In the event you’re trading crypto with out trying on the order guide, you’re principally guessing. The guide exhibits you what patrons and sellers are actually doing, proper now. Need higher entries, cleaner exits, and fewer surprises? Discover ways to learn the indicators that the majority inexperienced persons miss. It’s simpler than it seems to be, and far more helpful than you assume.

What Is an Order Guide in Crypto Buying and selling?

An order guide is a stay listing of all pending purchase and promote orders for a selected asset on a crypto change. It exhibits the particular worth and quantity merchants need for every order, organizing real-time provide and demand.

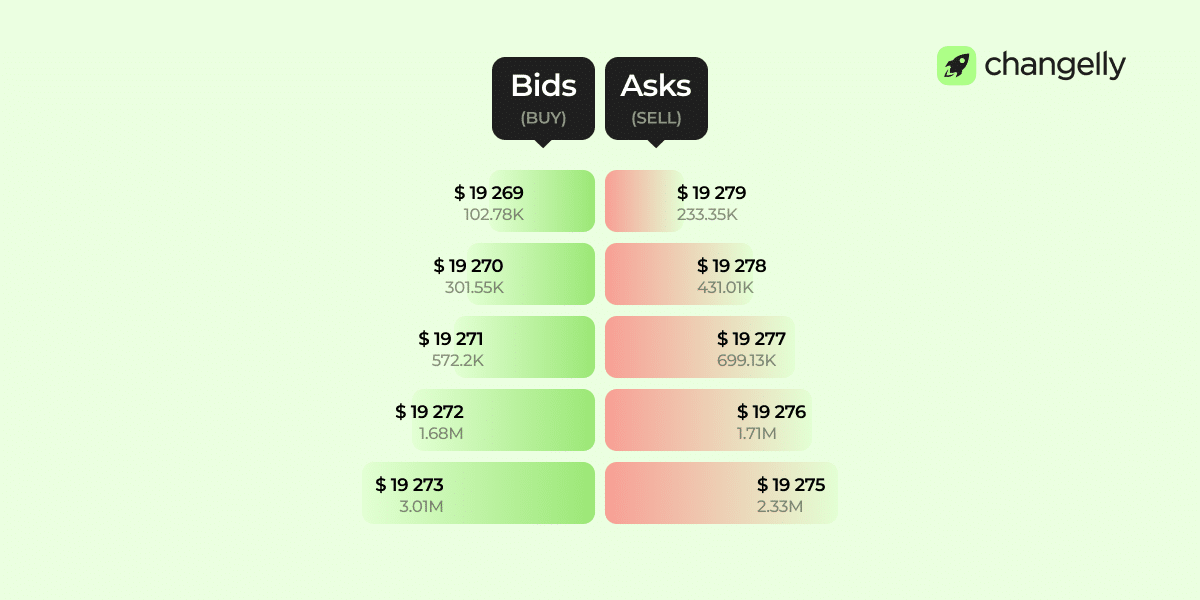

The order guide information is break up into two sides: bids (purchase) and asks (promote). Every bid or ask is grouped by specified worth and quantity. When a purchaser and vendor match on the similar worth, the order is stuffed and eliminated.

Each order guide snapshot displays a single trading pair—like BTC/USDT—and solely shows orders for that pair. Since every change and pair has its personal circulate, costs can differ barely between totally different cryptocurrencies and platforms.

How an Order Guide Capabilities in Actual Time

An order guide updates in actual time, when every new order—purchase or promote—is added primarily based on worth. When the very best bid meets the bottom ask, the commerce executes immediately. That order then disappears from the guide.

This stay stream of actual time market information lets the order guide replicate ongoing exercise. The highest costs—finest bid and finest ask—preserve shifting as orders fill, which continually redefines the present market worth.

Solely restrict orders seem on the guide. Market orders don’t, since they execute instantly at out there costs. That’s why the seen information represents dealer intentions, not accomplished trades.

As market circumstances change, the depth and form of the guide adjusts. A deeper guide indicators excessive market liquidity, whereas skinny depth exhibits fragility.

Anatomy of an Order Guide

A crypto order guide could look complicated at first, however it’s composed of some elementary components which are constant throughout exchanges.

