Bitcoin slid to $91,920 late Sunday in New York, down 3.8% from roughly $95,500, as a pointy risk-off impulse hit crypto markets and rapidly bled into excessive beta majors. Ether fell as a lot as 5.3% to $3,177, whereas XRP and Solana underperformed with drawdowns of 10.4% to $1.847 and 9% to $130, respectively, as leveraged positioning was compelled out.

Why Is Bitcoin And Crypto Down At present?

The quick catalyst was a geopolitics-to-trade headline that landed right into a weekend liquidity window: President Donald Trump mentioned the US would impose extra 10% tariffs on imports from Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands and Finland beginning Feb. 1, escalating to 25% on June 1 until a deal is reached for the US to amass Greenland.

Associated Studying

European officers framed the transfer as coercive and signaled a coordinated response. Dutch Overseas Minister David van Weel referred to as the menace “blackmail,” including: “It’s not crucial. It doesn’t assist the alliance (NATO).” The focused nations, lots of them NATO allies, issued a stark pushback warning that tariff threats “undermine transatlantic relations and threat a harmful downward spiral,” whereas EU representatives convened emergency talks over potential retaliation. France’s President Macron threatened EU’s “anti-coercion instrument.”

BREAKING: France’s President Macron requires the EU to activate its “most potent commerce weapon” in opposition to the US after President Trump’s tariff menace over Greenland.

Macron is now calling for the usage of the EU’s “anti-coercion instrument.”

If used in opposition to the US, it will… pic.twitter.com/E47Bpe03lK

— The Kobeissi Letter (@KobeissiLetter) January 18, 2026

For Bitcoin and the complete crypto market, the importance isn’t the tariff math in isolation; it’s the abrupt repricing of worldwide progress and coverage threat. When macro merchants de-risk into headlines like this, liquid markets are inclined to transmit the shock first and crypto, with its 24/7 construction and deep derivatives footprint, typically turns into the stress valve.

On-chain and venue-level indicators urged the promote stress was not merely offshore stream. CryptoQuant analyst Mignolet pointed to an elevated “CPG” (Coinbase Premium Hole), a metric monitoring the value differential between Coinbase’s USD market and Binance’s USDT market that’s typically learn as a proxy for US-led demand or provide.

“We’re seeing the strongest promoting premium (CPG) in current durations. For the reason that ETF market was not open on the time, this promoting stress is coming from US whales working exterior of ETFs. It’s one of many conventional promoting patterns we’ve seen repeatedly up to now,” Mignolet wrote in a CryptoQuant note.

That framing issues as a result of it implies the transfer wasn’t pushed by ETF creations/redemptions, so the marginal vendor was energetic in spot/OTC and derivatives channels that stay open by way of the weekend.

Associated Studying

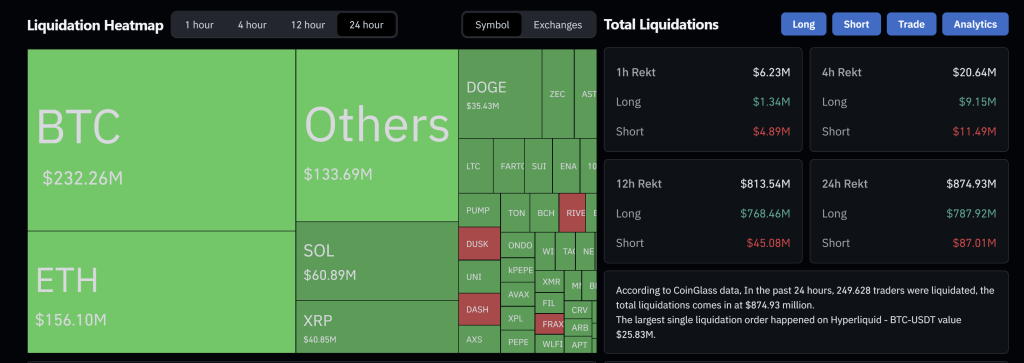

As soon as spot value slipped by way of key ranges, futures mechanics did the remaining. Coinglass knowledge confirmed 249.422 merchants had been liquidated, the entire liquidations coming in at $874.93 million over the previous 24 hours. Longs accounted for $787.92 million versus $87.01 million in shorts, an uneven wipeout that sometimes displays crowded lengthy publicity being force-closed into falling costs.

At press time, Bitcoin recovered to $93,000.

Featured picture created with DALL.E, chart from TradingView.com