A contemporary “XRP provide shock” narrative has been making the rounds on X, with a number of massive accounts circulating a Glassnode chart of alternate balances and arguing ETFs are quickly draining liquid provide. An XRP Ledger dUNL validator, nevertheless, rejected the premise outright, saying the numbers and the market construction don’t help a real allocation squeeze.

One broadly shared put up got here from @unknowDLT, who wrote on Dec. 27: “XRP ETFs are absorbing supply quick. With solely ~1.5B XRP left on exchanges and ~750M absorbed in weeks, a provide shock is probably going by early 2026.” The account tied that thesis to the “Readability Act,” arguing it might “forc[e] value discovery” and place 2026 because the second XRP shifts “from hypothesis to international liquidity infrastructure.”

Is A XRP Provide Shock Actually Coming?

Vet (@Vet_X0), an XRP Ledger dUNL validator, responded on Dec. 28 with a screenshot indicating alternate balances nearer to 16 billion XRP, not 1.5 billion, and framed the supply-shock discuss as a static misinterpret of a dynamic market.

“There isn’t a XRP provide shock on exchanges,” Vet wrote. “1) Holders have near 16B XRP on exchanges available. Loads for anybody to get some. 2) If the worth goes up or down anybody of you who has no XRP on exchanges might simply ship theirs inside 3-4 secs to 1.”

Associated Studying

Vet’s broader level was that alternate balances and order-book liquidity are usually not mounted portions; they alter quickly with value and incentives. In his view, that makes “provide shock” a a lot increased bar than a chart implying balances are trending down.

“Thus, additionally XRP listed on orderbooks on the market is dynamic. Elastic, it may possibly thicken or dry out in seconds backwards and forwards,” he wrote. “Generally $10M shopping for can push value increased and typically $100M shopping for doesn’t cease value taking place regardless. Markets are too dynamic to statically plot actions.”

The controversy then moved to confidence within the pockets labeling and the underlying counts. Fashionable pundit Zach Rector (@ZachRector7) questioned whether or not some entries appeared “off,” citing one instance: “Evernorth solely has 86 million XRP?” Vet replied that the revealed checklist ought to be handled as conservative, not exhaustive.

Associated Studying

“Full confidence that these numbers are the decrease sure of what really is on exchanges,” Vet wrote. “Means, these numbers are at worst on the decrease finish and that there are extra accounts of exchanges we haven’t seen but. I imply simply test Upbit alone, lets solely have a look at 4 out of many xrp accounts they’ve. 2B XRP. That is solely a portion of Upbit, not even counting different exchanges.”

Others argued that even when balances are massive, efficient float might nonetheless tighten as a result of custody construction, escrow cadence, and institutional accumulation. Dman Dealer (@dmantrader) pointed to monthly escrow mechanics and claimed ETF holdings sit in devoted XRPL wallets, describing them as “Locked up 1% of complete provide already in a pair months,” whereas additionally arguing that CEX and OTC inventories earmarked for purchasers are exhausting to measure.

Vet acknowledged a logistical angle — “Ripple is noting within the XRP report they facilitate provide transfers for ETFs” — however maintained {that a} real provide shock implies a direct allocation imbalance, not merely regular accumulation.

“A provide shock implies allocation imbalance by the market. Which isn’t true,” Vet wrote. “Positive, if tomorrow somebody says I need 30B XRP now then there can be a provide shock. However this individual apart, with 16B and lots of extra billion in Ripple sizzling accounts it’s particularly reasonable to say we have now sufficient for everybody to get their arms on XRP.”

For now, the thread attracts a transparent fault line: influencer-driven stability charts framing shortage versus an infrastructure-side argument that XRP liquidity is elastic, quickly mobilized, and unlikely to “shock” with out an unusually massive, pressing bid.

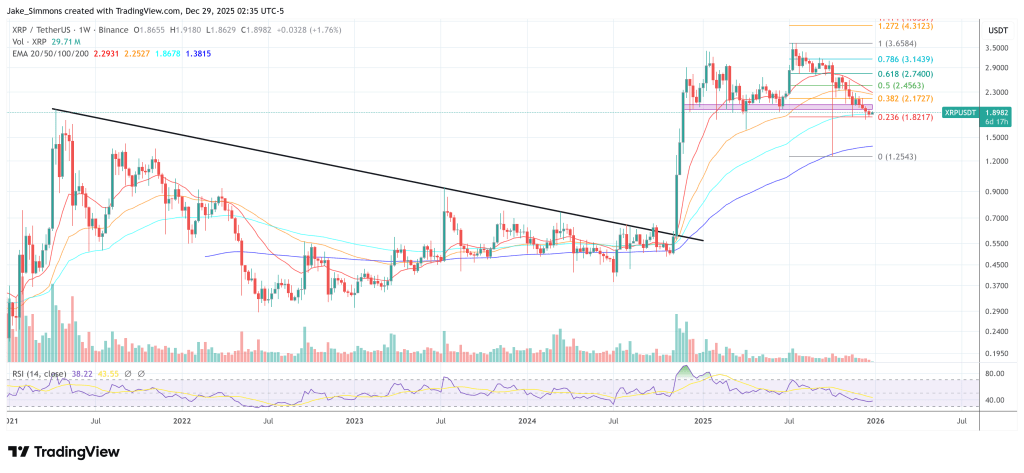

At press time, XRP traded at $1.8982.

Featured picture created with DALL.E, chart from TradingView.com