Particular due to Vlad Zamfir for introducing the thought of by-block consensus and convincing me of its deserves, alongside most of the different core concepts of Casper, and to Vlad Zamfir and Greg Meredith for his or her continued work on the protocol

Within the final publish on this sequence, we mentioned one of many two flagship function units of Serenity: a heightened diploma of abstraction that vastly will increase the pliability of the platform and takes a big step in transferring Ethereum from “Bitcoin plus Turing-complete” to “general-purpose decentralized computation”. Now, allow us to flip our consideration to the opposite flagship function, and the one for which the Serenity milestone was initially created: the Casper proof of stake algorithm.

Consensus By Guess

The keystone mechanism of Casper is the introduction of a essentially new philosophy within the discipline of public financial consensus: the idea of consensus-by-bet. The core concept of consensus-by-bet is straightforward: the protocol presents alternatives for validators to guess in opposition to the protocol on which blocks are going to be finalized. A guess on some block X on this context is a transaction which, by protocol guidelines, provides the validator a reward of Y cash (that are merely printed to offer to the validator out of skinny air, therefore “in opposition to the protocol”) in all universes by which block X was processed however which provides the validator a penalty of Z cash (that are destroyed) in all universes by which block X was not processed.

The validator will want to make such a guess provided that they consider block X is probably going sufficient to be processed in the universe that individuals care about that the tradeoff is value it. After which, here is the economically recursive enjoyable half: the universe that individuals care about, ie. the state that customers’ purchasers present when customers wish to know their account stability, the standing of their contracts, and so on, is itself derived by which blocks folks guess on essentially the most. Therefore, every validator’s incentive is to guess in the best way that they count on others to guess sooner or later, driving the method towards convergence.

A useful analogy right here is to take a look at proof of labor consensus – a protocol which appears extremely distinctive when considered by itself, however which may in truth be completely modeled as a really particular subset of consensus-by-bet. The argument is as follows. When you’re mining on high of a block, you’re expending electrical energy prices E per second in change for receiving an opportunity p per second of producing a block and receiving R cash in all forks containing your block, and 0 rewards in all different chains:

Therefore, each second, you obtain an anticipated acquire of p*R-E on the chain you’re mining on, and take a lack of E on all different chains; this may be interpreted as taking a guess at E:p*R-E odds that the chain you’re mining on will “win”; for instance, if p is 1 in 1 million, R is 25 BTC ~= $10000 USD and E is $0.007, then your positive aspects per second on the profitable chain are 0.000001 * 10000 – 0.007 = 0.003, your losses on the shedding chain are the electrical energy value of 0.007, and so you’re betting at 7:3 odds (or 70% likelihood) that the chain you’re mining on will win. Notice that proof of labor satisfies the requirement of being economically “recursive” in the best way described above: customers’ purchasers will calculate their balances by processing the chain that has essentially the most proof of labor (ie. bets) behind it.

Consensus-by-bet may be seen as a framework that encompasses this manner of proof of labor, and but additionally may be tailored to offer an financial sport to incentivize convergence for a lot of different lessons of consensus protocols. Conventional Byzantine-fault-tolerant consensus protocols, for instance, are inclined to have an idea of “pre-votes” and “pre-commits” earlier than the ultimate “commit” to a specific consequence; in a consensus-by-bet mannequin, one could make every stage be a guess, in order that members within the later levels can have larger assurance that members within the earlier levels “actually imply it”.

It will also be used to incentivize right conduct in out-of-band human consensus, if that’s wanted to beat excessive circumstances comparable to a 51% assault. If somebody buys up half the cash on a proof-of-stake chains, and assaults it, then the neighborhood merely must coordinate on a patch the place purchasers ignore the attacker’s fork, and the attacker and anybody who performs together with the attacker routinely loses all of their cash. A really bold objective can be to generate these forking selections routinely by on-line nodes – if accomplished efficiently, this could additionally subsume into the consensus-by-bet framework the underappreciated however vital consequence from conventional fault tolerance analysis that, beneath sturdy synchrony assumptions, even when nearly all nodes try to assault the system the remaining nodes can still come to consensus.

