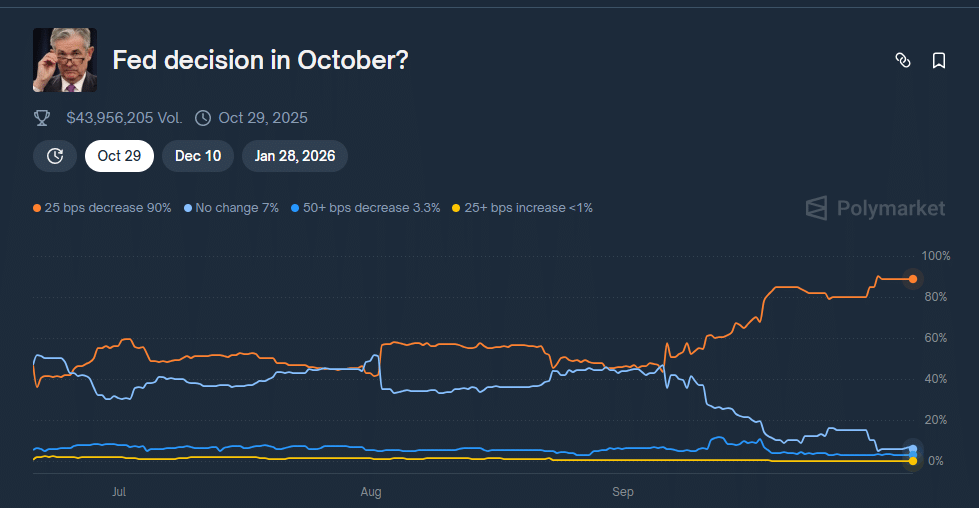

Wall Avenue and the cryptocurrency market are satisfied that Fed Chair Jerome Powell will preserve his promise and proceed slicing charges. It’s the highest story fueling FOMC crypto predictions. Futures markets now give a 95% likelihood of a quarter-point fee reduce at month’s finish, up from barely half that a number of weeks in the past.

Furthermore, the US government shutdown has locked the doorways on the Bureau of Labor Statistics, killing the September jobs report and key spending knowledge. With no numbers and no readability, Powell’s staff is working coverage on intuition.

“A scarcity of contemporary knowledge means the Fed can’t verify that the labor market stays on stable floor,” mentioned Krishna Guha, head of worldwide coverage at Evercore ISI.

There’s a working concept that Powell received’t give deeper rate cuts till folks get laid off after which they default on their burrito and pizza bank card debt. Let’s speak about that and three predictions for the upcoming FOMC:

DISCOVER: Top 20 Crypto to Buy in 2025

1. FOMC Crypto Predictions: Can The US Shutdown Transfer Markets?

Shutdowns are routine in Washington DC today, however the timing couldn’t be worse. Tens of hundreds of federal employees are furloughed whereas the Fed faces certainly one of its most delicate balancing acts in years.

The final time markets confronted this combine of knowledge drought and political paralysis, volatility surged throughout asset lessons and

.cwp-coin-chart svg path {

stroke-width: 0.65 !necessary;

}

0.70%

Bitcoin

BTC

Value

$124,046.11

0.70% /24h

Quantity in 24h

$49.07B

<!–

?

–>

Value 7d

// Make SVG responsive

jQuery(doc).prepared(perform($) {

var svg = $(‘.cwp-graph-container svg’).final();

if (svg.size) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘peak’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘peak’);

svg.css({‘width’: ‘100%’, ‘peak’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

alike.

In the meantime, the financial sentiment of US adults is deeply detrimental, with 74% describing situations as “honest or poor,” in line with Pew Research.

The unemployment fee has crept to 4.3%, the best since 2021, and personal payroll knowledge from ADP reveals 32,000 job losses in September. We’re in stagflation and Donald Trump needs rates of interest close to 0% and Powell’s time period ends in Might 2026. Charges will fall and proceed to fall, and by 2026 cash is perhaps printed at unprecedented charges once more.

“Persistent inflation, resilient demand, and solely modest labor market slack recommend coverage is barely restrictive,” mentioned Dallas Fed President Lorie Logan.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

2. Bitcoin’s New Dance with the Fed

Glassnode data reveals a surge in long-term holder accumulation for Bitcoin, whereas alternate outflows have elevated 9% week-over-week, an indication of rising conviction. DeFi Llama reviews $82.5 Bn in complete worth locked (TVL) throughout decentralized finance, up 11% from final month, with Ethereum and Solana main inflows.

With gold hitting $3,900 and the Nikkei climbing 4.3% on Japan’s fiscal stimulus expectations, merchants are treating BTC because the third safe haven within the new world triad: gold, shares, and code.

DISCOVER: 20+ Next Crypto to Explode in 2025

3. FOMC Crypto: The Fed Nonetheless Holds Crypto’s Destiny, What’s Subsequent?

Every fee reduce solves one downside and creates one other. Two extra cuts earlier than yr’s finish would virtually assure one other liquidity rush by early 2026.

“Each reduce weakens the greenback’s ethical authority,” mentioned one macro dealer in Singapore. “That’s bullish for Bitcoin – and terrifying for policymakers.”

The Fed’s determination this month received’t simply steer shares or bonds, however will set the tone for crypto’s subsequent leg. If Powell cuts with out contemporary knowledge, it confirms what markets already suspect: central banks are able to print and provides Trump what he needs.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Wall St.’s satisfied Fed Chair Jerome Powell will preserve his promise and preserve slicing charges. It’s the highest story fueling FOMC crypto predictions.

- Two extra cuts earlier than yr’s finish would virtually assure one other liquidity rush by early 2026.

The put up Will Powell Cut Rates This Week? Macro Analyst’s Top 3 FOMC Crypto Predictions – US Shutdown Warning? appeared first on 99Bitcoins.