Bids (Purchase Orders): What They Imply

Purchase orders, or bids, are provides from merchants seeking to buy crypto at a selected worth. Every bid consists of the worth and amount. The best bid is on the prime of the purchase aspect, it’s essentially the most somebody is keen to pay now. Collectively, these bids replicate market members’ demand and the place patrons count on help.

Asks (Promote Orders): What They Symbolize

Promote orders, or asks, are from merchants aiming to promote crypto at a selected worth. Every consists of an asking worth and quantity. The bottom ask—on the prime of the promote aspect—is the most affordable present provide. Asks present the place market members wish to take revenue and symbolize the out there provide available in the market.

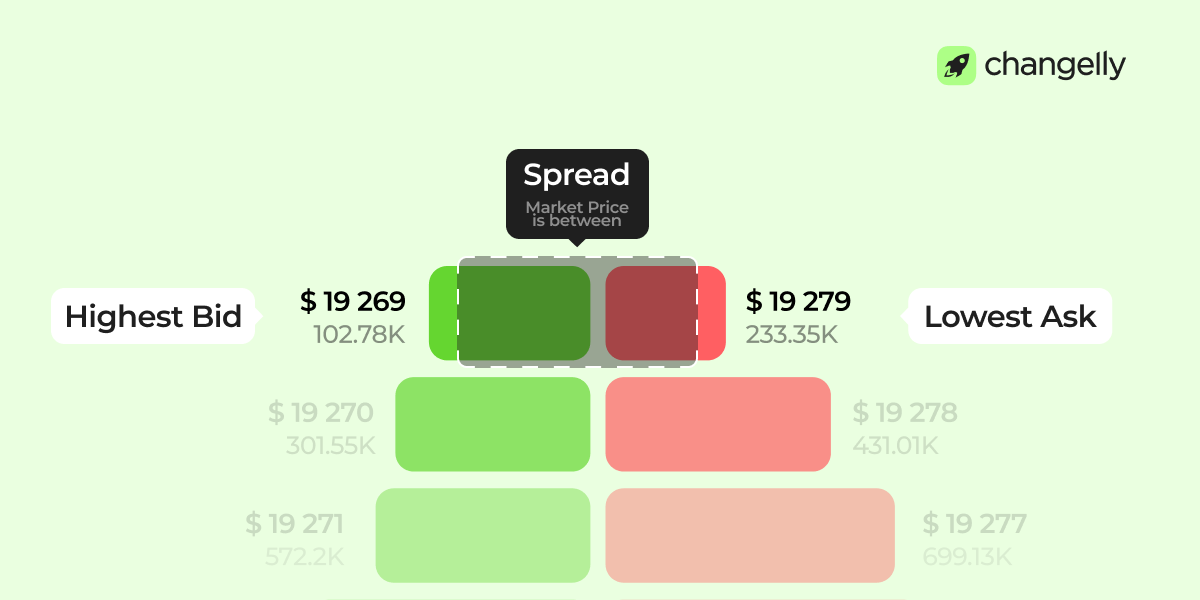

Bid-Ask Unfold: Why It Issues

The unfold is the hole between the very best bid and the bottom ask. A small unfold means lively buying and selling and good liquidity. A big unfold suggests low exercise or uncertainty. The unfold is the place market makers revenue, and the place worth discovery occurs. It helps outline the true market worth and the very best worth for instant execution.

Order Amount: How A lot Crypto Is Being Traded

Order amount exhibits how a lot crypto is listed at every worth stage. Bigger volumes recommend stronger purchaser or vendor curiosity. If many models sit at a stage, that worth could act as help or resistance. This information helps with liquidity evaluation—extra quantity means larger market depth and higher market liquidity for giant trades.

Value Ranges: Stacking Orders by Value

Every worth stage exhibits all orders at a selected worth. Exchanges group an identical worth factors into one line. The extra stacked ranges, the deeper the order guide depth and stability.

Time Precedence: Why Older Orders May Get Crammed First

Orders on the similar worth comply with time precedence, which means older orders fill first. This ensures equity amongst market members. The order guide information tracks submission time for correct matching.

How Do Order Books Work?

Right here’s how order books work: every time a dealer locations a purchase or promote order, it’s added to the guide at their chosen worth. When a market participant submits an identical order—say, a purchase on the similar worth as a promote—the matching engine executes the commerce immediately and removes each orders. This matching system ensures quick execution and helps decide the real-time market worth by worth discovery. The highest bid and ask continually replace as trades happen.