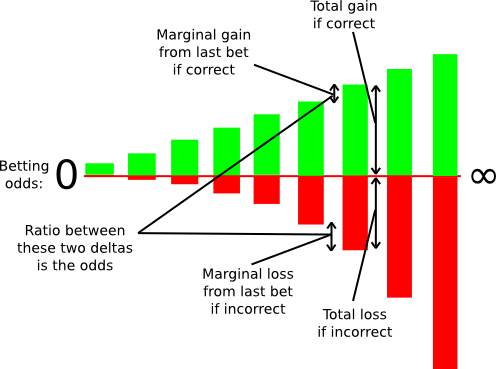

Within the context of consensus-by-bet, completely different consensus protocols differ in just one means: who’s allowed to guess, at what odds and the way a lot? In proof of labor, there is just one type of guess provided: the power to guess on the chain containing one’s personal block at odds E:p*R-E. In generalized consensus-by-bet, we are able to use a mechanism often known as a scoring rule to primarily supply an infinite variety of betting alternatives: one infinitesimally small guess at 1:1, one infinitesimally small guess at 1.000001:1, one infinitesimally small guess at 1.000002:1, and so forth.

A scoring rule as an infinite variety of bets.

One can nonetheless resolve precisely how massive these infinitesimal marginal bets are at every likelihood stage, however typically this method permits us to elicit a really exact studying of the likelihood with which some validator thinks some block is prone to be confirmed; if a validator thinks {that a} block will probably be confirmed with likelihood 90%, then they are going to settle for all the bets under 9:1 odds and not one of the bets above 9:1 odds, and seeing this the protocol will have the ability to infer this “opinion” that the possibility the block will probably be confirmed is 90% with exactness. Actually, the revelation principle tells us that we could as nicely ask the validators to provide a signed message containing their “opinion” on the likelihood that the block will probably be confirmed instantly, and let the protocol calculate the bets on the validator’s behalf.

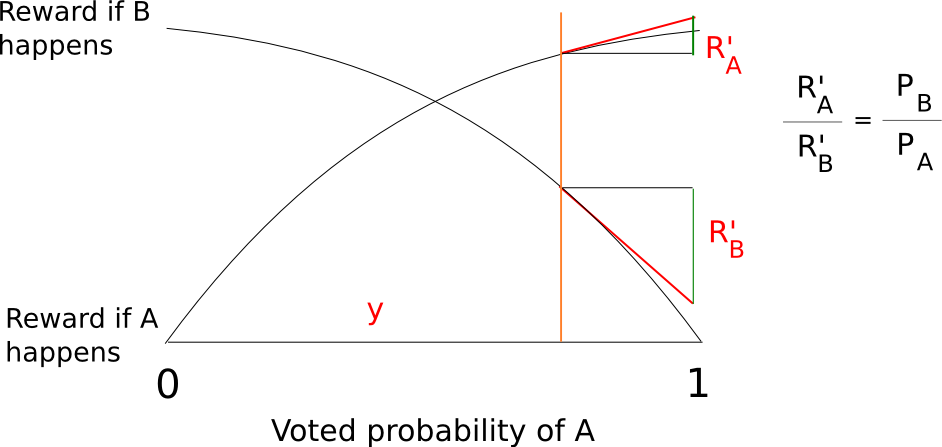

Because of the wonders of calculus, we are able to really provide you with pretty easy features to compute a complete reward and penalty at every likelihood stage which are mathematically equal to summing an infinite set of bets in any respect likelihood ranges under the validator’s said confidence. A reasonably easy instance is s(p) = p/(1-p) and f(p) = (p/(1-p))^2/2 the place s computes your reward if the occasion you’re betting on takes place and f computes your penalty if it doesn’t.

