So that you’ve invested in Zcash and are actually staring down everlasting riches. Congrats on betting on the subsequent Bitcoin

Subsequent cease: Prime 10

Vitalik informed you to purchase.

Naval informed you to purchase.

Balaji informed you to purchase.

Mert and Toly informed you to purchase.

And also you didn’t purchase Zcash? What’s flawed with you?

That is movement. https://t.co/RInL0PS6Jt pic.twitter.com/tWG4qxMQIs

— peacemonger (@peacemongerZ) October 31, 2025

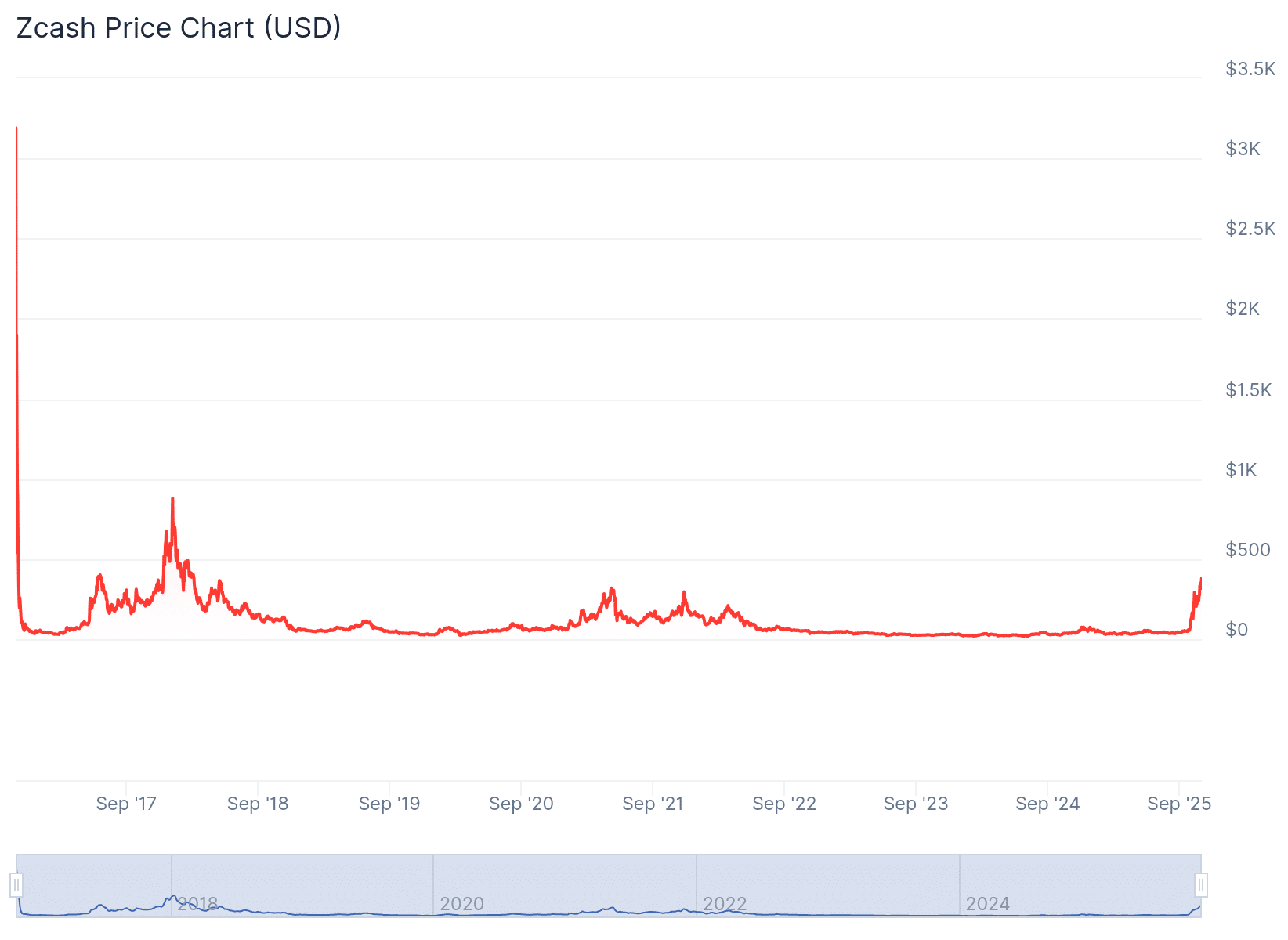

As soon as written off as a relic of the 2017 cycle, Zcash is now mounting one of many strongest recoveries of 2025 and has now even flipped the earlier high privateness coin, Monero (XMR).

So what’s subsequent for ZEC and the way excessive can this pet go?

DISCOVER: 20+ Next Crypto to Explode in 2025

Zcash’s Shielded Provide Hits All-Time Excessive, What’s Subsequent For ZEC Value?

There’s a key distinction between privateness cash Monero and Zcash: Monero actively courted darknet markets and obtained first mover benefit on the time when Zcash cell wallets sucked. Drug consumers need one thing easy; they don’t wish to study clear and shielded addresses when they’re excessive.

The issue is that Monero went too exhausting on DNM use case: they are going to by no means get on Coinbase, by no means have an ETF, and can at all times be a $300 coin.

