First launched by market analyst John Bollinger within the early Nineteen Eighties, Bollinger Bands are actually a staple of technical evaluation throughout monetary markets. In crypto, merchants use them to convey construction to fast-moving worth motion and to interpret volatility and momentum in actual time. This information exhibits the way to learn and apply them inside sensible crypto buying and selling methods.

What Are Bollinger Bands in Crypto?

Bollinger Bands are a broadly used technical indicator that helps crypto merchants see how far a worth has moved away from its common. They encompass three parts: a center band, which is often a easy transferring common of the coin’s closing worth over a selected lookback interval, and an higher band and decrease band plotted above and beneath that common. The space of the outer bands from the center band relies on the usual deviation of worth, multiplied by a user-defined issue.

Enjoyable reality! Bollinger Bands even have their own official website.

Do Bollinger Bands Work in Crypto?

Sure. In cryptocurrency markets, Bollinger Bands adapt to altering volatility. When costs develop into extra unstable, the outer bands widen. When costs relax, the bands contract. This makes them particularly helpful on candlestick charts for visualizing real-time market situations throughout any timeframe and any buying and selling pair listed on a crypto trade.

Learn extra: How to Read Crypto Candlestick Charts

What Bollinger Bands Inform Crypto Merchants

Bollinger Bands act as a quick-read dashboard for market situations. Right here’s what they will reveal.

Worth Volatility

The widening or narrowing of the outer bands displays shifts in market volatility. When the bands increase, volatility is excessive and costs are transferring strongly. After they contract, volatility is low and the market is consolidating.

Overbought and Oversold Situations

Touches or closes above the higher band can sign that an asset is overbought, whereas touches or closes beneath the decrease band could counsel oversold situations. These indicators aren’t ensures of reversal however give merchants a context for judging worth extremes.

Pattern Power and Continuation

A “band stroll” (the place worth repeatedly rides alongside the higher or decrease band) typically signifies a powerful pattern that may proceed. Seeing worth hug one band with out reversing instantly warns towards prematurely betting on a reversal.

Imply Reversion Potential

As a result of the center band represents the typical, worth typically drifts again towards it after transferring distant. Merchants use this tendency to determine potential entry or exit factors primarily based on imply reversion.

Breakout Warnings (Band Squeeze)

A pronounced narrowing of each bands, often called a “Bollinger squeeze,” indicators that volatility has compressed and a breakout is probably going. Merchants look ahead to a powerful transfer exterior the bands to verify the beginning of a brand new pattern after the squeeze.

Learn extra: Key Technical Indicators in Crypto Trading

How Bollinger Bands Work

Bollinger Bands work by overlaying a dynamic “envelope” round worth. This envelope adjusts mechanically as market situations change, exhibiting how far worth has strayed from its common. By combining a transferring common with a volatility measure, merchants can see not solely the pattern but additionally whether or not worth is unusually excessive or low relative to current motion.

How Are Bollinger Bands Calculated?

On the core of each Bollinger Band setup is an easy transferring common of closing costs over a selected lookback interval. This common kinds the center band. Above and beneath it sit the higher and decrease bands, that are calculated by including and subtracting a a number of of the standard deviation of worth. When volatility rises, the bands widen. When volatility drops, they tighten.

