Will Crypto recuperate and why is everybody so dour in regards to the outlook for the USA on a regular basis? I like making enjoyable of America but additionally suppose we’re all coping about that and the trajectory of

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.constructive svg path:nth-of-type(2) {

stroke: #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive {

shade: #008868 !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.constructive {

border: 1px stable #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.constructive::earlier than {

border-bottom: 4px stable #008868 !necessary;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-graph-container.unfavorable svg path:nth-of-type(2) {

stroke: #A90C0C !necessary;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.unfavorable {

border: 1px stable #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable {

shade: #A90C0C !necessary;

background-color: clear !necessary;

}

.cwp-coin-widget-container .cwp-coin-trend.unfavorable::earlier than {

border-top: 4px stable #A90C0C !necessary;

}

Bitcoin

0.74%

Bitcoin

BTC

Value

$87,307.85

0.74% /24h

Quantity in 24h

$29.99B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(operate($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

.

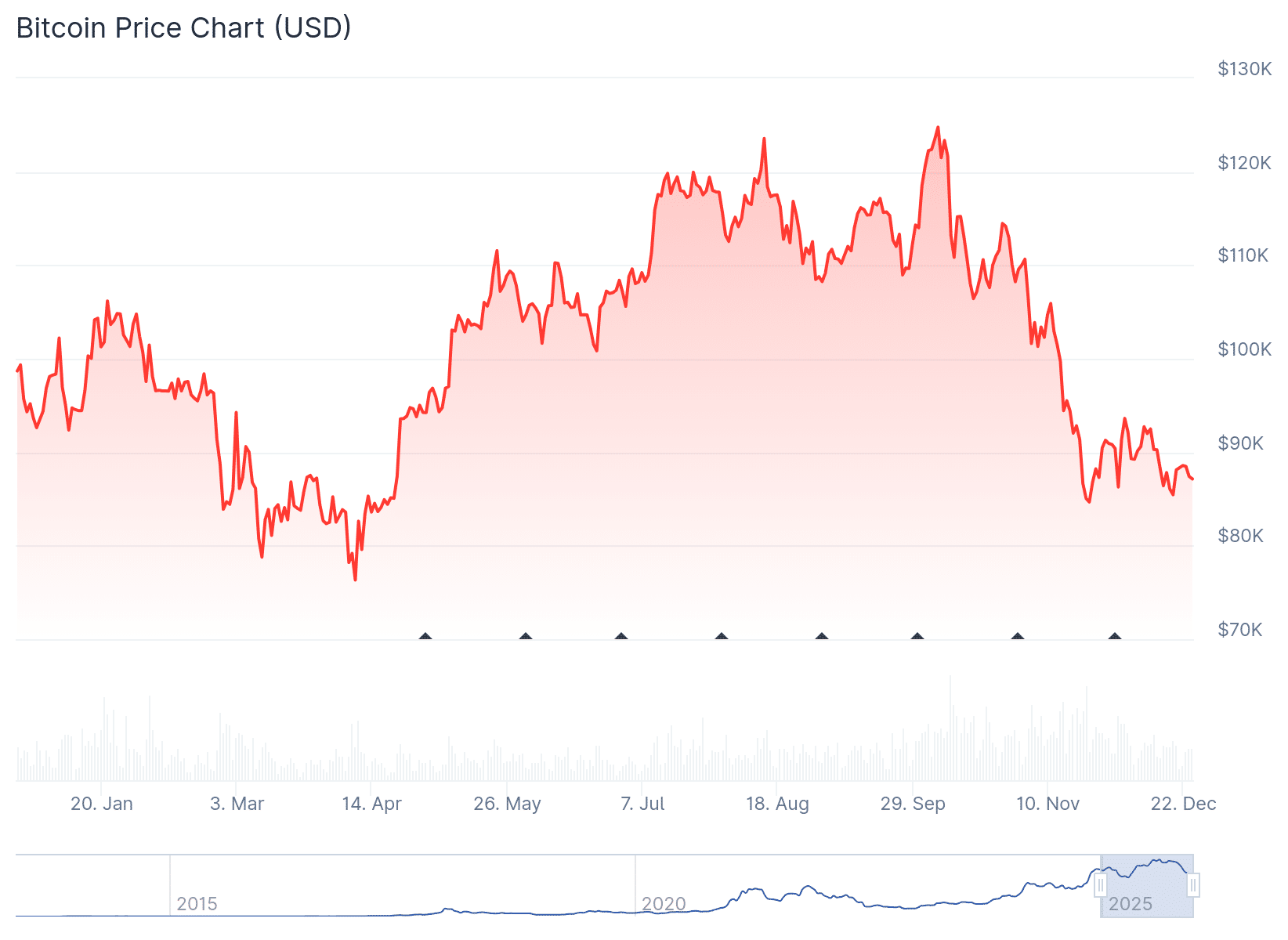

After weeks of promoting stress, essentially the most trustworthy query in crypto proper now isn’t “when moon,” however whether or not a rebound is even believable within the close to time period.

Bitcoin sliding from current highs rattled confidence, flushed leverage, and reminded late-cycle bulls that crypto doesn’t go perpetually up. But what appears to be like ugly on a chart doesn’t routinely imply damaged. In crypto, sideways is usually the prelude, not the obituary. Right here’s what to know:

DISCOVER: Top 20 Crypto to Buy in 2025

Will Crypto Recuperate? Bitcoin’s On-Chain Habits Tells a Calmer Story Than Value

Crypto Worry and Greed Chart

1y

1m

1w

24h

Value motion appears to be like drained, however on-chain knowledge suggests long-term holders usually are not panicking. In accordance with Glassnode, long-term holder provide stays close to cycle highs, whereas alternate balances proceed to development decrease.

CoinGecko data exhibits Bitcoin’s market cap holding close to $1.77T, with regular quantity. This isn’t euphoric cash flooding in, however additionally it is not capital sprinting for the exits.