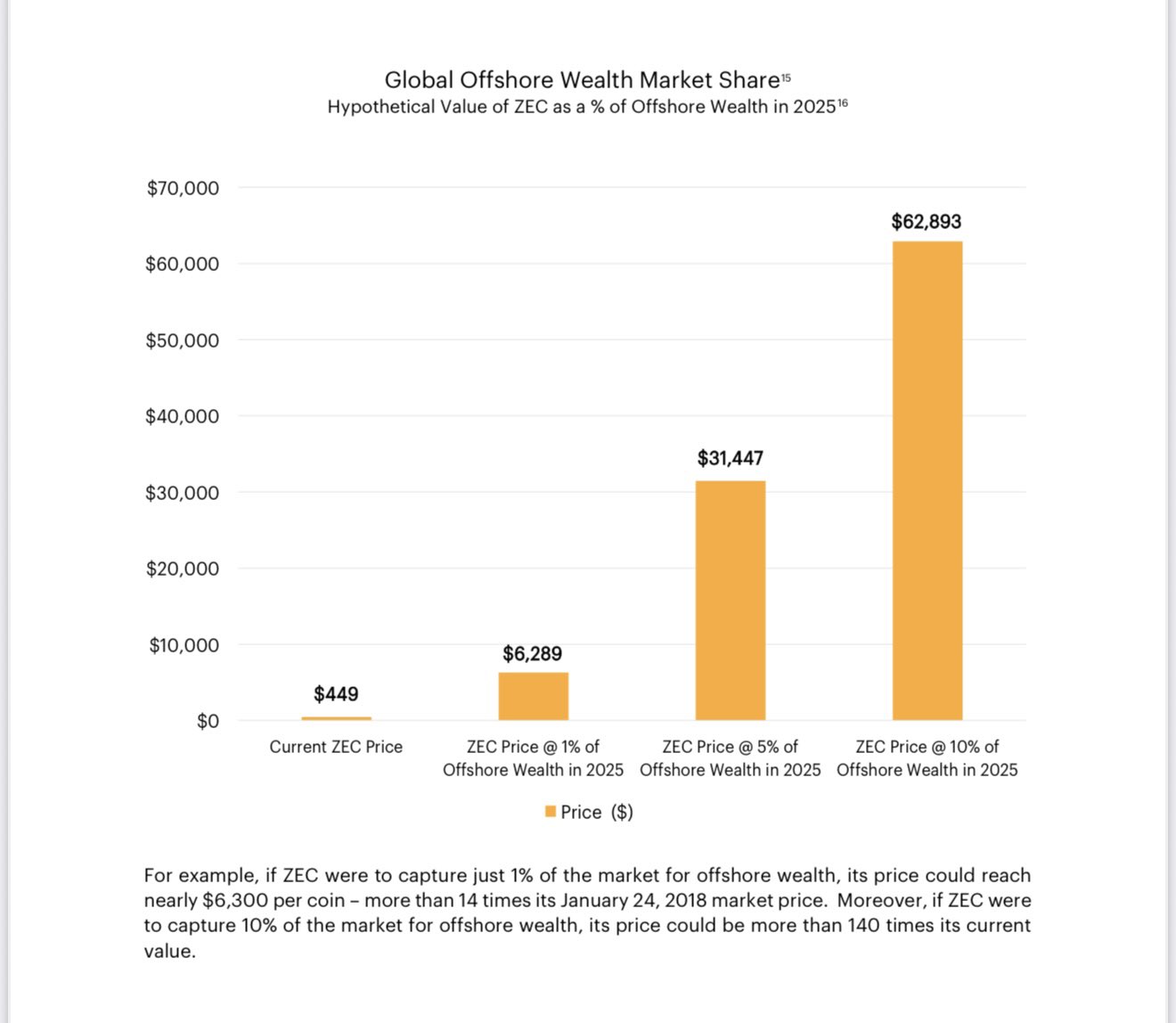

Zcash has an actual shot of changing into a proportion level of all official cash – that’s a a lot, a lot greater quantity than 100% of DNM cash.

