Has the bitcoin price lastly damaged away from its four-year cycle sample, or is that this bull market already getting into exhaustion? By learning historic development charges, liquidity knowledge, and macroeconomic correlations, we are able to higher perceive whether or not the present cycle has actually diverged, and what meaning for traders within the months forward.

Bitcoin Value Cycle Period

Analyzing BTC Growth Since Cycle Lows, we are able to see that Bitcoin has now formally surpassed the elapsed time from cycle low to cycle excessive seen in earlier bull markets. The 2018–2022 cycle peaked 1,059 days after its prior bear market low, and the present cycle has now moved past that length. If we common the elapsed time throughout the final two full market cycles, Bitcoin has already exceeded the historic imply and is on the verge of surpassing even the 2017 cycle size within the coming days.

Diminishing Affect on Bitcoin Value

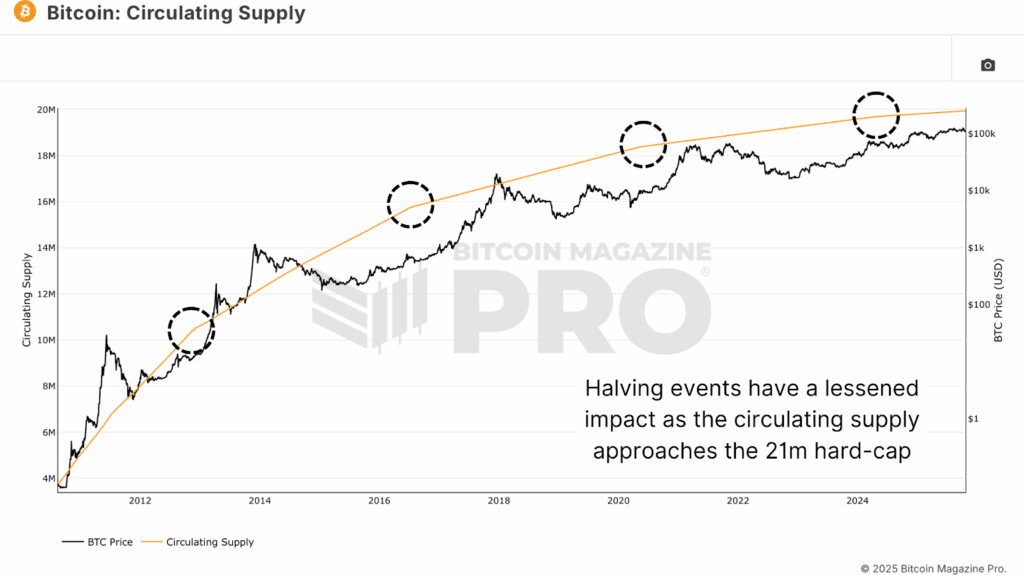

Traditionally, Bitcoin’s four-year cycle was rooted in its halving occasions, the place the block reward, and thus the inflation charge, was reduce in half. Every halving triggered a pointy provide shock, driving main bull markets. Nonetheless, this cycle has behaved otherwise. Following the latest halving, Bitcoin skilled 5 months of sideways consolidation relatively than the explosive post-halving rallies seen beforehand. Whereas worth has since made notable features, momentum has been weaker, main many to ask whether or not the halving has misplaced its affect.

With the present Circulating Supply already exceeding 95% of the 21 million final whole provide of Bitcoin, the marginal provide discount could not be as vital. In the present day, miners distribute roughly 450 newly created BTC per day, an quantity simply absorbed by a handful of institutional consumers or ETFs. Which means the halving alone could not be the dominant driver of Bitcoin’s market cycles.