A key benefit of the generalized method to consensus-by-bet is that this. In proof of labor, the quantity of “financial weight” behind a given block will increase solely linearly with time: if a block has six confirmations, then reverting it solely prices miners (in equilibrium) roughly six instances the block reward, and if a block has 600 confirmations then reverting it prices 600 instances the block reward. In generalized consensus-by-bet, the quantity of financial weight that validators throw behind a block might improve exponentially: if a lot of the different validators are prepared to guess at 10:1, you is perhaps snug sticking your neck out at 20:1, and as soon as nearly everybody bets 20:1 you would possibly go for 40:1 and even increased. Therefore, a block could nicely attain a stage of “de-facto full finality”, the place validators’ total deposits are at stake backing that block, in as little as a couple of minutes, relying on how courageous the validators are (and the way a lot the protocol incentivizes them to be).

Blocks, Chains and Consensus as Tug of Warfare

One other distinctive element of the best way that Casper does issues is that fairly than consensus being by-chain as is the case with present proof of labor protocols, consensus is by-block: the consensus course of involves a call on the standing of the block at every top independently of each different top. This mechanism does introduce some inefficiencies – significantly, a guess should register the validator’s opinion on the block at each top fairly than simply the pinnacle of the chain – nevertheless it proves to be a lot easier to implement methods for consensus-by-bet on this mannequin, and it additionally has the benefit that it’s way more pleasant to excessive blockchain pace: theoretically, one can actually have a block time that’s quicker than community propagation with this mannequin, as blocks may be produced independently of one another, although with the apparent proviso that block finalization will nonetheless take some time longer.

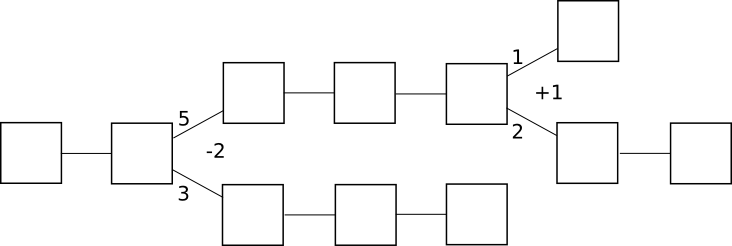

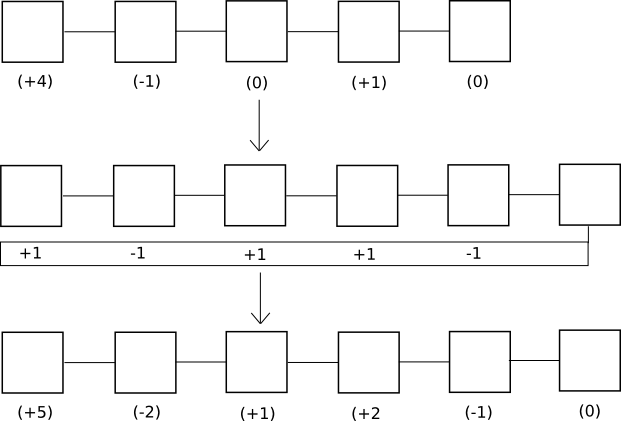

In by-chain consensus, one can view the consensus course of as being a type of tug-of-war between unfavorable infinity and optimistic infinity at every fork, the place the “standing” on the fork represents the variety of blocks within the longest chain on the correct facet minus the variety of blocks on the left facet:

Shoppers attempting to find out the “right chain” merely transfer ahead ranging from the genesis block, and at every fork go left if the standing is unfavorable and proper if the standing is optimistic. The financial incentives listed below are additionally clear: as soon as the standing goes optimistic, there’s a sturdy financial strain for it to converge to optimistic infinity, albeit very slowly. If the standing goes unfavorable, there’s a sturdy financial strain for it to converge to unfavorable infinity.

