On Sep. 23, Bitcoin’s hashrate set a brand new all-time excessive of 1,073 EH/s. During the last month, uncooked compute rose about 21%.

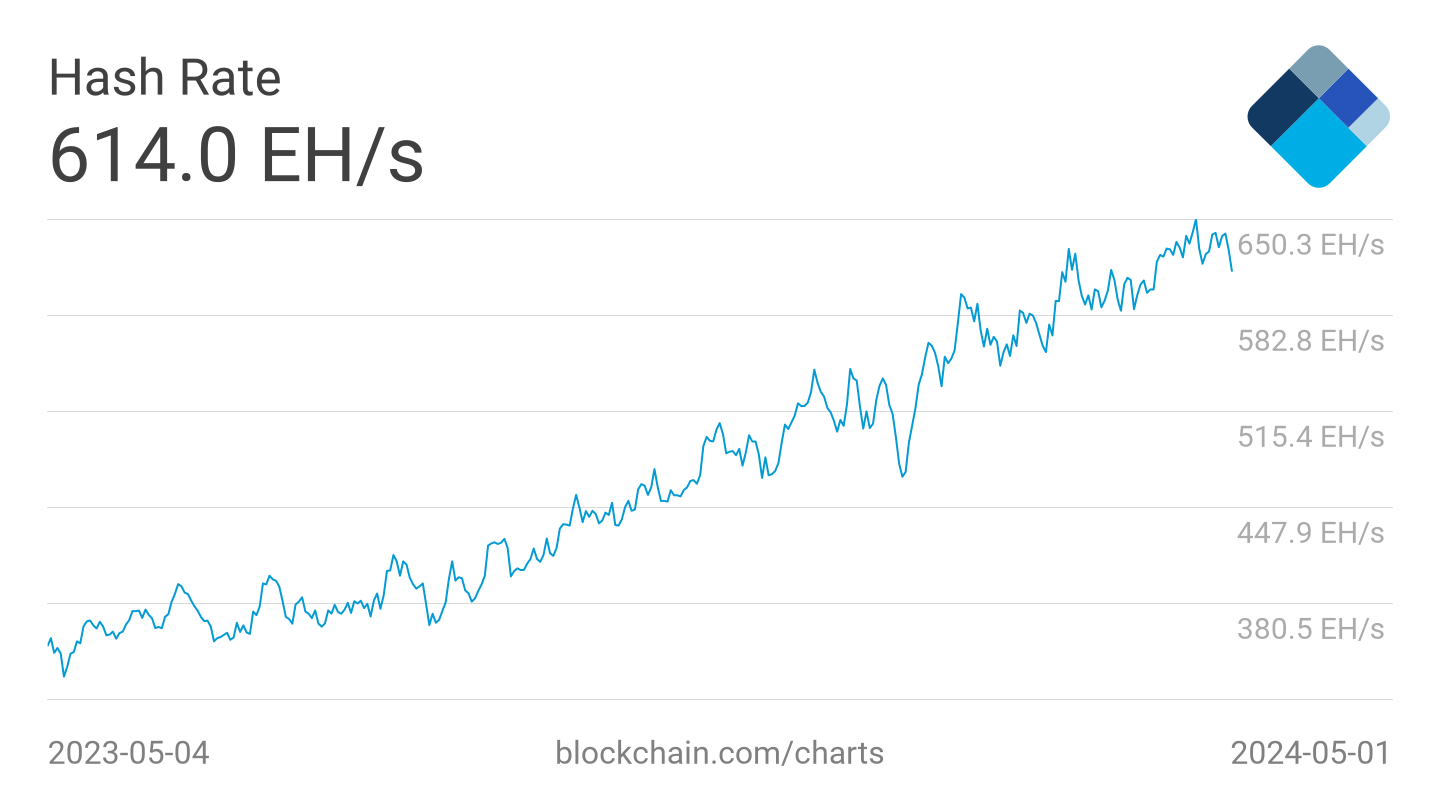

During the last quarter, roughly 70%. During the last yr, the curve went vertical, up round 675%.