International Liquidity Cycles Driving the Bitcoin Value

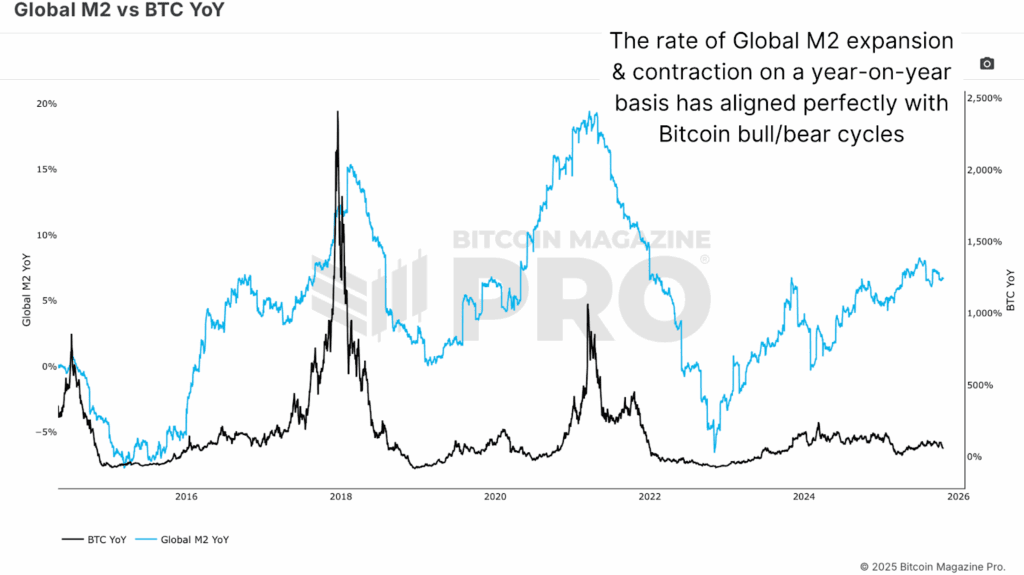

Once we view Global M2 Money Supply versus BTC on a year-on-year foundation, a transparent sample emerges. Every main Bitcoin backside has aligned virtually completely with the trough of International M2 liquidity development.

If we map the Bitcoin halvings and the M2 troughs aspect by aspect, we see that halvings sometimes lag the liquidity cycle, suggesting that liquidity enlargement, not halving occasions, will be the true catalyst for Bitcoin’s rallies. This isn’t distinctive to Bitcoin. Gold has proven the identical conduct for many years, with its worth efficiency intently mirroring the speed of International M2 enlargement or contraction.

Inverse Correlations Shaping Bitcoin Value Tendencies

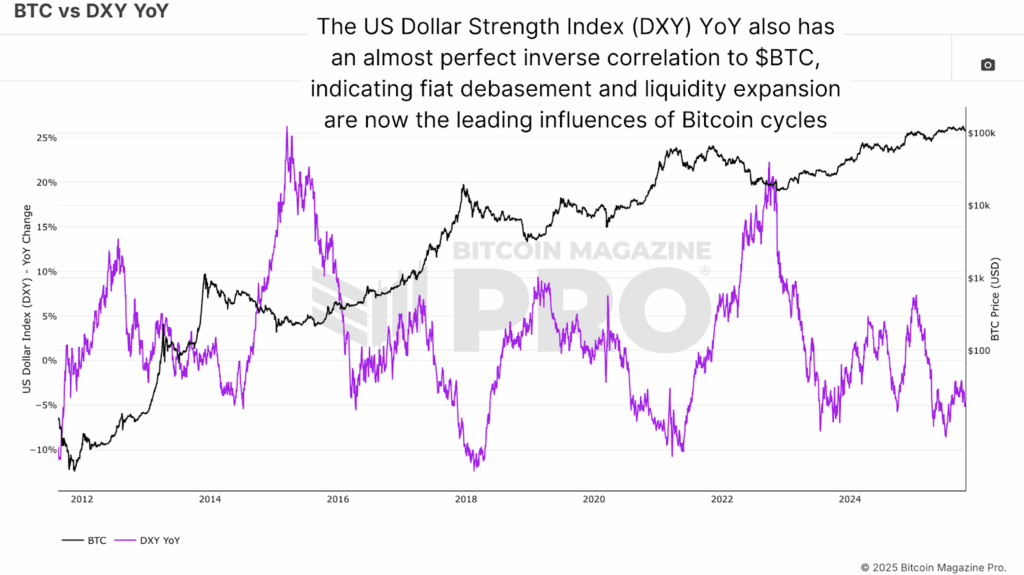

A key a part of this liquidity story lies within the U.S. Greenback Power Index (DXY). Traditionally, BTC versus DXY on a year-on-year foundation has been virtually completely inversely correlated. When the greenback strengthens year-on-year, Bitcoin tends to enter bear market circumstances. When the greenback weakens, Bitcoin begins a brand new bull market. This inverse relationship additionally holds true for Gold and fairness markets, underscoring the broader debasement cycle thesis that as fiat currencies lose buying energy, laborious belongings quickly respect.