By the way, be aware that beneath this framework the core concept behind the GHOST scoring rule turns into a pure generalization – as a substitute of simply counting the size of the longest chain towards the standing, depend each block on both sides of the fork:

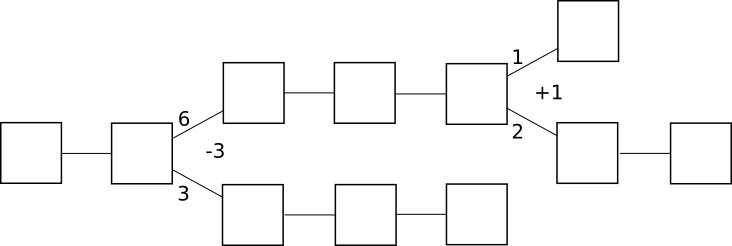

In by-block consensus, there may be as soon as once more the tug of warfare, although this time the “standing” is just an arbitrary quantity that may be elevated or decreased by sure actions linked to the protocol; at each block top, purchasers course of the block if the standing is optimistic and don’t course of the block if the standing is unfavorable. Notice that despite the fact that proof of labor is at the moment by-chain, it would not should be: one can simply think about a protocol the place as a substitute of offering a guardian block, a block with a legitimate proof of labor resolution should present a +1 or -1 vote on each block top in its historical past; +1 votes can be rewarded provided that the block that was voted on does get processed, and -1 votes can be rewarded provided that the block that was voted on doesn’t get processed:

After all, in proof of labor such a design wouldn’t work nicely for one easy motive: if you need to vote on completely each earlier top, then the quantity of voting that must be accomplished will improve quadratically with time and pretty shortly grind the system to a halt. With consensus-by-bet, nevertheless, as a result of the tug of warfare can converge to finish finality exponentially, the voting overhead is way more tolerable.

One counterintuitive consequence of this mechanism is the truth that a block can stay unconfirmed even when blocks after that block are utterly finalized. This will seem to be a big hit in effectivity, as if there may be one block whose standing is flip-flopping with ten blocks on high of it then every flip would entail recalculating state transitions for a complete ten blocks, however be aware that in a by-chain mannequin the very same factor can occur between chains as nicely, and the by-block model really supplies customers with extra info: if their transaction was confirmed and finalized in block 20101, and so they know that no matter the contents of block 20100 that transaction can have a sure consequence, then the consequence that they care about is finalized despite the fact that components of the historical past earlier than the consequence are usually not. By-chain consensus algorithms can by no means present this property.

So how does Casper work anyway?

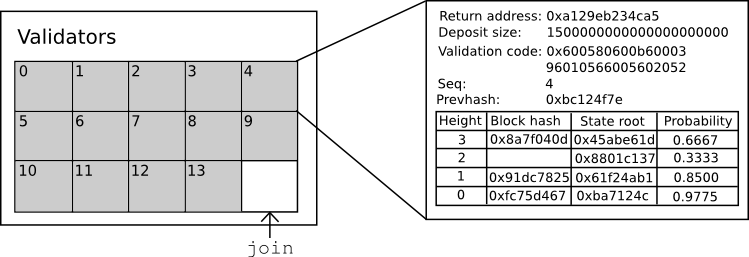

In any security-deposit-based proof of stake protocol, there’s a present set of bonded validators, which is saved observe of as a part of the state; to be able to make a guess or take one in all quite a lot of essential actions within the protocol, you should be within the set with the intention to be punished in the event you misbehave. Becoming a member of the set of bonded validators and leaving the set of bonded validators are each particular transaction sorts, and demanding actions within the protocol comparable to bets are additionally transaction sorts; bets could also be transmitted as impartial objects via the community, however they will also be included into blocks.

Consistent with Serenity’s spirit of abstraction, all of that is applied through a Casper contract, which has features for making bets, becoming a member of, withdrawing, and accessing consensus info, and so one can submit bets and take different actions just by calling the Casper contract with the specified knowledge. The state of the Casper contract seems to be as follows:

The contract retains observe of the present set of validators, and for every validator it retains observe of six main issues:

- The return tackle for the validator’s deposit

- The present dimension of the validator’s deposit (be aware that the bets that the validator makes will improve or lower this worth)

- The validator’s validation code

- The sequence variety of the latest guess

- The hash of the latest guess

- The validator’s opinion desk

The idea of “validation code” is one other abstraction function in Serenity; whereas different proof of stake protocols require validators to make use of one particular signature verification algorithm, the Casper implementation in Serenity permits validators to specify a chunk of code that accepts a hash and a signature and returns 0 or 1, and earlier than accepting a guess checks the hash of the guess in opposition to its signature. The default validation code is an ECDSA verifier, however one also can experiment with different verifiers: multisig, threshold signatures (doubtlessly helpful for creating decentralized stake swimming pools!), Lamport signatures, and so on.

