mNAV, or market internet asset worth, is a valuation metric that expresses the real-time financial worth of an organization’s bitcoin reserves. It adjusts the corporate’s holdings to the present market value of bitcoin, accounts for liquid money and debt, and components in share dilution.

mNAV supplies a clearer image of a bitcoin treasury company’s true monetary place than standard accounting requirements. It has grow to be the usual device for evaluating company bitcoin methods as a result of it facilities the evaluation on bitcoin itself, fairly than legacy accounting conventions that may distort worth.

Key Takeaways

- Actual-Time Precision: mNAV displays the present market worth of an organization’s bitcoin reserves on a per-share foundation, up to date in real-time fairly than quarterly.

- Financial Actuality: It supplies traders with a clear measure of reserve worth that cuts via GAAP reporting lags.

- Market Sentiment: Premiums and reductions to mNAV reveal how the market interprets an organization’s execution, governance, and capital effectivity.

- Valuation Anchor: mNAV is crucial for analyzing public bitcoin treasury corporations and entry automobiles.

Objective: Why We Want mNAV

The aim of mNAV is to supply an correct, real-time valuation anchor for corporations that maintain bitcoin.

Traditionally, underneath US accounting guidelines (GAAP), bitcoin was handled strictly as an intangible asset. This required corporations to acknowledge impairments when the value fell however prevented them from recognizing beneficial properties till the asset was offered. Whereas current updates to FASB guidelines (ASU 2023-08) now permit corporations to report bitcoin at honest worth, GAAP monetary statements stay retrospective—snapshots taken solely as soon as per quarter.

Bitcoin markets transfer 24/7. A quarterly earnings report is usually stale the second it’s revealed.

mNAV fills this hole. It replaces static quarterly reporting with dynamic, market-based valuation. Buyers acquire a constant, clear, and economically significant measure of the corporate’s bitcoin place that adjusts with the market. This supplies a dependable foundation for evaluating efficiency, governance, threat, and capital technique.

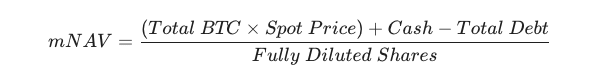

Mechanics: How mNAV Works

mNAV is easy to calculate, however precision is essential. It treats the corporate successfully as a holding car, netting out money owed and money to seek out the “bare” worth of the bitcoin per share.

1. Holdings in BTC

Firms disclose their bitcoin reserves in BTC phrases. That is the foundational enter. As a result of bitcoin’s provide is mounted, the amount held is the first driver of long-term worth.

2. Market Pricing

The true-time spot value of bitcoin is utilized to the corporate’s complete BTC holdings to find out the gross worth of the reserves.

3. Internet Debt (Money vs. Liabilities)

To get an correct “Internet Asset” worth, you need to account for the steadiness sheet.

- Add Money: Money and money equivalents are added to the bitcoin worth.

- Subtract Debt: Complete debt (together with convertible notes and senior secured notes) is subtracted.

- Word: For working corporations (like software program corporations), this formulation is conservative. It successfully values the working enterprise at zero, assuming its money flows exist primarily to service the debt.

4. Absolutely Diluted Share Depend

The result’s divided by the totally diluted variety of shares. This consists of excellent shares, choices, Restricted Inventory Items (RSUs), and shares underlying convertible notes if they’re “within the cash.”

System for mNAV per share

The output is a reserve-based valuation per share. Buyers examine the inventory value to this benchmark to grasp if they’re paying a premium (paying for future execution) or a reduction (pricing in threat).

Background and Origins

mNAV emerged as a sensible necessity as soon as firms started holding bitcoin in materials measurement. Early adopters like MicroStrategy (now Technique) revealed that customary accounting couldn’t seize the fact of bitcoin’s market habits. Impairment costs made wholesome steadiness sheets look distressed, whereas large unrealized beneficial properties went unreported.

Analysts started circulating market-value-adjusted figures to grasp the true power of those corporations. At the same time as accounting guidelines modernize, mNAV stays the dominant metric as a result of it’s easy, comparable throughout corporations, and targeted on BTC phrases fairly than accounting classification.

Why Firms Commerce Above or Beneath mNAV

Firms hardly ever commerce precisely at mNAV. The market applies premiums or reductions based mostly on the way it interprets execution high quality, treasury self-discipline, and capital construction.

