In response to market observers, this week might mark a turning level for XRP as 5 spot ETFs commerce on the identical time for the primary full week. 21Shares’ XRP fund (TOXR) launched at this time, becoming a member of Bitwise, Grayscale, Franklin Templeton and Canary Capital. Studies have disclosed that ETF inflows have already topped Over $660 million in lower than a month, with zero outflows throughout 10 consecutive buying and selling days.

Associated Studying

5 ETFs Commerce Collectively

Bitwise not too long ago elevated its XRP holdings to 80 million tokens. ETF managers now maintain greater than $687 million in belongings, which represents simply over 300 million XRP on file. 21Shares debuted with a $500,000 seed basket and costs a 0.50% administration charge. Based mostly on stories, competitors amongst issuers will reveal how aggressively these funds plan to maintain shopping for over the long run.

Demand Mannequin

A price-path sensitivity simulation run by Mohamed Bangura was shared by analysts and brought up by commentators. The mannequin used a baseline ETF demand of 74.5 million XRP per day, whole alternate provide of two.7 billion XRP, and an escrow launch of 300 million XRP each 30 days.

Subsequent week is a giant milestone for XRP.

We can have the primary full week of buying and selling with 5 pure spot ETF’s working in competitors.

It’s going to inform us ALOT by the tip of week what we will anticipate for these funds buying XRP for the long run. https://t.co/S3TENqa4PP pic.twitter.com/LQ48QLKcgh

— Chad Steingraber (@ChadSteingraber) November 30, 2025

Elasticity values of 0.2, 0.5 and 1.0 had been examined over 180 days. The outcomes confirmed that low elasticity can quickly drain exchange-held provide, whereas greater elasticity can produce sharper value spikes as OTC liquidity absorbs flows. That outcome has many merchants watching liquidity statistics carefully.

Liquidity Strain Builds

Jake Claver, CEO of Digital Ascension Group, warned that non-public OTC and dark-pool channels could also be working skinny. He estimated that about 800 million XRP of personal liquidity was absorbed within the first week of ETF accumulation.

As a result of a lot ETF shopping for occurs off-exchange, value motion has not but matched the tightening provide, and markets may even see extra abrupt strikes when funds are compelled to supply cash from public exchanges.

Whales Reshuffle Balances

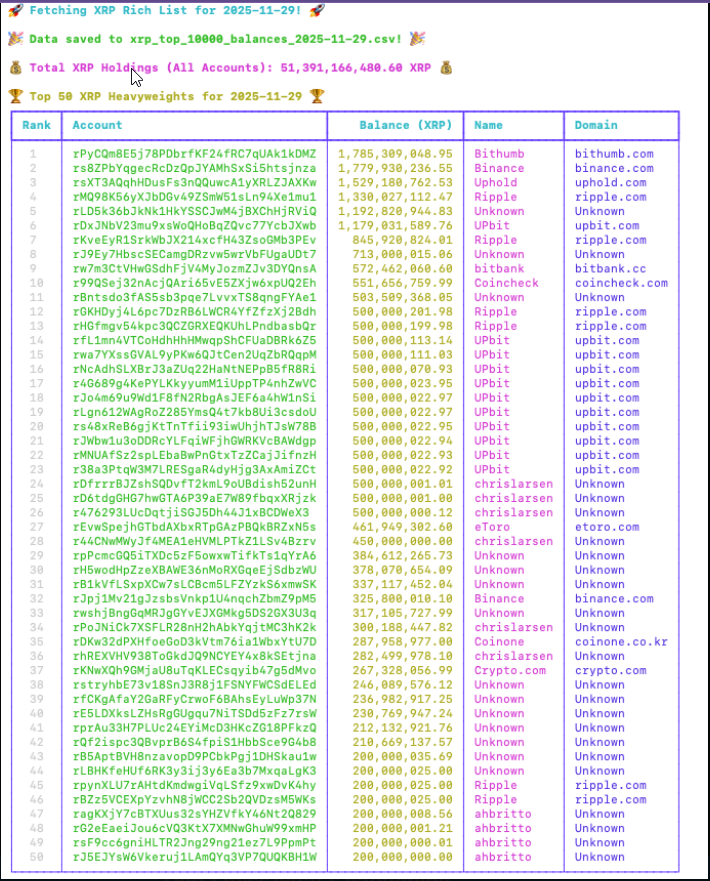

In the meantime, stories have disclosed modifications amongst giant holders. The top 10,000 wallets now maintain 51.39 billion XRP, or about 85% of circulating provide. In in the future, 78 new wallets took in 77.324 million XRP. One pockets reportedly collected 35 million XRP, one other grabbed 3.63 million, and 6 wallets added 1.99 million every.

🚀 XRP RICH LIST SHOCKWAVE (11/29/2025) 🐳

Recent knowledge reveals the highest 10,000 wallets now management 51.39B+ XRP, and at this time’s ledger exercise screams new whales + stealth accumulation.

78 new accounts grabbed 77M+ XRP in in the future.246 current wallets elevated balances by one other… pic.twitter.com/wpXZMJUQpI

— XRP 🅧 Military | Chacha72kobe4er (@Mullen_Army) November 30, 2025

As much as 44 new wallets had been reported to have amassed over 300 million XRP every, whereas 246 current wallets elevated their mixed steadiness by 17.91 million XRP. These strikes level to quiet accumulation throughout current market weak spot.

Associated Studying

What Comes Subsequent

Analysts say the present setup is a take a look at of liquidity greater than a easy demand story. ETF holdings of roughly 300 million XRP are sizable however nonetheless small in contrast with potential day by day demand if inflows keep excessive and extra funds launch.

If OTC channels dry up and ETFs should purchase on exchanges, volatility might rise shortly. Merchants and portfolio managers shall be watching order books, OTC stories and ETF filings within the coming days to see how the availability image modifications in apply.

Featured picture from Buying and selling Information, chart from TradingView