Each guess should include a sequence primary increased than the earlier guess, and each guess should include a hash of the earlier guess; therefore, one can view the sequence of bets made by a validator as being a type of “personal blockchain”; considered in that context, the validator’s opinion is actually the state of that chain. An opinion is a desk that describes:

- What the validator thinks the almost definitely state root is at any given block top

- What the validator thinks the almost definitely block hash is at any given block top (or zero if no block hash is current)

- How possible the block with that hash is to be finalized

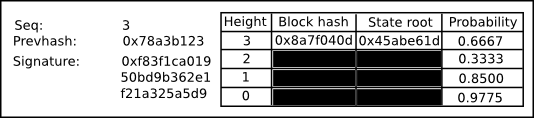

A guess is an object that appears like this:

The important thing info is the next:

- The sequence variety of the guess

- The hash of the earlier guess

- A signature

- A listing of updates to the opinion

The perform within the Casper contract that processes a guess has three components to it. First, it validates the sequence quantity, earlier hash and signature of a guess. Subsequent, it updates the opinion desk with any new info equipped by the guess. A guess ought to typically replace a couple of very latest chances, block hashes and state roots, so a lot of the desk will typically be unchanged. Lastly, it applies the scoring rule to the opinion: if the opinion says that you just consider {that a} given block has a 99% likelihood of finalization, and if, within the explicit universe that this explicit contract is working in, the block was finalized, then you definately would possibly get 99 factors; in any other case you would possibly lose 4900 factors.

Notice that, as a result of the method of working this perform contained in the Casper contract takes place as a part of the state transition perform, this course of is absolutely conscious of what each earlier block and state root is not less than inside the context of its personal universe; even when, from the standpoint of the surface world, the validators proposing and voting on block 20125 do not know whether or not or not block 20123 will probably be finalized, when the validators come round to processing that block they are going to be – or, maybe, they may course of each universes and solely later resolve to stay with one. In an effort to stop validators from offering completely different bets to completely different universes, we’ve a easy slashing situation: in the event you make two bets with the identical sequence quantity, and even in the event you make a guess that you just can’t get the Casper contract to course of, you lose your total deposit.

Withdrawing from the validator pool takes two steps. First, one should submit a guess whose most top is -1; this routinely ends the chain of bets and begins a four-month countdown timer (20 blocks / 100 seconds on the testnet) earlier than the bettor can get well their funds by calling a 3rd technique, withdraw. Withdrawing may be accomplished by anybody, and sends funds again to the identical tackle that despatched the unique be a part of transaction.

Block proposition

A block comprises (i) a quantity representing the block top, (ii) the proposer tackle, (iii) a transaction root hash and (iv) a signature. For a block to be legitimate, the proposer tackle should be the identical because the validator that’s scheduled to generate a block for the given top, and the signature should validate when run in opposition to the validator’s personal validation code. The time to submit a block at top N is decided by T = G + N * 5 the place G is the genesis timestamp; therefore, a block ought to ordinarily seem each 5 seconds.

An NXT-style random quantity generator is used to find out who can generate a block at every top; primarily, this includes taking lacking block proposers as a supply of entropy. The reasoning behind that is that despite the fact that this entropy is manipulable, manipulation comes at a excessive value: one should sacrifice one’s proper to create a block and gather transaction charges to be able to manipulate it. Whether it is deemed completely mandatory, the price of manipulation may be elevated a number of orders of magnitude additional by changing the NXT-style RNG with a RANDAO-like protocol.

The Validator Technique

So how does a validator function beneath the Casper protocol? Validators have two main classes of exercise: making blocks and making bets. Making blocks is a course of that takes place independently from all the pieces else: validators collect transactions, and when it comes time for them to make a block, they produce one, signal it and ship it out to the community. The method for making bets is extra difficult. The present default validator technique in Casper is one that’s designed to imitate points of conventional Byzantine-fault-tolerant consensus: have a look at how different validators are betting, take the thirty third percentile, and transfer a step towards 0 or 1 from there.