At present, the DXY has been in a short-term uptrend, coinciding with Bitcoin’s latest consolidation. Nonetheless, the index is now approaching a key historic resistance zone, one which has beforehand marked main turning factors and preceded extended DXY declines. If this sample holds, the subsequent main drop in greenback energy might set off a renewed upcycle for Bitcoin.

Quantitative Tightening and the Bitcoin Value

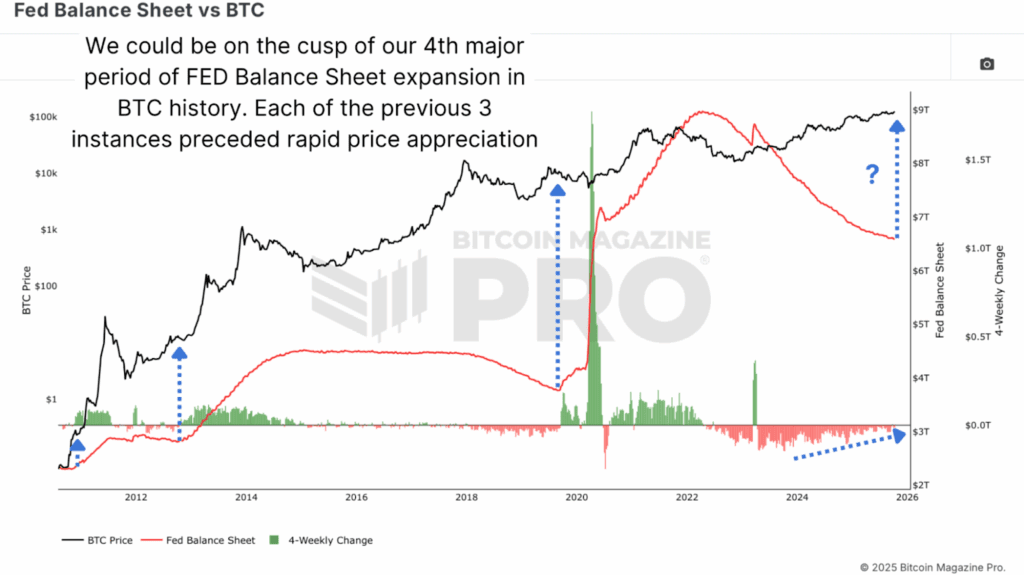

Comments from Federal Reserve Chair Jerome Powell not too long ago hinted that the period of steadiness sheet contraction (quantitative tightening) could also be nearing an finish. Wanting on the Fed Balance Sheet versus BTC, the beginning of steadiness sheet enlargement and renewed quantitative easing has traditionally coincided with main upward strikes in Bitcoin and fairness markets alike.

In the course of the two years following earlier Fed steadiness sheet expansions, the S&P 500 averaged a 47% return, greater than 5 instances the typical two-year efficiency throughout impartial durations. If we’re certainly getting into a brand new easing section, it couldn’t solely extend Bitcoin’s present cycle but in addition set the stage for a liquidity-driven melt-up throughout threat belongings.

Conclusion: The Evolving Bitcoin Value Cycle

Bitcoin has now outlasted the timeframes of its earlier two cycles, main many to query whether or not the four-year rhythm nonetheless applies. However after we step again, a distinct narrative emerges, one pushed not by programmed shortage, however by International liquidity, fiat debasement, and macro capital stream. The “four-year cycle” is probably not damaged, however it could have merely developed.

If the U.S. Greenback weakens, the Fed pauses tightening, and International M2 development accelerates, then Bitcoin possible nonetheless has room to run. For now, as all the time, one of the best strategy stays the identical: react, don’t predict. Keep data-driven, keep affected person, and hold your eyes on liquidity.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here: Where Are We In This Bitcoin Cycle

For deeper knowledge, charts, {and professional} insights into bitcoin worth developments, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding selections.