Capital Market Arbitrage & Accretive Issuance: Some corporations excel at reworking capital markets into bitcoin acquisition engines. They difficulty fairness or debt at enticing phrases to purchase extra bitcoin.

Notably, if an organization trades at a premium to mNAV, it might probably difficulty new shares to buy bitcoin, successfully growing the bitcoin-per-share for present holders. The market typically rewards this “accretive loop” with a sustained premium, because it accelerates the buildup of reserves.

Bitcoin-Backed Monetary Devices: Firms with deep bitcoin reserves can difficulty monetary merchandise backed by these holdings, corresponding to bitcoin-backed notes or yield-generating devices. Markets reward the flexibility to make use of bitcoin to construct new monetary infrastructure.

World Market Entry: Massive swimming pools of institutional capital nonetheless can not purchase or custody bitcoin immediately. Treasury corporations provide a well-known entry level via fairness and stuck earnings. This utility will increase demand for shares, typically pushing valuations above mNAV.

Reductions: The Market Referendum: Reductions typically sign misery. If an organization trades under mNAV, it implies traders are nervous about governance, administration charges, extreme leverage, or the shortcoming to carry bitcoin long-term.

Premiums to mNAV

A premium to mNAV signifies that traders worth the corporate’s capabilities past the uncooked worth of its present holdings.

A premium is a vote of confidence. It suggests traders consider the corporate will:

- Generate Accretion: Concern capital effectively to develop bitcoin-per-share.

- Mitigate Threat: Handle leverage intelligently to keep away from pressured promoting.

- Create Utility: Construct services or products on high of the bitcoin stack.

Premiums contract when confidence fades. Poor execution or deterioration in capital effectivity can cut back demand for the shares, inflicting valuations to float again towards—or under—mNAV.

Instance: Technique ($MSTR)

Strategy is the biggest and most studied bitcoin treasury firm. As a result of its technique entails energetic capital market administration (issuing convertibles and fairness to purchase BTC), analysts, plebs and traders routinely monitor mNAV to interpret its valuation.

Technique typically trades at a big premium to mNAV. This premium displays the market’s valuation of its capacity to borrow cheaply and purchase bitcoin that appreciates sooner than the price of that debt. When the corporate efficiently executes this arbitrage, the premium tends to carry. If market circumstances weaken or leverage issues rise, the inventory might drift nearer to mNAV.

For present information on Technique’s mNAV, premium, and BTC Yield, view the Strategy’s Company Metrics on BitcoinMagazinePro.com.

mNAV vs. E book Worth

E book worth displays historic value based mostly on accounting guidelines. It’s a lagging indicator, while mNAV displays present financial actuality. mNAV replaces historic value with reside market information and adjusts for dilution.

For a bitcoin treasury, E book Worth is extra appropriate for the accountants; and mNAV is most popular by traders.

Incessantly Requested Questions

Does mNAV work like NAV in an ETF?

No. ETFs have an arbitrage mechanism (Approved Members) that forces the value to match NAV. Working corporations do not need this. Their shares float freely based mostly on sentiment, permitting for vital premiums and reductions.

Does mNAV apply to personal corporations?

It may be calculated if the personal firm discloses holdings and liabilities, however it’s most helpful for public corporations with clear, liquid share counts.

Why do reductions seem?

Reductions often replicate threat. If the market fears the corporate could also be pressured to promote bitcoin to pay money owed, or if the administration construction is poor, the inventory might commerce at a reduction to the uncooked worth of the property.

Associated Ideas

Bitcoin Strategic Reserve – A deliberate long-term allocation of bitcoin used to defend towards fiat dilution and protect capital over time. Treasury corporations sometimes construct this into their core technique.

Bitcoin Treasury Company – Bitcoin treasury corporations are redefining capital preservation. By inserting bitcoin on the heart of their steadiness sheet technique, these corporations unlock entry to capital and take up bitcoin’s provide.

Closing Ideas

mNAV has grow to be some of the essential valuation instruments in company bitcoin adoption. It reveals the true financial worth of bitcoin reserves and offers traders a constant benchmark for evaluating corporations that anchor their steadiness sheets within the hardest financial asset out there.

As extra corporations undertake bitcoin methods, mNAV will stay the central metric for understanding how capital markets combine with sound cash.