US inflation reportedly cooled, and the Fed already minimize charges 3 times, however Bitcoin worth retains stalling each time it pokes close to $90,000, identical to it did yesterday, the twenty second of December.

Watching the order books on Binance and Coinbase throughout Monday’s European session, it was clear that $90,000 wasn’t only a psychological wall or a big promote wall; it was being refreshed each time the worth ticked up, suggesting refined ‘restrict’ promoting fairly than a retail panic.

On the floor, this seems to be like a bullish macro backdrop, however below the hood, the inflation information seems to be messy, and Bitcoin’s personal liquidity seems to be drained.

What Does This “Excellent” Inflation Report Actually Imply for Bitcoin?

Let’s begin with the large headline: November US CPI confirmed 2.7% year-over-year inflation, decrease than the three.1% that economists anticipated, and core inflation dropped to 2.6%. That seems like precisely what threat belongings, together with Bitcoin, normally love. Decrease inflation usually means cheaper cash and simpler situations for belongings that folks purchase for progress or as an inflation hedge.

GDP information simply got here in at 4.3% which is a big enhance from the forecasted 3.3%.

Identical goes for CPI information final week which had a giant deviation at 2.7% in opposition to the three.1% forecast.

You don't usually see variations this massive, can we belief this information?

Very suspicious certainly. #CPI #GDP pic.twitter.com/pV4RyXXCUV

— JNFateful (@jn_fateful) December 23, 2025

However this report comes with an asterisk. Due to a six-week authorities shutdown, the US by no means revealed October CPI and statisticians needed to estimate chunks of November information as an alternative of utilizing actual worth observations.

Rents and a few companies, which carry heavy weight in CPI, relied on modeled numbers, not precise market readings. When the information that strikes trillions of {dollars} comes from estimates, massive cash steps again and waits.

The Fed seen this drawback. Governor John Williams referred to as the inflation print “encouraging,” however he additionally warned that shutdown distortions have an effect on each inflation and unemployment. Because of this the Fed likes the path, however it doesn’t belief this single report sufficient to open the floodgates. Williams then mentioned there may be “no speedy want” for extra cuts and described coverage as “effectively balanced”, that’s Fed-speak for “don’t count on a cash printer get together but.”

For Bitcoin buyers, this issues as a result of BTC has began to commerce like a macro asset. In 2025, merchants watched CPI days the identical approach inventory merchants watched earnings season. When the market thinks the Fed will maintain actual rates of interest excessive for longer as a result of the information seems to be noisy, it stays cautious on Bitcoin, too.

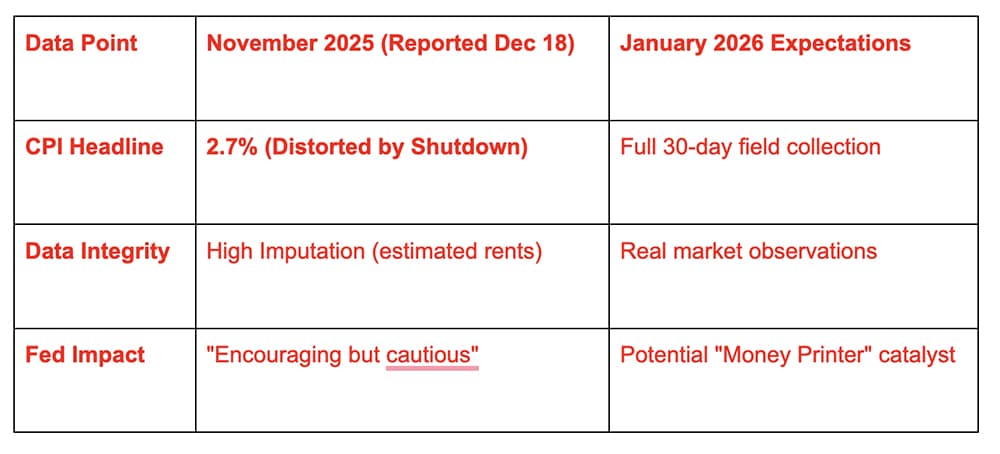

Beneath is a comparability desk on why this issues, evaluating Noisy November vs the upcoming “clear” January.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Why Isn’t Good Macro Information Pushing Bitcoin Value Increased?

Even with three price cuts, actual yields – that’s, rates of interest after inflation – nonetheless sit round 1.9% on 10‑yr TIPS. Again in 2020–21, these actual charges have been unfavorable, which made holding money painful and pushed buyers into Bitcoin and different threat belongings. Right this moment, you really earn one thing on secure authorities bonds, so the strain to chase Bitcoin at any worth is far decrease.