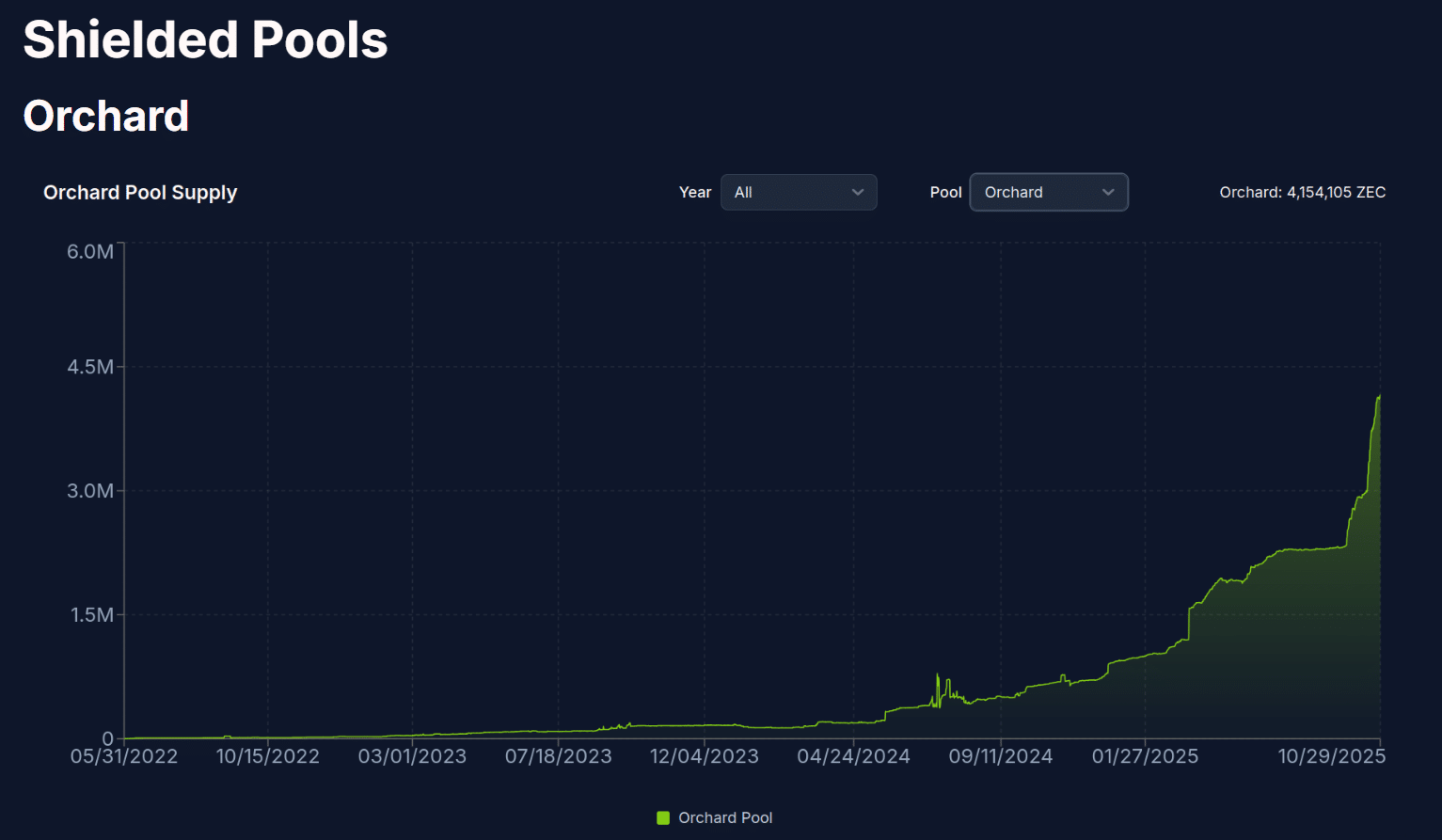

Whereas regulators have attacked Monero over its DNM share, Zcash’s hidden provide retains climbing. Greater than 4.5M ZEC – 28% of circulation – now sits inside shielded addresses that reveal nothing: not sender, not receiver, not even the quantity.

The timing is nice. As governments demand extra knowledge, certainly one of crypto’s oldest privateness chains is doing the other and with the backing of regulators and exchanges.

“This rise in shielded cash alerts rising belief in ZEC’s privateness infrastructure,” mentioned one Zcash Basis contributor.

So, can ZEC hit $1,000 and even $50,000 if it turns into a hub for offshore and personal wealth? Right here’s what the numbers say:

Can ZEC Hit $1k? Technical Momentum and Institutional Flows

Zcash nonetheless appears robust. Each day quantity has topped $730 million, RSI hovers close to 72, and a bullish MACD crossover confirms consumers are in management. Resistance sits round $400, with room to run towards $450 – $500 if momentum holds.

CoinGecko knowledge exhibits that ZEC is up greater than 30% this month, outperforming Bitcoin, Ethereum, and Solana.

Grayscale’s Zcash Belief now manages $137 million, fueling speak of an ETF conversion and renewed institutional curiosity.

“Arthur Hayes’ $1,000 name doesn’t sound far-fetched if privateness cash keep in rotation,” a QCP Capital dealer mentioned. “The narrative’s shifting quick.”

Privateness Cash Reclaim the Narrative

Zcash’s resurgence is going on simply as regulators intensify their surveillance efforts. Governments from Washington to Brussels are tightening guidelines that power wallets to disclose identities and hint each transaction.

If ZEC can maintain above $400, it may claw its method again into crypto’s high tier. Privateness isn’t dying and might be the perfect narrative heading into 2026.

EXPLORE: Is It All Over For the Bull Run? Rates Cuts Sink Crypto Markets

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- So that you’ve invested in Zcash and are actually staring down everlasting riches. Congrats on betting on the subsequent Bitcoin. Subsequent cease: Prime 10.

- Zcash’s resurgence is touchdown proper as regulators double down on surveillance

The publish Weekly Crypto Roundup: Zcash Flips Monero, What’s Next? appeared first on 99Bitcoins.