Market makers play a key function right here. They place each purchase and promote orders to supply liquidity, revenue from the bid-ask unfold, and stabilize the market.

When costs differ between exchanges, merchants search for arbitrage alternatives. By shopping for low on one platform and promoting excessive on one other, they revenue from the hole. These trades assist steadiness costs throughout markets and preserve the crypto ecosystem extra environment friendly.

The best way to Get Free Crypto

Easy methods to construct a worthwhile portfolio at zero price

The best way to Learn an Order Guide

Typical Order Guide Format: Columns and Rows

Most crypto platforms show purchase and promote orders in two columns: buys and sells. Every row exhibits a worth and quantity. The highest of the guide highlights the very best worth the place the subsequent commerce would possibly occur.

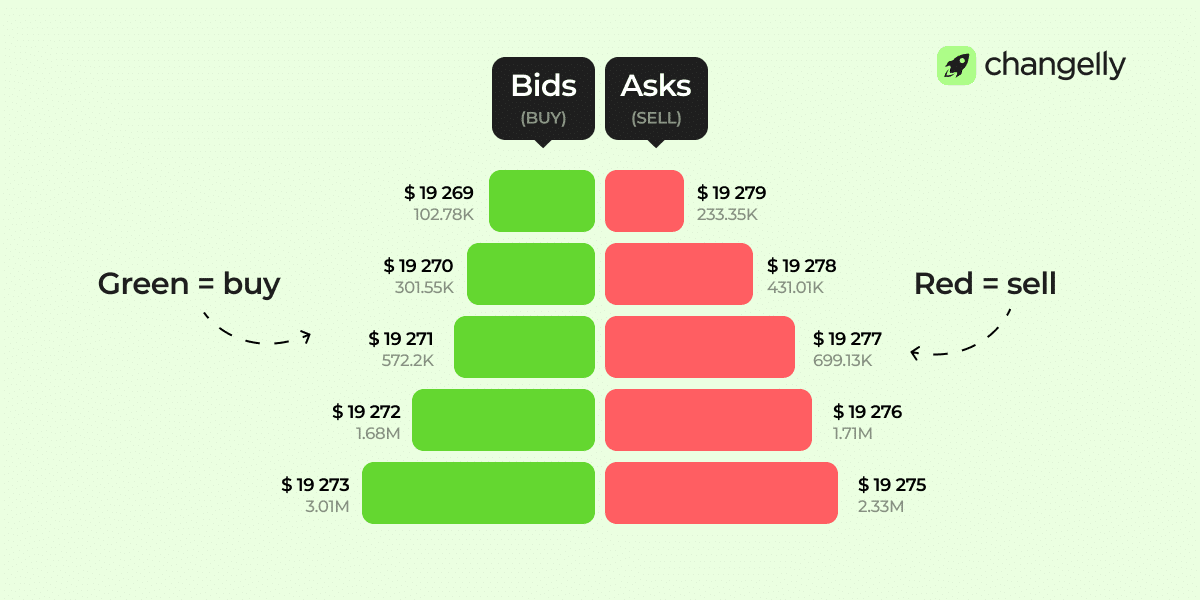

Color Coding: Inexperienced (Purchase) vs. Pink (Promote)

Inexperienced highlights purchase orders (bids); pink exhibits promote orders (asks). These colours assist you to shortly scan the order guide and spot the steadiness between purchaser demand and vendor stress.

The best way to Discover the Market Value Utilizing the Order Guide

The present market worth is between the very best bid and the bottom ask. This hole is the unfold. Whenever you place a market order, it fills at the very best worth out there from the opposite aspect.