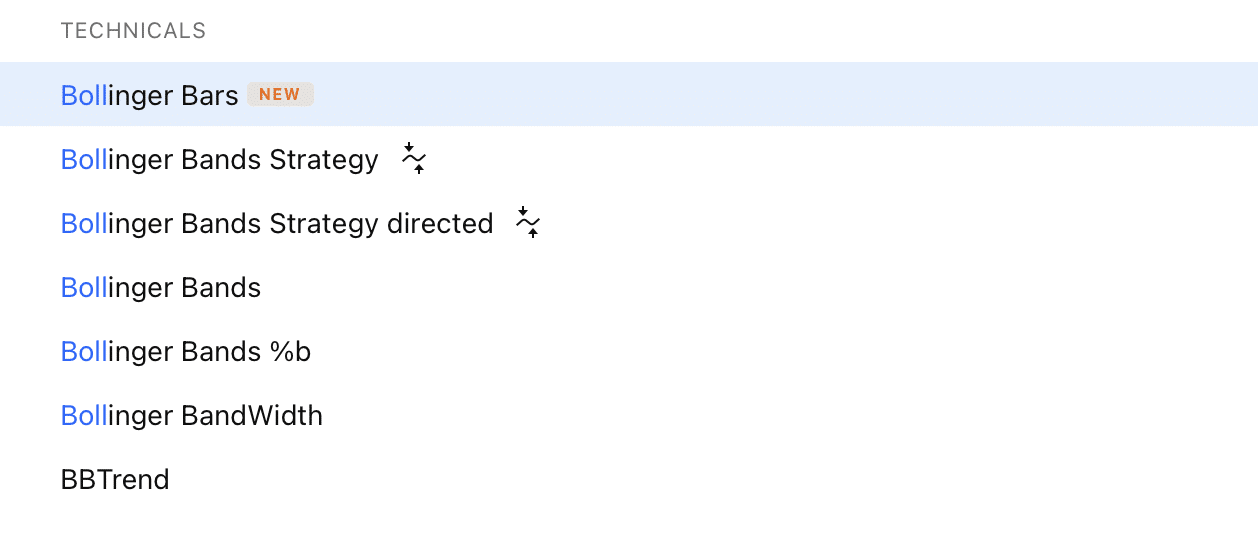

In apply, merchants don’t calculate these figures by hand. Fashionable charting platforms and crypto exchanges plot Bollinger Bands mechanically as soon as you choose the indicator and set your most well-liked parameters corresponding to interval size and standard-deviation multiplier.

The right way to Set Up Bollinger Bands on a Crypto Chart

Making use of Bollinger Bands is fairly easy. Open a candlestick chart of your chosen buying and selling pair in your trade or charting platform. From the symptoms menu, add Bollinger Bands. You may depart the default settings or regulate the lookback interval, the standard-deviation multiplier, and the timeframe to match your buying and selling model. Many merchants additionally overlay complementary instruments just like the Relative Strength Index (RSI) or Keltner Channels to verify indicators and enhance context.

Bollinger Band Buying and selling Methods for Crypto

Bollinger Bands aren’t only for visible evaluation: they are often the spine of a structured buying and selling technique.

Imply Reversion Technique

Merchants search for costs which have moved far above or beneath the bands, anticipating them to revert towards the center band. Entry is taken when a candle closes exterior the band after which again inside. Exits happen close to the center line or earlier help and resistance ranges.

When to make use of it. Greatest in sideways or range-bound markets the place worth oscillates between highs and lows fairly than trending strongly.

Keep Secure within the Crypto World

Discover ways to spot scams and defend your crypto with our free guidelines.

Bollinger Band Squeeze Technique (Breakout Setup)

A squeeze occurs when the higher and decrease bands contract considerably, indicating low volatility. Merchants monitor for a decisive breakout of worth past both band, typically confirmed by larger quantity or a powerful candlestick shut.

When to make use of it. Helpful when a big transfer is anticipated. The squeeze acts as an early warning of impending market volatility.

Pattern Following Technique (Using the Band)

In a powerful uptrend, merchants search for worth to “stroll” alongside the higher band, coming into lengthy positions on pullbacks towards the center band and exiting on indicators of exhaustion. In a downtrend, the identical logic applies utilizing the decrease band.

When to make use of it. Greatest when clear momentum exists and worth is steadily hugging one band, signaling energy fairly than imminent reversal.

Reversal with RSI Affirmation

Mix Bollinger Bands with the Relative Power Index. When worth touches or closes exterior a band whereas the RSI exhibits overbought or oversold situations, merchants search for a reversal again towards the center line.

When to make use of it. Appropriate for catching turning factors after excessive strikes, particularly when market sentiment is stretched.

Double Bollinger Band Technique

Plot two units of Bollinger Bands with totally different standard-deviation multipliers (for instance, one at 1 customary deviation and one other at 2). The inside bands outline a “regular” zone, and the outer bands present the extremes. Positions are taken primarily based on which zone worth enters.

When to make use of it. Useful for filtering trades and figuring out stronger indicators, particularly in unstable crypto markets.

The right way to Use Bollinger Bands in Crypto Buying and selling for Higher Entry and Exit Factors

Bollinger Bands assist merchants see when crypto costs are stretched or consolidating. By following the steps beneath in your worth chart, you may flip this indicator right into a sensible device for planning entries and exits.

Step 1: Begin with the Center Band (Easy Shifting Common)

Focus first on the center band—a easy transferring common of closing costs over your chosen lookback interval. It marks the short-term imply and sometimes acts as a reference for help or resistance.

Step 2: Test Band Settings on Your Chart

In our day and age, there’s no have to calculate or plot something your self. Simply open your charting platform and verify the default parameters for Bollinger Bands. Be certain that the lookback interval, standard-deviation multiplier, and timeframe suit your buying and selling model. This ensures the higher Bollinger Band and decrease Bollinger Band replicate the market situations you’re analyzing.

Step 3: Learn the Higher and Decrease Bands

Take a look at how worth interacts with the bands. The higher Bollinger Band highlights the higher restrict of typical worth motion, and the decrease band exhibits the decrease restrict. Look ahead to touches, closes exterior, or strikes again inside—these are the uncooked “indicators” you’ll use for entries and exits.

Step 4: Interpret Band Construction

Learn the bands’ form:

- Extensive bands = excessive volatility

- Slender bands = consolidation and potential breakout

- Worth hugging one band (“band stroll”) = robust pattern

- Worth transferring again inside after a contact = potential imply reversion

Repeated closes close to the higher Bollinger Band can verify robust momentum, whereas reversals from both band could sign a shift again towards the center. Indicators corresponding to %B and Bollinger Bandwidth give a numerical view of those situations for those who favor information over visuals.

