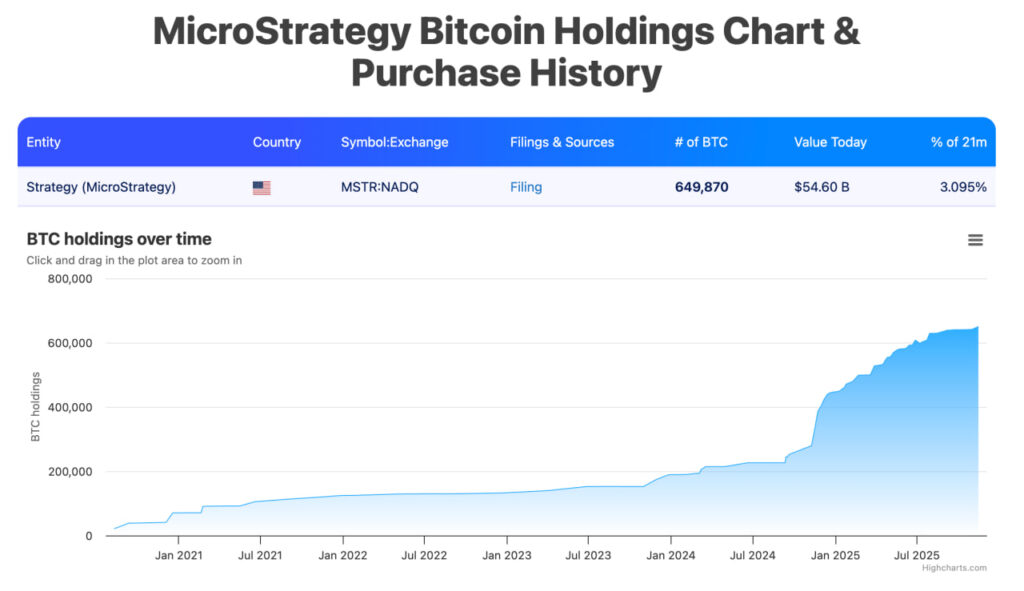

MicroStrategy remains to be the biggest company holder of Bitcoin, sitting on roughly 649,870 BTC as of mid-November 2025. They purchased all of this for round 48.37 billion {dollars} complete, which places their common price at about 74,433 {dollars} per Bitcoin.

With Bitcoin dipping underneath 80k, issues are beginning to look uncomfortable for Michael Saylor and MicroStrategy. There’s additionally an actual danger that the corporate could possibly be faraway from the Nasdaq-100 Index, which is what QQQ and plenty of tech-focused ETFs monitor.

Why? As a result of MSCI, one of many greatest index suppliers on this planet, opened a session on whether or not firms whose digital belongings (like Bitcoin) make up greater than roughly half of their complete belongings ought to nonetheless be categorised as regular working firms. The ultimate determination is anticipated round January 15, 2026.

If MSCI decides to exclude these “digital asset treasury firms,” MicroStrategy can be faraway from MSCI indices. Analysts warn that this might set off $ 2.8 to $ 11.6 billion in pressured passive promoting.

The probability of this taking place is estimated to be between 80% and 95%. Some analysts imagine the result is already priced in, which could clarify a part of Bitcoin’s latest sharp drop.

If MSCI removes MicroStrategy, passive outflows may attain roughly $ 2.8 billion. If Nasdaq-100, FTSE Russell, and others comply with MSCI’s lead (which JPMorgan estimates at a 70 to 90 % likelihood), complete pressured promoting may attain $8 to $11 billion, roughly 15 to twenty % of MicroStrategy’s market capitalization.

Regardless of all of this, Michael Saylor continues to purchase and maintain Bitcoin. He sees it as a long-term treasury technique. Nonetheless, within the brief to medium time period, this case would pose a serious headwind for the inventory on account of pressured promoting, lowered liquidity, and tougher situations for elevating capital.

What Will Occur to MicroStrategy if Bitcoin Falls Below $74,000?

With every part taking place proper now, the one factor that would actually assist MicroStrategy is that if Bitcoin holds up higher than it at the moment is. Nonetheless, it isn’t, and that’s the reason the percentages of BTC dropping under 74k are fairly excessive.

If that occurs, MicroStrategy’s Bitcoin holdings would begin displaying an unrealized loss on paper. Since MSTR trades like a extremely leveraged Bitcoin proxy, the inventory would probably take one other main hit. It has already been sliding laborious in latest weeks, and mixed with the potential MSCI removing, the state of affairs may get tough.

So is that this the tip of MicroStrategy and Michael Saylor? No, completely not. There will likely be no pressured promoting or margin calls within the close to future. Most of MicroStrategy’s roughly 8 billion {dollars} in debt is in convertible notes that don’t mature till 2027 by way of 2032.

MicroStrategy has already survived far worse twice earlier than, particularly in 2022 when individuals genuinely believed chapter was on the desk. At the moment, the corporate’s Bitcoin stack stays deeply worthwhile, its debt construction is the cleanest it has ever been, and the one vital new risk is index exclusion.

They’ll say we acquired fortunate.

— Michael Saylor (@saylor) November 20, 2025

That will damage the inventory due to pressured passive promoting. Nonetheless, it doesn’t threaten the corporate itself, nor does it drive them to promote their Bitcoin. Although it’s probably Saylor isn’t going wherever. Lengthy dwell Bitcoin.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- MicroStrategy faces actual stress from the MSCI index overview and a possible drop underneath 74k. However none of it forces them to promote Bitcoin or threatens the corporate’s survival.

- MSTR may even see heavy pressured promoting and inventory volatility. But its debt is long-term, its BTC stack remains to be worthwhile, and Saylor stays absolutely dedicated to holding.

The submit What Will Happen To Microstrategy If Bitcoin Falls Under $74,000? appeared first on 99Bitcoins.