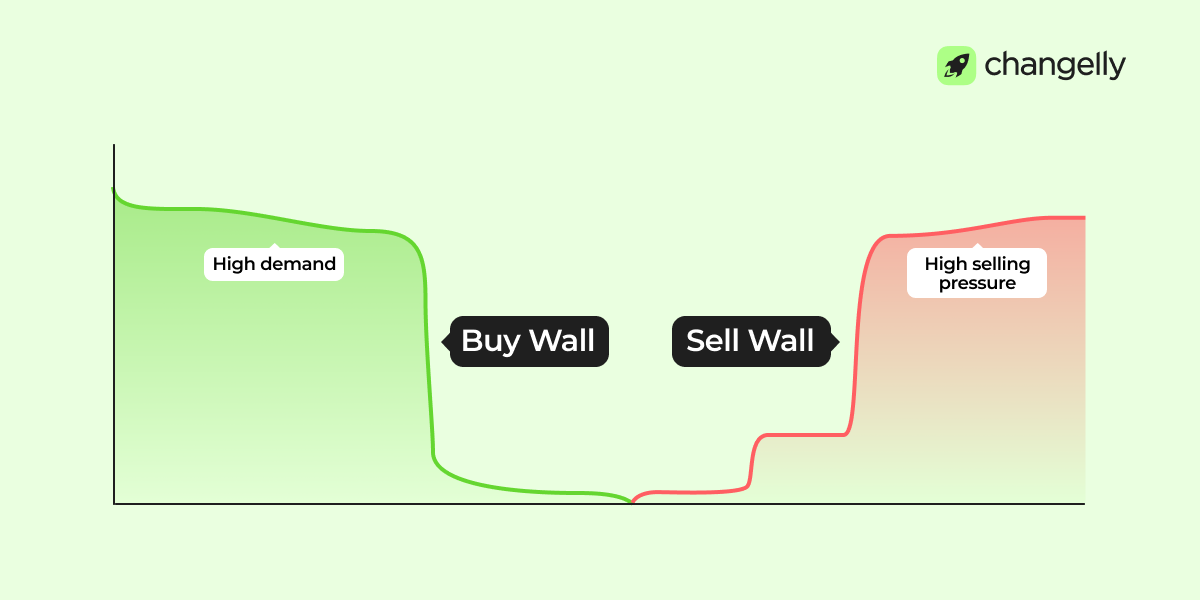

Depth Charts

A market depth chart exhibits the identical order guide visually. The inexperienced aspect shows complete purchase quantity at every worth; pink exhibits promote quantity. Sharp spikes or partitions point out robust help or resistance ranges primarily based on massive order concentrations.

What Are Purchase Partitions and Promote Partitions?

A purchase wall kinds when plenty of purchase orders stack at one worth. It indicators robust demand or help. A promote wall exhibits heavy promoting curiosity, typically appearing as resistance. Each replicate dealer sentiment and areas of low liquidity.

Forms of Order Books

Centralized Order Guide (COB)

A Centralized Order Guide is managed by a single cryptocurrency change, like Binance, Kraken, or Coinbase. All person orders are saved and matched utilizing the platform’s system.

These buying and selling platforms provide quick execution, deep liquidity, and superior instruments. However you will need to belief the change to handle your funds and information.

Decentralized Order Guide (DOB)

A Decentralized Order Guide runs on a blockchain and isn’t managed by a government. Tasks like dYdX and Serum use smart contracts to match trades peer-to-peer.

You keep management of your property, however execution could also be slower attributable to community constraints. DOBs replicate the values of Web3 and DeFi.

Actual-Time Order Guide

A Actual-Time Order Guide updates immediately with each new order or commerce. Most main platforms provide this by default. It exhibits stay order guide modifications and helps you react shortly to cost shifts and buying and selling quantity.

Aggregated Order Guide

An Aggregated Order Guide combines order guide information from a number of buying and selling platforms. It exhibits the very best bids and asks throughout exchanges, providing broader liquidity and higher worth discovery.

Providers like TradingView and CoinAPI present this performance.

Darkish Pool Order Guide

A Darkish Pool Order Guide hides order dimension and participant id. It’s used largely by establishments making massive trades. These books don’t present up on public order books, however they affect market liquidity and worth developments behind the scenes.

Forms of Orders and How They Seem within the Order Guide

Market Orders: Quick Shopping for or Promoting

Market orders execute immediately at the very best out there worth. They don’t sit on the order guide as a result of they match current orders straight away. That is the quickest approach to purchase or promote, however not all the time the most affordable, particularly in unstable markets or beneath charge limits. Learners typically use market orders for simplicity, however they provide much less management over the ultimate worth.

Restrict Orders: Setting Your Personal Value

A restrict order helps you to set a specified worth at which you wish to purchase or promote. It seems on the order guide and waits till one other dealer accepts your provide. This offers you extra management and is good while you’re focusing on a selected worth. It’s a wise selection for affected person merchants making strategic buying and selling selections.