Hashrate was once a chart for miners and protocol nerds. Now it reads like a capital expenditure scoreboard for an business you’ll be able to commerce.

Let’s reply the fundamental query shortly: What’s hashrate, and why ought to anybody exterior a mining warehouse care?

Hashrate is the entire computational effort pointed at Bitcoin’s proof-of-work: i.e., how onerous it might be to outvote the community and rewrite the ledger. Extra hashrate makes an assault dearer and fewer sensible. However the extra fascinating angle isn’t simply “security”; it’s what this says concerning the scale of the business behind it.

You don’t get a zetahash with out years of organising services, putting in transformers, hauling in container a great deal of machines, and locking in power contracts large enough to energy total cities. Each uptick on this line is cash and engineering exhibiting up in the true world.

Mechanically, the protocol retains block cadence regular by elevating or reducing problem each 2016 blocks, like a treadmill that accelerates when the runners get stronger. When hashrate jumps prefer it did into September, the treadmill kicks quicker on the subsequent epoch or two, and margin will get tighter.

That suggestions loop drives the enterprise: machines come on-line, blocks arrive too shortly, problem adjusts, and unit economics compress till solely probably the most environment friendly operators maintain their edge. The protocol is agnostic; it doesn’t negotiate. Miners both hit their energy value and fleet-efficiency targets or they get pushed to the again of the road.

The most recent every day print set a recent excessive round 1,073 EH/s. The previous 30 days added roughly 184 EH/s on the peak of the run-up, an absolute bounce large enough to have counted as your complete community not way back.

Yr to this point, hashrate is up about 36%. The collection crossed every psychological marker on a predictable cadence: 1 EH/s in early 2016, 10 EH/s by late 2017, 100 EH/s by late 2019, 500 EH/s in late 2023, and now four-comma territory. These thresholds marked step-ups in industrial scale: new-gen ASIC waves, denser racks, higher firmware, and cheaper electrical energy.

That is the place “why hashrate issues past mining” turns into the fallacious lens to take a look at it. It issues rather a lot for mining as a result of public miners now sit on the middle of this business. MARA, RIOT, CLSK, CORZ, IREN, CIFR, and friends aren’t simply buying and selling proxies for Bitcoin; they’re working firms tied to this treadmill.

When hashrate accelerates quicker than value, problem chases it, and hashprice compresses. You may see that shake out on earnings calls: fleet age and watts per terahash instantly matter greater than intelligent treasury strains.

Operators with sub-$0.04-$0.05/kWh energy, environment friendly immersion or high-utilization air-cooled websites, and firmed energy hedges trip the adjustment with out coughing up margin. Everybody else watches their breakeven rise.

The fairness market aspect of that is easy to relate and onerous to run.

Scale is now an actual infrastructure downside: substation lead occasions, transmission constraints, interconnect queues, and localized politics about the place you’ll be able to place load. That’s why the hashrate chart reads like a map of who really executed.

A community that simply cleared one zetahash is an business with onerous property all internationally, grouped in areas with low cost energy and a supporting native authorities. The inventory tape displays that sorting.

Firms with recent fleets and available megawatts seize share into an upswing; the remainder get diluted, consolidated, or quietly sidelined when the subsequent problem ratchet arrives.

The business is at all times tempted to show hashrate spikes into value calls.

Nevertheless, the higher story right here is that value displays temper whereas hashrate displays dedication. Rigs don’t magically seem as a result of social sentiment turned inexperienced. The transfer we simply logged implies months of capex already spent and months extra queued up for supply.

If spot stalls, problem will nonetheless do its job and drive the business to get leaner. If value runs with it, you’ll see the general public names dash as operational leverage flips constructive.

The previous month’s +20% and the quarter’s +70% aren’t simply massive; they’re quick. The one largest 30-day absolute acquire on this run hit in mid-September, a reminder that the cadence of deployments is now lumpy as containers land in bursts, energy comes on-line in chunks, and grid seasons matter.

That rhythm is what is going to resolve the leaderboard over the subsequent few epochs.

You may pretend a story. You may’t pretend delivered energy.