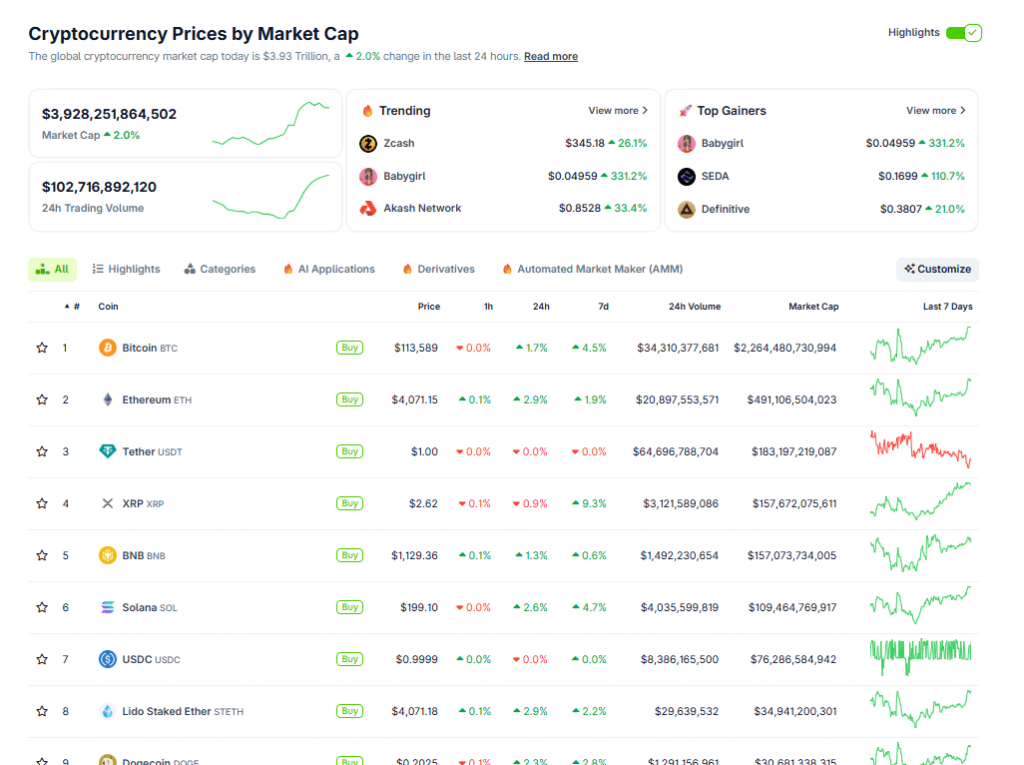

XRP crypto has roared again into the highlight this weekend, surging previous Binance Coin (BNB) to reclaim its place because the third-largest cryptocurrency by market capitalization, a rating it hasn’t held constantly in years.

(Supply – CoinGecko)

The token climbed to $2.63 with a market cap of roughly $158Bn, edging above BNB’s $156Bn as capital flows shifted sharply in XRP’s favor.

The transfer caps a +12.8% weekly rally, outpacing each different top-five digital asset and reigniting debate over whether or not XRP is getting into a long-awaited institutional cycle.

BNB, regardless of modest positive factors of +0.55% on the day and +4.35% on the week, seems to be dropping momentum after an October rebound pushed largely by regulatory reduction and new U.S. alternate assist, highlighted by former president Donald Trump’s pardon of Changpeng Zhao and secondary market listings on Coinbase and Robinhood.

However the drivers behind XRP’s surge run deeper than easy market rotation.

Institutional XRP Information Might Set off Parabolic XRP Worth Breakout

The standout catalyst is the emergence of Evernorth, a digital asset treasury (DAT) initiative aiming to build up and deploy XRP at scale.

Funded partly by Ripple co-founder Chris Larsen, who strategically liquidated a portion of his private holdings to seed the enterprise, Evernorth is structured to tighten the circulating provide quite than flood it.

Backed by Japan’s SBI Group, the mission is getting ready a $1B+ SPAC increase to determine an institutional-grade XRP reserve, with deliberate actions spanning liquidity provisioning, on-chain treasury administration, and lending markets throughout the XRP Ledger.