To perform this, every validator collects and tries to remain as up-to-date as attainable on the bets being made by all different validators, and retains observe of the present opinion of every one. If there aren’t any or few opinions on a specific block top from different validators, then it follows an preliminary algorithm that appears roughly as follows:

- If the block will not be but current, however the present time continues to be very near the time that the block ought to have been printed, guess 0.5

- If the block will not be but current, however a very long time has already handed for the reason that block ought to have been printed, guess 0.3

- If the block is current, and it arrived on time, guess 0.7

- If the block is current, nevertheless it arrived both far too early or far too late, guess 0.3

Some randomness is added to be able to assist stop “caught” situations, however the primary precept stays the identical.

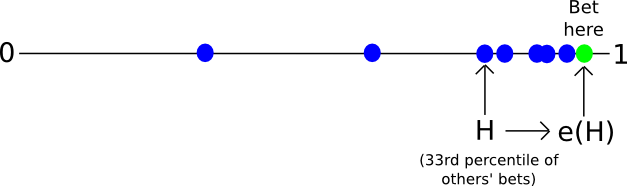

If there are already many opinions on a specific block top from different validators, then we take the next technique:

- Let L be the worth such that two thirds of validators are betting increased than L. Let M be the median (ie. the worth such that half of validators are betting increased than M). Let H be the worth such that two thirds of validators are betting decrease than H.

- Let e(x) be a perform that makes x extra “excessive”, ie. pushes the worth away from 0.5 and towards 1. A easy instance is the piecewise perform e(x) = 0.5 + x / 2 if x > 0.5 else x / 2.

- If L > 0.8, guess e(L)

- If H , guess e(H)

- In any other case, guess e(M), although restrict the consequence to be inside the vary [0.15, 0.85] in order that lower than 67% of validators cannot power one other validator to maneuver their bets too far

Validators are free to decide on their very own stage of danger aversion inside the context of this technique by selecting the form of e. A perform the place f(e) = 0.99999 for e > 0.8 might work (and would in truth possible present the identical conduct as Tendermint) nevertheless it creates considerably increased dangers and permits hostile validators making up a big portion of the bonded validator set to trick these validators into shedding their total deposit at a low value (the assault technique can be to guess 0.9, trick the opposite validators into betting 0.99999, after which soar again to betting 0.1 and power the system to converge to zero). However, a perform that converges very slowly will incur increased inefficiencies when the system will not be beneath assault, as finality will come extra slowly and validators might want to hold betting on every top longer.

Now, how does a consumer decide what the present state is? Basically, the method is as follows. It begins off by downloading all blocks and all bets. It then makes use of the identical algorithm as above to assemble its personal opinion, nevertheless it doesn’t publish it. As a substitute, it merely seems to be at every top sequentially, processing a block if its likelihood is larger than 0.5 and skipping it in any other case; the state after processing all of those blocks is proven because the “present state” of the blockchain. The consumer also can present a subjective notion of “finality”: when the opinion at each top as much as some okay is both above 99.999% or under 0.001%, then the consumer considers the primary okay blocks finalized.

Additional Analysis

There may be nonetheless fairly a little bit of analysis to do for Casper and generalized consensus-by-bet. Explicit factors embrace:

- Arising with outcomes to indicate that the system economically incentivizes convergence, even within the presence of some amount of Byzantine validators

- Figuring out optimum validator methods

- Ensuring that the mechanism for together with the bets in blocks will not be exploitable

- Growing effectivity. At present, the POC1 simulation can deal with ~16 validators working on the identical time (up from ~13 every week in the past), although ideally we must always push this up as a lot as attainable (be aware that the variety of validators the system can deal with on a reside community needs to be roughly the sq. of the efficiency of the POC, because the POC runs all nodes on the identical machine).

The subsequent article on this sequence will cope with efforts so as to add a scaffolding for scalability into Serenity, and can possible be launched across the identical time as POC2.