Bitcoin (BTC) is holding shakily above $90,000 as merchants assess the following transfer forward of the US Federal Reserve’s remaining assembly of the yr. Some market individuals are anticipating a doable year-end rally, whereas others see indicators of weak point.

Key Resistance in Focus

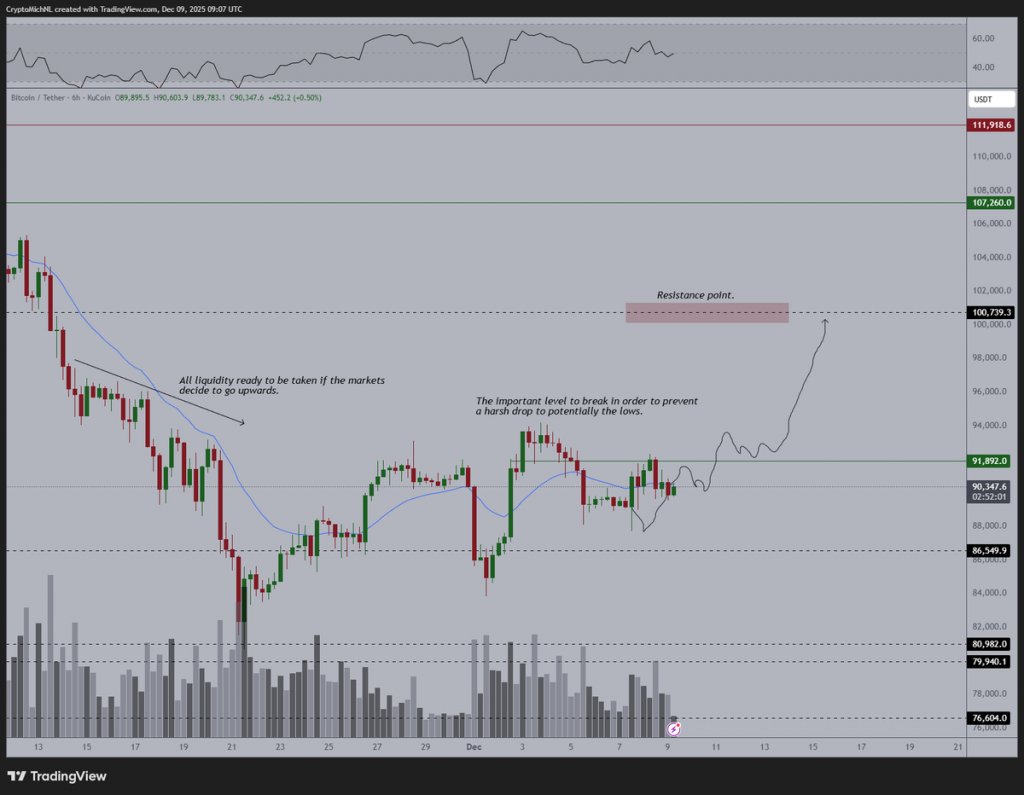

Crypto analyst Michaël van de Poppe says Bitcoin continues to be buying and selling alongside a bullish path. He pointed to $91,892 as a stage that must be cleared to keep up upward momentum. If that occurs, the following main resistance is round $100,793. A transfer via this zone may open the best way to $100,000 earlier than the tip of December.

Van de Poppe mentioned,

“It’s all relying on the open within the US, if that’s going to be inflicting the usual correction, then it’s time to purchase the dip.”

He additionally flagged a rejection at $92,000, saying it “doesn’t look nice within the short-term,” however left open the possibility of a breakout. If the market fails to carry present ranges, he expects a doable drop to between $78,000 and $82,000 earlier than a rebound.

Bitcoin has gained over 4% up to now week, regardless of a slight decline of two% over the past 24 hours. Present worth sits round $90,330, with quantity above $43 billion.

Fed Assembly Provides Uncertainty

Consideration is now on the Federal Reserve’s upcoming coverage meeting on December 10. In a current video, analyst Ali Martinez pointed out that Bitcoin has reacted negatively after most FOMC conferences this yr. Out of seven conferences thus far, six have been adopted by corrections, with just one short-lived rally in Might.

Market knowledge reveals expectations for a fee reduce are excessive, with present projections at over 87%. Nonetheless, Fed Chair Jerome Powell could take a cautious stance. Van de Poppe warned,

“I wouldn’t be stunned if… Powell says ‘I don’t know whether or not we’ll proceed with fee cuts’ and the market does a traditional sell-off.”

Merchants are making ready for both consequence, with some anticipating a remaining transfer decrease earlier than a possible reversal into year-end.

Bearish Flag Sample Raises Doubts

A chart shared by Ali suggests Bitcoin could also be forming a bearish flag. If confirmed, this setup may result in a transfer down towards $70,000. The sample follows a pointy drop, with a consolidation section forming beneath key resistance. A break beneath the decrease trendline would recommend continued weak point.

In the meantime, different analysts are watching short-term construction. DamiDefi noted that Bitcoin stays beneath a downward trendline on the 4-hour chart. He mentioned a breakout above $94,000 would affirm energy, but when current lows are misplaced, additional draw back is probably going.

“Till $BTC clears this downtrend, you’re not shopping for a dip, you’re shopping for a downtrend,” he mentioned.

Though there’s a battle of opinion relating to the short-term path, on-chain info indicates that Bitcoin continues to be shifting out of centralized exchanges. The pattern normally signifies a long-term holding nature and might lower the promoting stress.

The put up Will the Fed Crash Bitcoin (BTC) or Spark a $100K Rally? appeared first on CryptoPotato.