Step 5: Use the Bands to Determine Commerce Alternatives

Enter and exit primarily based on what the bands present. In ranges, think about shopping for close to the decrease Bollinger Band and taking revenue close to the higher Bollinger Band or the center one. In traits, use pullbacks to the center band to affix the transfer. Mix this with stop-loss and take-profit orders for threat administration, and backtest your plan over totally different timeframes and buying and selling pairs.

Crypto Buying and selling With and With out Bollinger Bands: Execs and Cons

Bollinger Bands give crypto merchants clear visible cues for volatility, extremes, and breakouts. Buying and selling with out them means counting on uncooked worth information or different indicators.

| Side | With Bollinger Bands | With out Bollinger Bands |

| Market Context | Exhibits volatility and extremes at a look | No built-in volatility view |

| Entry/Exit | Clear higher/center/decrease band references | No clear reference factors |

| Breakouts | Squeeze highlights doubtless breakouts | Breakouts tougher to identify early |

| Help/Resistance | Bands act as dynamic ranges | Should draw static ranges manually |

| Technique | Simpler to construct and backtest guidelines | Tougher to systemize trades |

| Studying Curve | Wants indicator know-how | Less complicated however much less construction |

Limitations of Bollinger Bands

Bollinger Bands are a preferred technical evaluation device in crypto and different monetary markets, however they’re not magic. They’ll enhance your view of a worth chart, but counting on them alone can result in errors.

First, Bollinger Bands solely measure previous worth actions. They don’t predict the longer term. The higher band and decrease band shift with each new candle, so any “sign” you see is reactive, not predictive.

Second, totally different settings can produce very totally different higher band indicators, which implies two merchants would possibly interpret the identical chart in completely alternative ways.

Third, like most technical indicators, Bollinger Bands can fail throughout robust news-driven strikes or skinny liquidity, when worth slices by means of the higher band or decrease band with out reverting. And all cryptocurrency merchants understand how frequent that’s in crypto.

Lastly, they work greatest when mixed with different instruments and well-tested buying and selling methods. With out affirmation from quantity, worth motion, or complementary indicators, the bands alone can generate false breakouts or untimely entries.

Suggestions for Buying and selling Crypto with Bollinger Bands

Listed below are some ideas for utilizing Bollinger Bands that concentrate on what truly works in dwell markets, not simply idea.

- Affirm the pattern first. Test how costs are inclined to behave earlier than reacting to a band contact. In a powerful rally, worth can hug the higher band for days with out reversing, and in a brand new bearish pattern, it will probably hug the decrease band.

- Don’t commerce each contact. A contact of the higher or decrease band alone isn’t a sign. Search for affirmation from quantity, candlestick patterns, or different indicators earlier than appearing.

- Spot oversold situations with context. In an oversold market situation, a transfer beneath the decrease band plus divergence on an oscillator (like RSI) can sign a bounce, however with out that context it might simply be a continuation of the pattern.

- Look ahead to tightening bands. When bands contract and present much less volatility, anticipate a possible breakout. Plan your commerce directionally however look forward to a transparent break and retest to cut back false begins.

- Adapt your settings. Modify the lookback interval or deviation multiplier for various cash or timeframes. Extremely unstable altcoins may have wider settings, whereas low-volatility pairs may have tighter ones.

- Handle threat on each commerce. All the time use stop-loss and take-profit ranges sized to your account and technique. Bollinger Bands give context however not threat limits.

Learn extra: Crypto Risk Management Strategies

Ultimate Ideas

Bollinger Bands stay a go-to indicator as a result of they translate uncooked volatility into a transparent visible framework. Used accurately, they assist crypto merchants spot momentum, overextension, and low-volatility setups earlier than a transfer. However they’re not a stand-alone system—mix them with sound threat administration, complementary indicators, and disciplined commerce planning to construct crypto buying and selling methods you may belief throughout timeframes and market situations.

FAQ

What timeframe ought to I take advantage of Bollinger Bands on: 1-hour, 4-hour, or each day charts?

It is dependent upon your crypto buying and selling technique and objectives. Shorter timeframes give extra frequent information factors and indicators however could be noisy, whereas each day charts filter noise and present stronger pattern or promote indicators in the wrong way of short-term strikes.

Can I take advantage of Bollinger Bands with MACD or quantity evaluation on the similar time?

Sure. Combining Bollinger Bands with MACD or quantity evaluation provides confirming information factors for entries and exits, serving to you keep away from reacting to a single indicator’s false promote indicators.

Do Bollinger Bands work in a different way in crypto in comparison with shares or foreign exchange?

The calculation is identical, however crypto’s 24/7 buying and selling and better volatility imply extra frequent band touches and squeezes. This could produce faster breakouts and promote indicators or reversals in the wrong way than you’d anticipate in slower markets.

Disclaimer: Please word that the contents of this text aren’t monetary or investing recommendation. The data offered on this article is the writer’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be conversant in all native rules earlier than committing to an funding.