Cease Orders: Buying and selling When a Situation Is Met

Cease orders set off solely when the market hits a sure worth. They turn into market orders or restrict orders as soon as activated. Many use them to cease losses or lock in positive aspects mechanically. To set these successfully, you’ll have to receive information from the market and determine your threat stage upfront.

How Orders Get Matched

Matching begins when a purchase order provides to pay the identical quantity a promote order is asking. The system compares all costs within the guide and appears for matches. It begins with the very best worth, then checks which order got here first. That one will get stuffed. If the match isn’t actual—for instance, if the purchase order is bigger than the promote—it solely fills a part of the order. The remainder waits for one more match. This course of runs continually, guaranteeing each worth settlement leads to a commerce.

Some decentralized exchanges skip this method solely. As a substitute of matching orders, they use AMMs (automated market makers) the place merchants swap tokens instantly with a liquidity pool, not one other person.

How Merchants Use the Crypto Order Guide

Merchants learn the order guide to trace provide and demand. They take a look at volume round key ranges and watch how bid costs change in actual time. A surge in bids could recommend robust demand, and probably help. Merchants place restrict orders simply above stacked bids to get stuffed early, or simply under main asks to promote into resistance.

The aim isn’t to guess course, however to see the place stress builds and use that information to plan entries, exits, or stop-loss ranges.

Widespread Errors Learners Make

One mistake is misreading purchase or promote partitions as fastened. However these orders can disappear immediately. They present intention, not dedication.

One other mistake: ignoring historic information. Value reacts to the identical zones time and again. In the event you don’t know the place worth bounced or stalled earlier than, you’re buying and selling blind.

Learners additionally overlook about assessing market sentiment. They react to a crowded order guide with out checking quantity, worth motion, or latest information. If merchants pull orders or quantity dries up, sentiment has shifted. Emotional trades comply with worth, not logic. That results in overtrading or chasing. And plenty of ignore general market circumstances, pondering a neighborhood wall issues greater than macro developments. Order books assist, however provided that learn in context.

Ultimate Phrases

Order books aren’t predictions, they’re fairly home windows into market intent. They present the place individuals wish to commerce, not the place the worth will go. However used proper, they assist you to see stress, plan smarter entries, and keep away from dangerous fills. Begin small, check what you see, and match it with charts and quantity. That’s the way you be taught to commerce with actual context, not noise.

FAQ

Can I commerce with out understanding the order guide?

Sure, you may commerce with out utilizing the order guide, however you could miss vital indicators. It’s a important part of any change that helps you make knowledgeable selections. With out it, you’re simply guessing. The guide exhibits what patrons and sellers are doing in actual time, which may help you select higher entry and exit factors.

What’s the objective of an order guide?

The order guide is a important part that exhibits all open purchase and promote orders. It allows worth discovery by letting merchants compete on worth. It additionally helps market liquidity, guaranteeing trades occur shortly. By watching the order guide, you may achieve useful insights into demand, provide, and worth momentum earlier than making a transfer.

What occurs when a bid matches an ask in an order guide?

When a bid matches an ask, a commerce is executed. This course of is automated and occurs by the change’s matching system. The customer will get the asset, and the vendor receives cost. It’s how each crypto commerce works. The matched worth turns into a part of worth discovery, influencing the subsequent market worth proven on the platform. That’s why order books are so central to how exchanges function.

How typically does the order guide replace, and may I belief what I see?

The order guide updates in actual time, reflecting each new commerce or order. You see actual time market information, which helps you react to fast-moving circumstances.

Nevertheless, charge limits in your system or API would possibly trigger small delays. Additionally, merchants can cancel orders, so market circumstances could change shortly.

Nonetheless, the order guide information is correct and stays your finest view into what’s occurring now.

What does it imply if there’s an enormous purchase wall or promote wall?

A purchase wall means many purchase orders are stacked at one worth. It suggests robust demand or help at that stage. A promote wall exhibits plenty of promoting curiosity and acts as resistance. These partitions form market sentiment and sign the place merchants count on worth to stall. Large partitions can even point out low liquidity above or under, affecting market depth and market liquidity general.

Disclaimer: Please observe that the contents of this text usually are not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.