This supply-constraining dynamic emerges concurrently as Ripple aggressively expands into enterprise funds, RLUSD stablecoin progress approaches $1Bn in on-ledger property, and Ripple Prime launches as a brokerage-style institutional entry hub.

In the meantime, the XRP ETF race is accelerating. Grayscale, Bitwise, CoinShares, Franklin, WisdomTree, 21Shares, and Canary all submitted coordinated amended S-1 filings a transfer analysts interpret as direct response to SEC suggestions, signaling regulatory alignment and clearing a serious bottleneck.

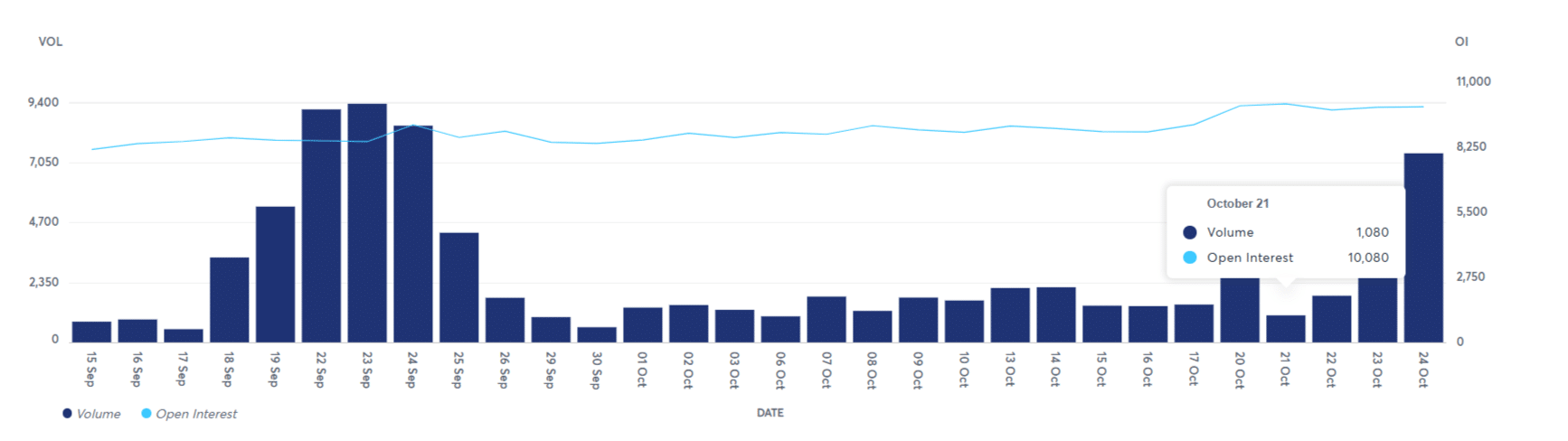

(Supply – CME Group)

CME futures open curiosity has surged as properly, hitting $9.9B, whereas spot XRP ETFs have quietly gathered over $100M in AUM inside weeks of launch.

Curiously, sentiment amongst retail merchants stays traditionally low, with small wallets promoting into the rally, making a traditional contrarian setup as institutional accumulation deepens.

EXPLORE: XRP Futures – Ripple Trading Guide

XRP Worth Evaluation: Will Worth Motion Erupt to $2.9 After 20DMA Reclaim?

As XRP worth pushes into technical energy, XRP is at the moment buying and selling at a market worth of $2.61 (representing a 24-hour change of +0.74%) at press time.

This comes as a bullish push to the upside noticed XRP USD reclaim a foothold above the 20DMA assist at $2.49 on Saturday, October 25, marking a pivotal second as the worth smashed a ceiling of resistance that had dominated the pattern since October 7.

Now consolidating its foothold, field buying and selling clearly depicts an upside trajectory within the coming week for XRP (FOMC allowing), with quick targets at $ 2.90 and $ 3.40.

(Supply – TradingView, XRP USDT)

The RSI indicator, in the meantime, continues to bolster XRP worth outlook, with a impartial studying at 51 highlighting that the transfer hasn’t over-extended momentum simply but – one thing that places the +11% leap to $2.9 firmly on the playing cards.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The submit XRP Crypto Reclaims #3 Spot, Overtakes BNB: Institutional XRP News on Verge of Going Parabolic appeared first on 99Bitcoins.