Why did Ethereum drop? Effectively the basics haven’t modified for ETH however my internet price has.

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.optimistic svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic {

colour: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.optimistic {

border: 1px strong #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.optimistic::earlier than {

border-bottom: 4px strong #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.detrimental svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.detrimental {

border: 1px strong #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.detrimental {

colour: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.detrimental::earlier than {

border-top: 4px strong #A90C0C !necessary;

}

Ethereum

4.67%

Ethereum

ETH

Worth

$2,841.69

4.67% /24h

Quantity in 24h

$19.79B

<!–

?

–>

Worth 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

slid sharply this week, falling more than 7% in 24 hours as a mixture of structural and psychological pressures collided – however how is it impacting Ethereum value prediction.

A Yearn Finance exploit triggered the preliminary wave of promoting, however the cascade shortly unfold throughout the market, sending BTC down 5% and pulling whole crypto market cap under $3Tn.

$1M revenue in simply 1 hour!

Dealer pension-usdt.eth opened a 2x quick on 6,358 $ETH($18M) an hour in the past — proper earlier than the market dropped — now sitting on an unrealized revenue of $1M.https://t.co/wWuCTPFTHx pic.twitter.com/RuuVZ5ztlC

— Lookonchain (@lookonchain) December 1, 2025

In the meantime, crypto whales are promoting their luggage, and quick sellers sense a chance. Right here’s what it is advisable know for the ETH value:

DISCOVER: Top 20 Crypto to Buy in 2025

Why Did Ethereum Drop? A 2015 ICO Whale Reawakens After a Decade

One of many day’s largest headlines got here from an on-chain alert exhibiting a 2015 Ethereum ICO wallet, that has been dormant for ten years, shifting 40,000 ETH, initially bought for $12,400 at $0.31. That stash is now price roughly $120 million, a 9,677x return by immediately’s pricing.

Regardless of fears of a selloff, no change deposits have been detected.

Lookonchain: “The switch seems to be an inner transfer, not a liquidation occasion.”

A whale transferred $120,000,000 in $ETH after 10 years of dormancy.

He purchased them for simply $12,400 and is now sitting on a 9,633x return.

Life-changing wealth with Ethereum. pic.twitter.com/sOaBGLgMyz

— Ted (@TedPillows) November 30, 2025

Traditionally, early-era ETH whales have brought about extra social-media panic than actual market harm. Dormant pockets activations are narrative occasions, not sometimes liquidity occasions.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The Yearn Exploit Sparks a Broader Selloff: What’s Subsequent For Ethereum Worth Prediction?

The true set off got here from a Yearn Finance exploit reported by CoinDesk, which blindsided markets already stretched by leverage. Because the exploit circulated, ETH futures unwound aggressively, and greater than $600M in crypto liquidations hit the tape, per CoinGlass.

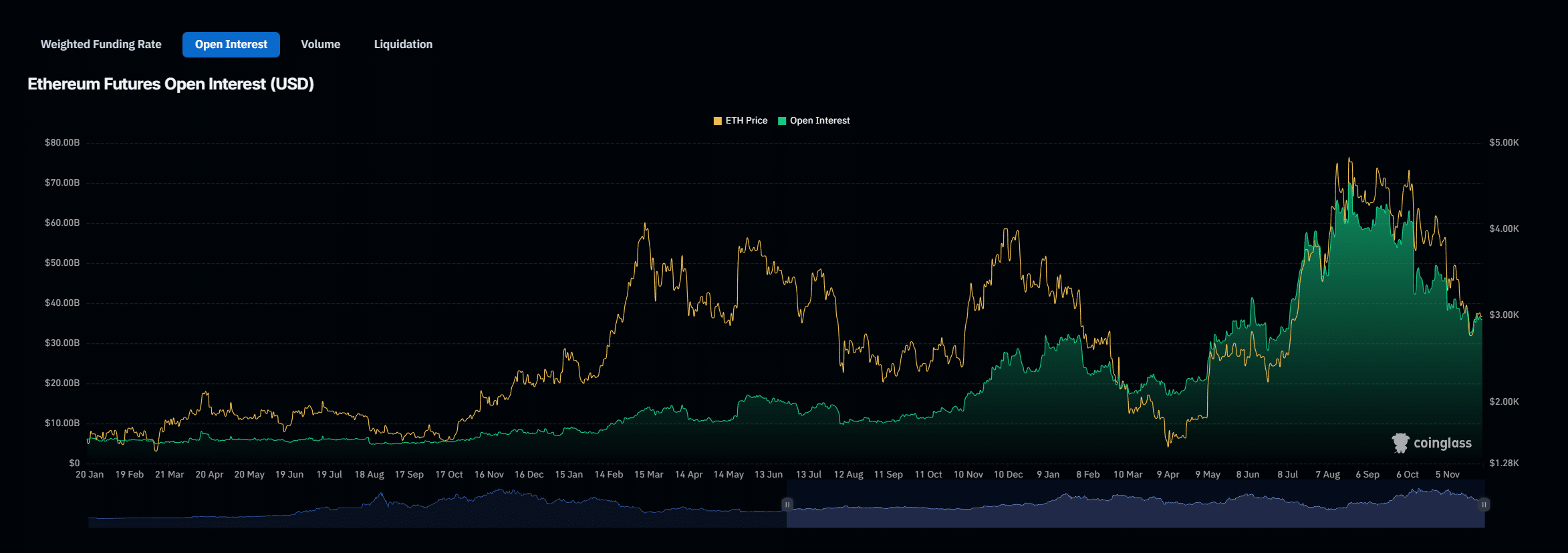

CoinGlass data reveals a pointy enhance in ETH futures open curiosity by way of late November, adopted by a violent flush as merchants have been compelled out. Retail buyers accused insiders of front-running the exploit, although no proof helps the declare.

In the meantime, Taiwanese whale Machi Massive Brother as soon as once more discovered himself on the incorrect aspect of volatility. His partial liquidation left him holding 3,300 ETH at 25x leverage, with a liquidation value of $2,831.58.

Screenshots of his HYPE and ETH perpetual positions present one other $1.7M in compelled closes and a -108% ROE. Analyst Wukong: “That is what occurs once you deal with ETH like a on line casino chip as a substitute of collateral.”

Machi(@machibigbrother) simply acquired partially liquidated once more because the market dropped!

He nonetheless has a 3,300 $ETH($9.4M) lengthy place left, with a brand new liquidation value of $2,831.58.https://t.co/uxkXmHSGbg pic.twitter.com/XnigX3im8G

— Lookonchain (@lookonchain) December 1, 2025

Market Circumstances Nonetheless Favor Volatility For ETH USD Worth

From a knowledge perspective, Ethereum stays in a fragile spot.

CoinGecko reveals ETH buying and selling on fading spot quantity, whereas Glassnode’s funding fee metrics point out an unhealthy tilt towards excessive leverage even after this washout. FRED information on world liquidity continues to development downward as Japan indicators tightening and US actual yields stay elevated.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

- Why did Ethereum drop? Effectively the basics haven’t modified for ETH however my internet price has.

- From a knowledge perspective, Ethereum stays in a fragile spot.

The submit Why Did Ethereum Drop? Crypto Crash Dents Ethereum Price Prediction for December appeared first on 99Bitcoins.