep up belief. Algorithmic stablecoins, although capital-efficient, stay dangerous as a result of their reliance on financial fashions as an alternative of collateral.

FAQ

Are stablecoins the identical as digital {dollars}?

No. Stablecoins are sometimes pegged to the worth of a fiat foreign money just like the US greenback, however they aren’t issued or assured by central banks. They’re created by non-public stablecoin issuers and backed by reserve belongings akin to US Treasury payments, gold, or cryptocurrencies. This makes them much like “digital {dollars}” in operate however not in authorized standing or safety.

Can stablecoins lose their peg? How usually does that occur?

Sure, stablecoins can lose their peg, and these sorts of conditions are referred to as de-pegging. This occurs when the worth of the backing belongings drops, liquidity points come up, or market belief declines. Whereas giant cash like USD Coin (USDC) and Tether (USDT) hardly ever expertise main de-pegs, smaller or poorly managed stablecoins can lose their peg extra steadily, generally resulting in everlasting collapse (as seen with algorithmic stablecoins like TerraUSD).

Are algorithmic stablecoins safer or riskier than crypto-backed ones?

Algorithmic stablecoins are usually riskier. Whereas crypto-backed stablecoins maintain actual collateral on the blockchain, algorithmic variations depend on code and financial incentives to keep up stability. If consumer confidence drops, they’ll spiral right into a reflexive failure, inflicting speedy worth collapse.

As a newbie, ought to I stick with only one stablecoin or unfold throughout just a few?

For rookies, it’s often finest to begin with one respected fiat-backed stablecoin akin to USDC or USDT. When you’re extra accustomed to the stablecoin market, you’ll be able to diversify throughout a number of sorts.

Disclaimer: Please notice that the contents of this text are usually not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.