The Fed additionally stopped quantitative tightening on Dec. 1, which sounds bullish at first look. However the central financial institution confused that its new asset purchases are “technical,” not a brand new wave of full-blown quantitative easing. Consider it like a mechanic holding the engine from stalling, not slamming the accelerator. Which means no massive liquidity tsunami but, which explains why BTC is just not blasting via $90,000 because it did at earlier milestones.

THE REAL REASON CRYPTO IS CLIMBING….

It isn’t due to charts, or indicators…

It’s as a result of the Quantitative tightening headwind that crypto has been struggling in opposition to since early 2022 has been eliminated…

Extra price cuts, extra money printing extra threat on..

That is… pic.twitter.com/0DeBl9F6fa

— The Home Of Crypto (@Peter_thoc) December 3, 2025

On high of that, the Financial institution of Japan raised charges to 0.75%, the best in a long time. Many world funds used to borrow in low cost yen and put money into threat belongings worldwide – the so‑referred to as carry commerce. When Japan slowly removes that zero-rate anchor, these buyers know {that a} sharp yen transfer may drive them to unwind trades and promote belongings, together with Bitcoin. Even when that squeeze has not hit but, the menace alone makes merchants cautious of taking over massive new BTC publicity on the prime quality.

Now zoom in on Bitcoin itself. On‑chain information companies report that BTC market depth – the quantity of purchase and promote orders sitting close to the present worth – dropped round 30% from its 2025 peak. Which means thinner order books. Think about making an attempt to promote a giant stack of cash in a small native market as an alternative of a large inventory alternate; your commerce strikes the worth extra. ETF information tells an identical story: Bitcoin ETFs noticed billions in outflows in November, which drained among the simple demand that powered the October run to $126,000.

There’s additionally a big band of “underwater” provide between roughly $93,000 and $120,000, the place many consumers sit on losses. Each time BTC pops towards $90K and above, a few of these holders are desperate to promote and escape break‑even. That creates a ceiling. In order for you extra element on how these ranges form worth, our recent coverage of Bitcoin’s rejection at $90K walks via the worth motion.

What Ought to On a regular basis Bitcoin Traders Do With This Stalemate?

First, deal with this as a reminder that macro information could be messy and late, whereas your cash is actual and on the spot. Inflation stories that depend on estimated rents can swing Fed expectations, which in flip swing Bitcoin, even when the underlying financial system has not modified a lot. Massive funds know this, in order that they usually look ahead to a “clear” observe‑up print earlier than making massive bets. You may borrow that persistence.

For those who already maintain Bitcoin, this type of sideways chop close to a giant spherical quantity is regular. BTC stalled round $70K and $80K earlier in 2025 when macro narratives seemed unsure, then finally moved as soon as new information and liquidity arrived. What issues greater than guessing the subsequent $5,000 transfer is whether or not you sized your place on your threat tolerance and time horizon. If a 20–30% drop would smash your funds, you maintain an excessive amount of Bitcoin.

In case you are desirous about shopping for, don’t deal with “inflation is falling” as an all‑clear sign. The Fed nonetheless runs constructive actual charges, Japan is just slowly normalizing, and Bitcoin liquidity has thinned. That mixture means sharp strikes in each instructions stay on the desk. Greenback‑price averaging – shopping for small, common quantities as an alternative of 1 massive lump sum – can cut back the stress of making an attempt to time a breakout above $90K. Our latest market update around Bitcoin holding $89K exhibits how this gradual‑and‑regular method suits uneven situations.

GM GM!

enjoying crypto in 2026

– Get positioned early, not emotionally

– Consistency > depth

– Danger administration is alpha

– Greed kills good portfolios

– Suppose in cycles, not candles

– Earnings arent actual till they’re bookedSubsequent cycle received’t be simple however it’ll be value it.

— Keval Gala (@kevalgala03) December 22, 2025

Above all, do not forget that Bitcoin stays a excessive‑threat asset, even when it behaves extra like a macro barometer now. By no means use lease cash or emergency financial savings to chase a breakout, irrespective of how good the inflation headline seems to be. The following clear CPI report in early 2026, and any shift from impartial Fed coverage towards actual easing, will seemingly resolve whether or not Bitcoin lastly clears $90,000 with conviction or spends extra time grinding on this vary.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Comply with 99Bitcoins on X For the Newest Market Updates and Subscribe on YouTube For Every day Professional Market Evaluation.

The publish Why Bitcoin Price Can’t Clear $90K Even With “Perfect” Inflation appeared first on 99Bitcoins.