Over the past month, Bitcoin ranged inside the $100,000 — $110,000 worth area till its current breakout to achieve a brand new all-time excessive. On-chain information present {that a} shift in BTC holder habits could have performed a major function within the flagship cryptocurrency’s recent price action.

LTHs Start Distributing, However STHs Accumulate

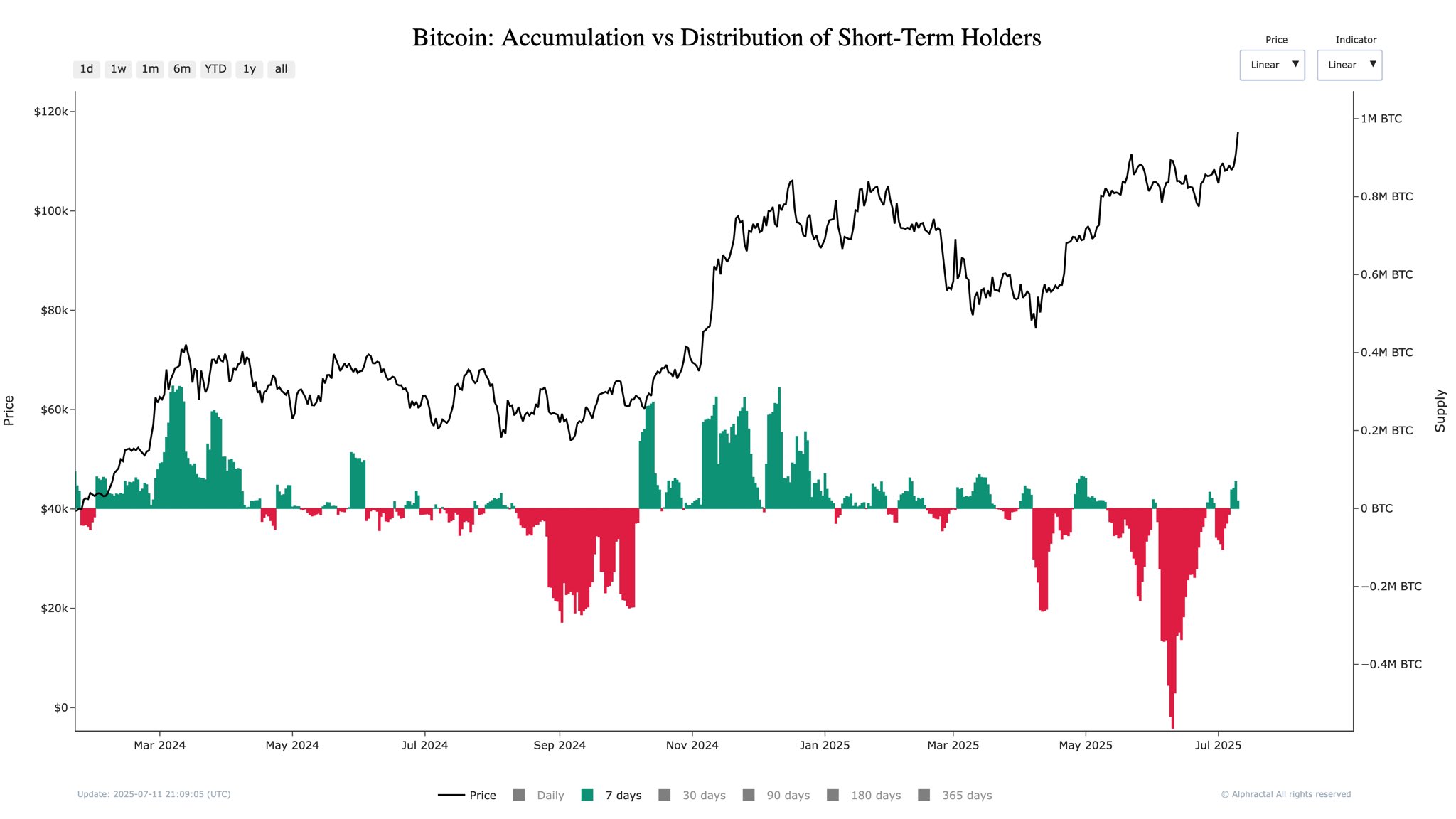

In a July 12 put up on the X platform, on-chain analyst Boris explained how a shift in Bitcoin holder exercise has affected the market over the previous months. This clarification was primarily based on indicators measuring the Accumulation Vs Distribution of Lengthy-Time period Holders (LTH) and Quick-Time period Holders (STH).

For these two holder classes, the metric tracks and analyzes pockets habits to find out whether or not they’re rising or lowering their Bitcoin holdings over time.

Associated Studying: Bitcoin Breaks Records: What Miners and Leverage Traders Are Doing Behind the Scenes

For the long-term holders, the chart above exhibits how accumulation grew from the later days of Could to the tip of June. That is represented by the rising inexperienced graphs over the purple.

Throughout the similar timeframe, the chart beneath exhibits short-term holders have been represented extra by the purple graphs than the inexperienced, indicating extra distribution than accumulation up to now month.

Boris credited the LTHs for Bitcoin’s survival above the $100,000 help zone. “Regardless of heavy STH distribution and retail promoting strain, BTC defended the 100K help — a transparent signal of structural accumulation led by LTH wallets,” the on-chain analyst stated.

In accordance with Boris, the short-term holders have been observed to have sold greater than 563,000 BTC as Bitcoin continued to vary. As this occurred, the Lengthy-Time period holders steadily collected Bitcoin, and this absorbed many of the promoting strain from STHs.

Nevertheless, this dynamic appears to have reversed very lately. The web pundit reported that the Lengthy-Time period Holders began distributing their Bitcoin holdings. This sell-off from the LTHs could also be a results of profit-taking, because the cryptocurrency’s upward drift would necessitate.

Then again, the short-term holders have began to build up Bitcoin. This pattern seen with this reactive group of investors signifies renewed retail curiosity or speculative entry amidst the present bullish rally.

Boris additional inferred that this handover from LTH help to STH help will need to have fuelled Bitcoin’s newest breakout, as short-term momentum is injected into the market.

What’s Subsequent For Bitcoin?

Whereas this rotation of provide between holder courses might not be unusual in crypto market cycles, the dimensions and timing of this swap counsel that Bitcoin’s worth motion holds extra fascinating rallies within the close to future. Nevertheless, if the short-term shopping for strain ought to taper, the absence of long-term help could trigger a decrease help to be retested. As of this writing, Bitcoin is valued at $117,300, reflecting no important motion up to now 24 hours.

Associated Studying

Featured picture from iStock, chart from TradingView