DeFi Llama data reinforces the identical theme. Complete worth locked throughout main chains has stabilized after months of contraction, implying capital is ready, not fleeing.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The 2025–2026 Setup Nonetheless Favors Upside Persistence

If there’s a real risk to a crypto rebound, it’s macro spillover. US equities, notably AI-linked names like Nvidia, are carrying huge expectations. When shares sneeze, crypto nonetheless catches pneumonia. FRED knowledge exhibits monetary circumstances stay restrictive, whilst markets worth in eventual charge cuts.

From a technical perspective, Bitcoin is buying and selling beneath key EMAs, which retains short-term construction neutral-to-bearish. That mentioned, compression across the 20-day and 50-day EMAs traditionally precedes volatility growth. The query is path.

Lots of people have been asking for an replace on this chart, so I’ll simply depart this right here for anybody who must see it.

This exhibits the typical BTC trajectory following an oversold RSI studying, with RSI falling beneath 30 at t=0.

To this point, it’s been fairly bang on.

Until you… pic.twitter.com/FRLt5w7oFT— Julien Bittel, CFA (@BittelJulien) December 17, 2025

Assist ranges cluster tightly between $86,800 and $88,000. Resistance sits close to $90,000, then $92,000. A clear reclaim of $90K with quantity doubtless flips that sentiment quick.

Most forward-looking fashions nonetheless mission Bitcoin retesting $100K–$110K by late 2025 if macro circumstances stabilize. Provide stays structurally constrained and if ETF flows proceed, even when uneven.

Crypto winters don’t normally begin with orderly consolidation. They begin with panic. This seems like a shakeout that clears weak palms whereas stronger capital waits. Sideways, irritating, and boring can nonetheless be bullish.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Observe 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

- Value motion appears to be like drained, however on-chain knowledge suggests long-term holders usually are not panicking.

- CoinGecko knowledge exhibits Bitcoin’s market cap holding close to $1.77T, with muted however regular quantity.

The put up Will Crypto Recover or Are We Stuck in the Chop Into 2026?? appeared first on 99Bitcoins.